Answered step by step

Verified Expert Solution

Question

1 Approved Answer

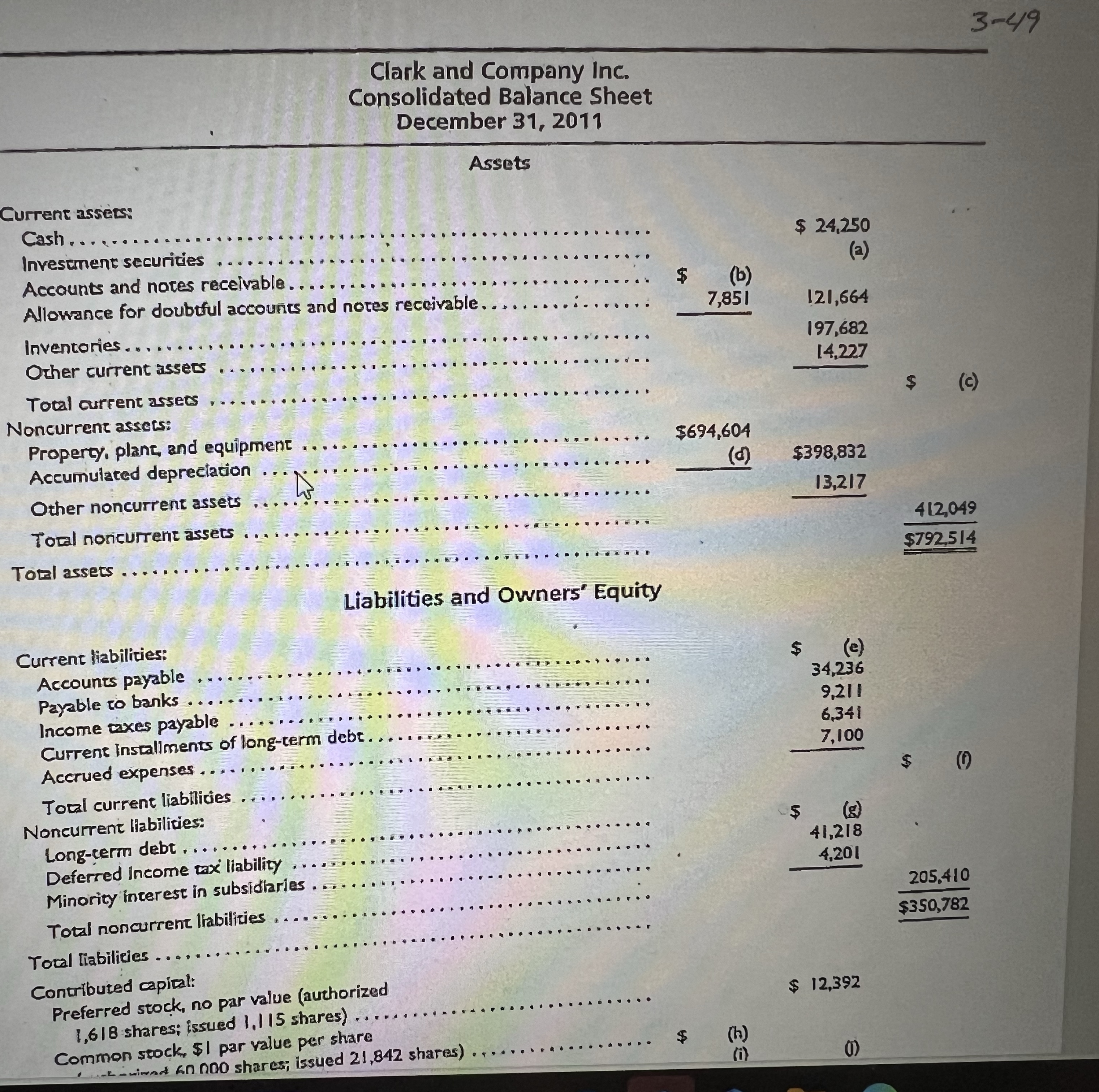

Assets Current assets: $ 2 4 , 2 5 0 Invesument securities Accounts and nores receivable. Alowance for doubtful accounts and notes receivable. Other current

Assets

Current assets:

$

Invesument securities

Accounts and nores receivable.

Alowance for doubtful accounts and notes receivable.

Other current assers

a

Total current assecs

Noncurrent assets:

Property; plant, and equipment

Accumulared depreciation

$

Other noncurrent assets

$

$

c

Total noncurrent assets

Tozal assets.

Liabilities and Owners' Equity

Current liabilities:

Accounts payable

Payable to banks.

Income axes payable

Current installments of longterm debt.

Accrued expenses.

Toal currene liablities

Noncurrent liabilities:

Longterm debt.

Deferred income tax liability

Total noncurrent liabilities

Toual liabilities.

Contributed capial:

Prefersed stock, no par value authorized

$

shares; issued shares

Common stock $ par value per share

shares

h

i

Clark and Company Inc.

Consolidated Balance Sheet

December

Assets

Current asseets:

Cash.

$

Invesment securities

a

Accounts and notes receivable.

Inventories

Other current assers

Total current assecs

Noncurrent assets:

Property, plant, and equipment

Accumulated depreciation

$

$

Other noncurrent assets

Total noncurrent assets

Total assets

Liabilities and Owners' Equity

Current liabilities:

Accounts payable

Payable to banks.

Income paxes payable

Current installments of longterm debt.

Accrued expenses.

Tocal currene liablicies

Noncurrent liabilities:

Longterm debt.

Deferred income taxi liability

Minority incerest in subsidlaries.

Total noncurrent liabilizies.

Tocal Iiabilities.

Contributed capital:

Preferred stock, no par value authorized

shares; issued shares

$

Common seock, $ par value per share

h

i

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started