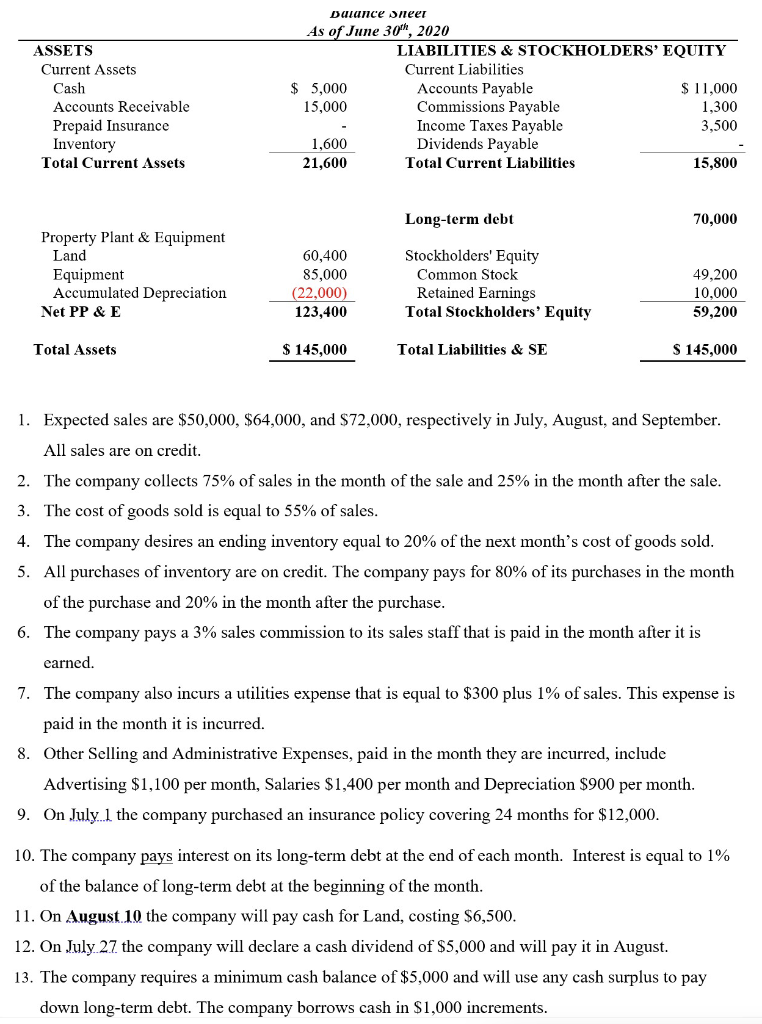

