Answered step by step

Verified Expert Solution

Question

1 Approved Answer

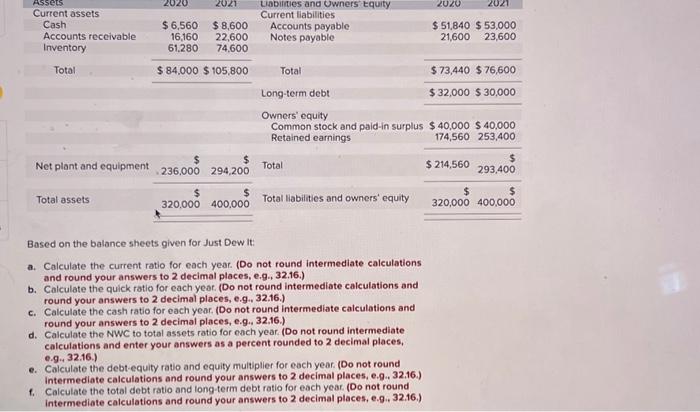

Assets Current assets Cash Accounts receivable Inventory Total Net plant and equipment Total assets 2020 $6,560 2021 $8,600 16,160 22,600 61,280 74,600 $ 84,000 $105,800

Assets Current assets Cash Accounts receivable Inventory Total Net plant and equipment Total assets 2020 $6,560 2021 $8,600 16,160 22,600 61,280 74,600 $ 84,000 $105,800 236,000 294,200 $ $ 320,000 400,000 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Total Total liabilities and owners' equity Based on the balance sheets given for Just Dew It: a. Calculate the current ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate the quick ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Calculate the cash ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. Calculate the NWC to total assets ratio for each year. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) 2020 Long-term debt Owners' equity Common stock and paid-in surplus $40,000 $40,000 Retained earnings 174,560 253,400 e. Calculate the debt-equity ratio and equity multiplier for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Calculate the total debt ratio and long-term debt ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) f. 2021 $ 51,840 $ 53,000 21,600 23,600 $73,440 $76,600 $32,000 $30,000 $ 214,560 $ 293,400 $ $ 320,000 400,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started