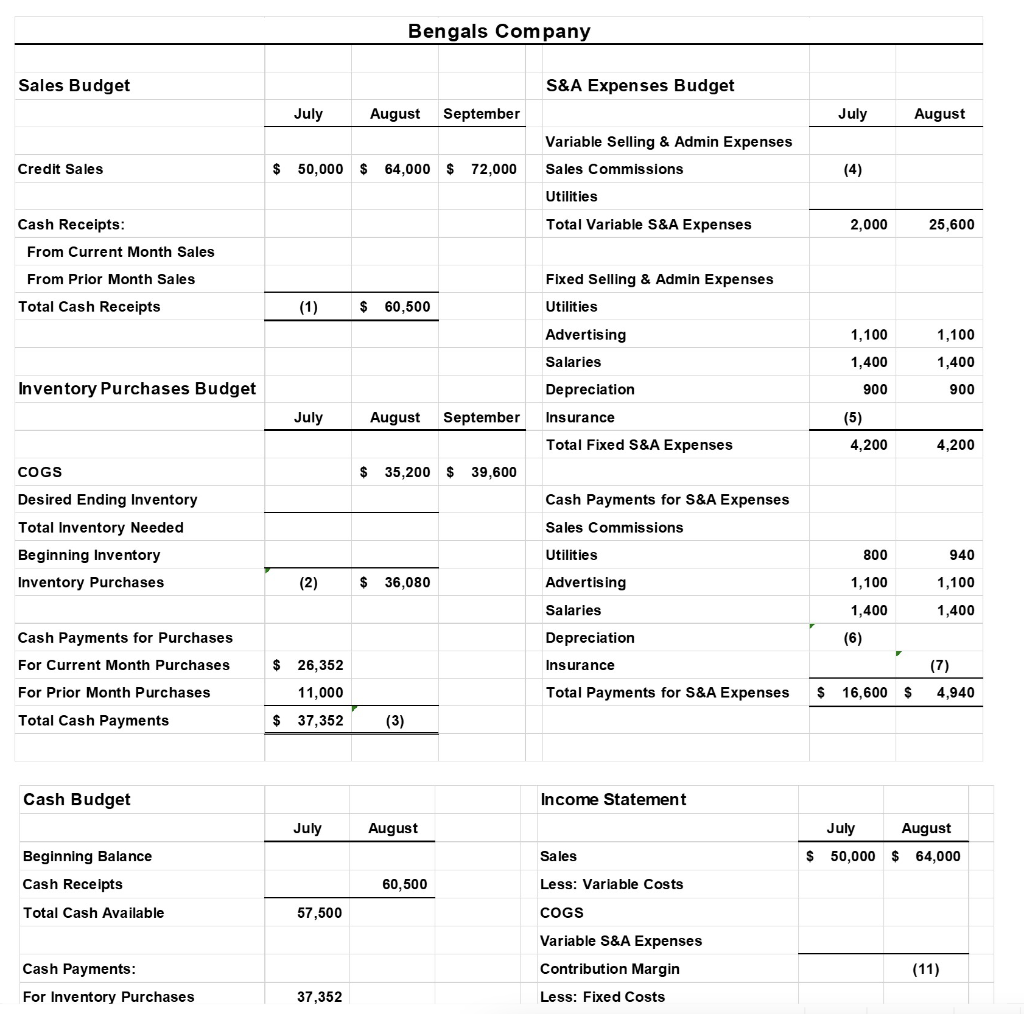

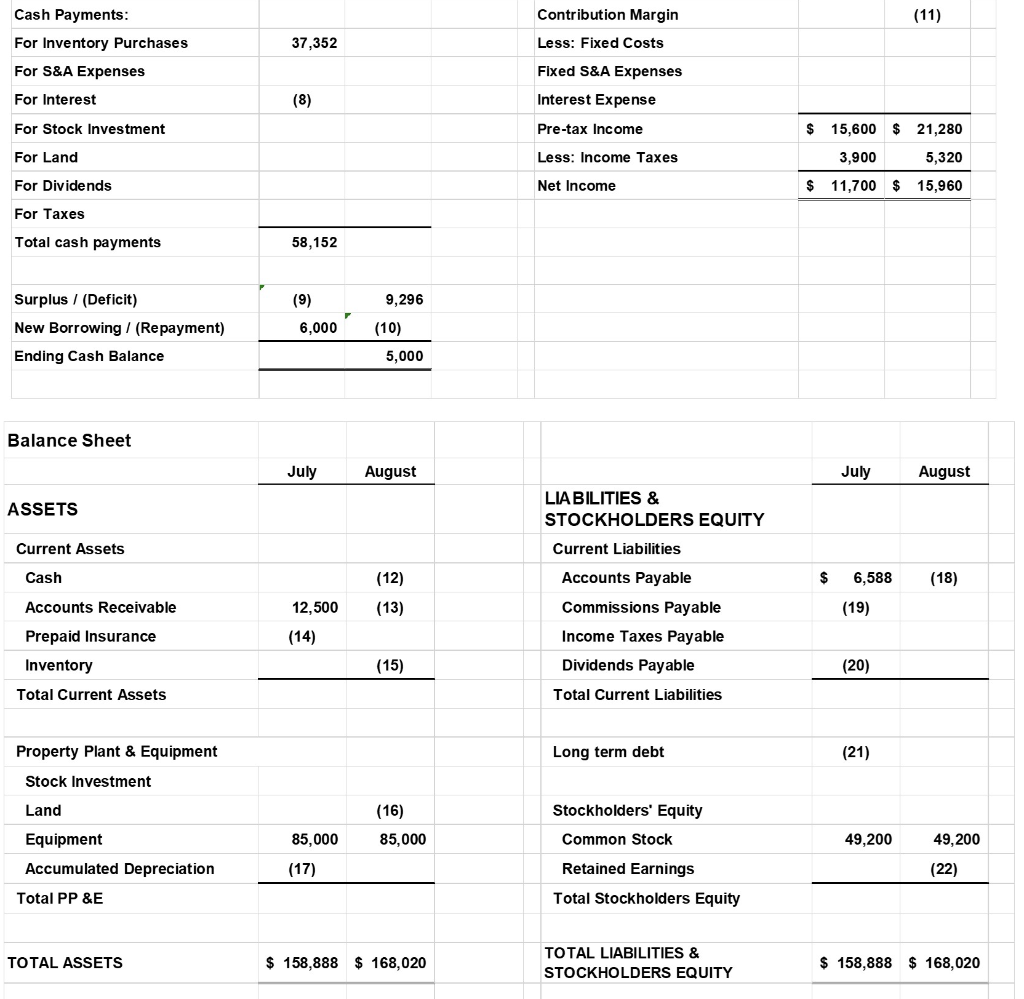

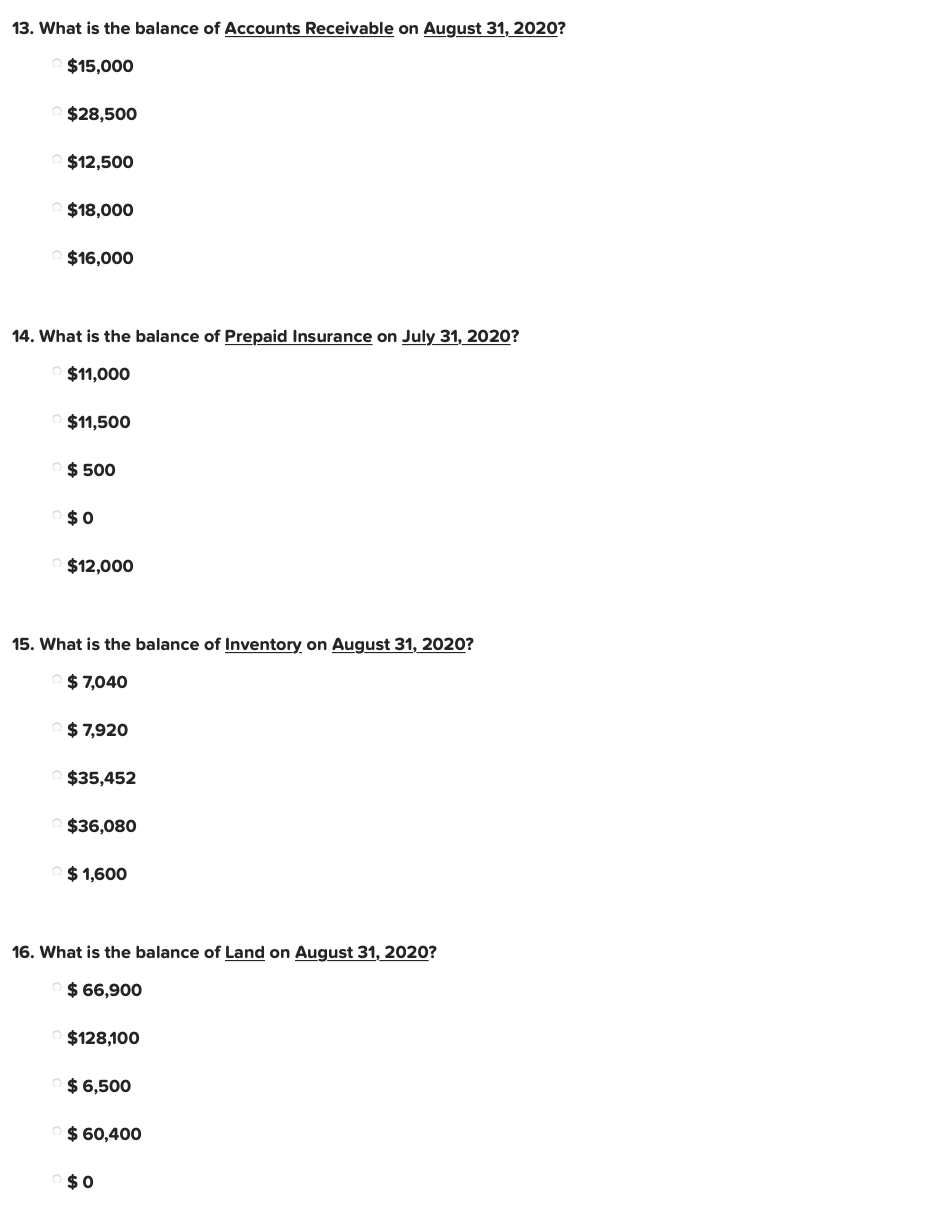

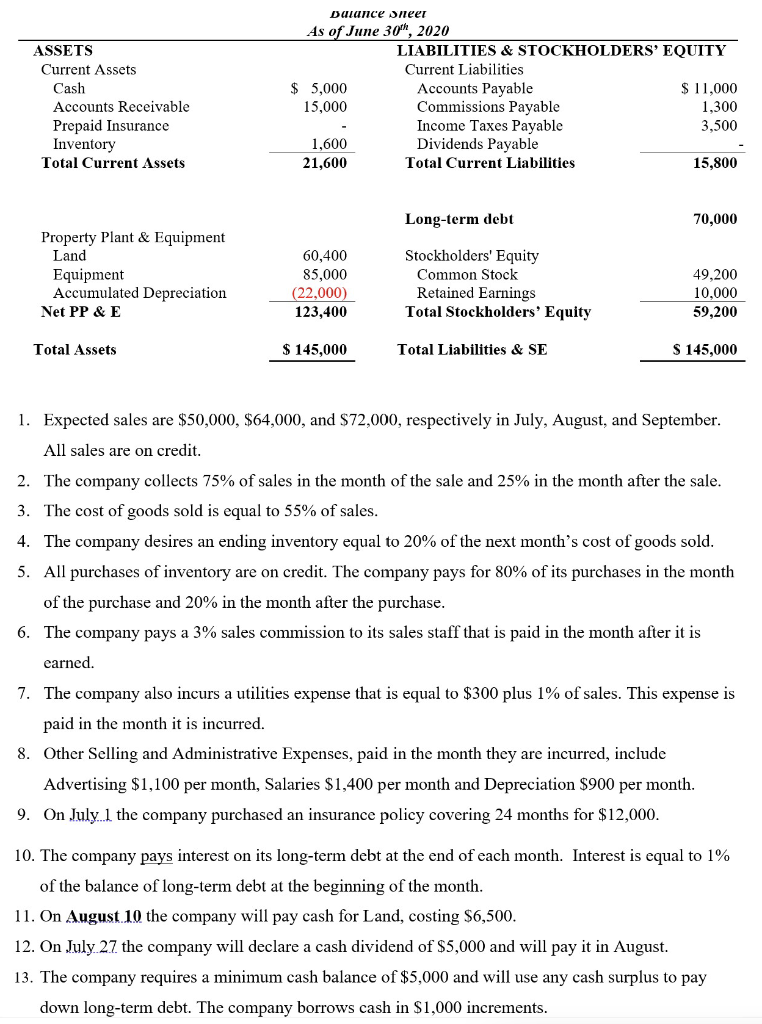

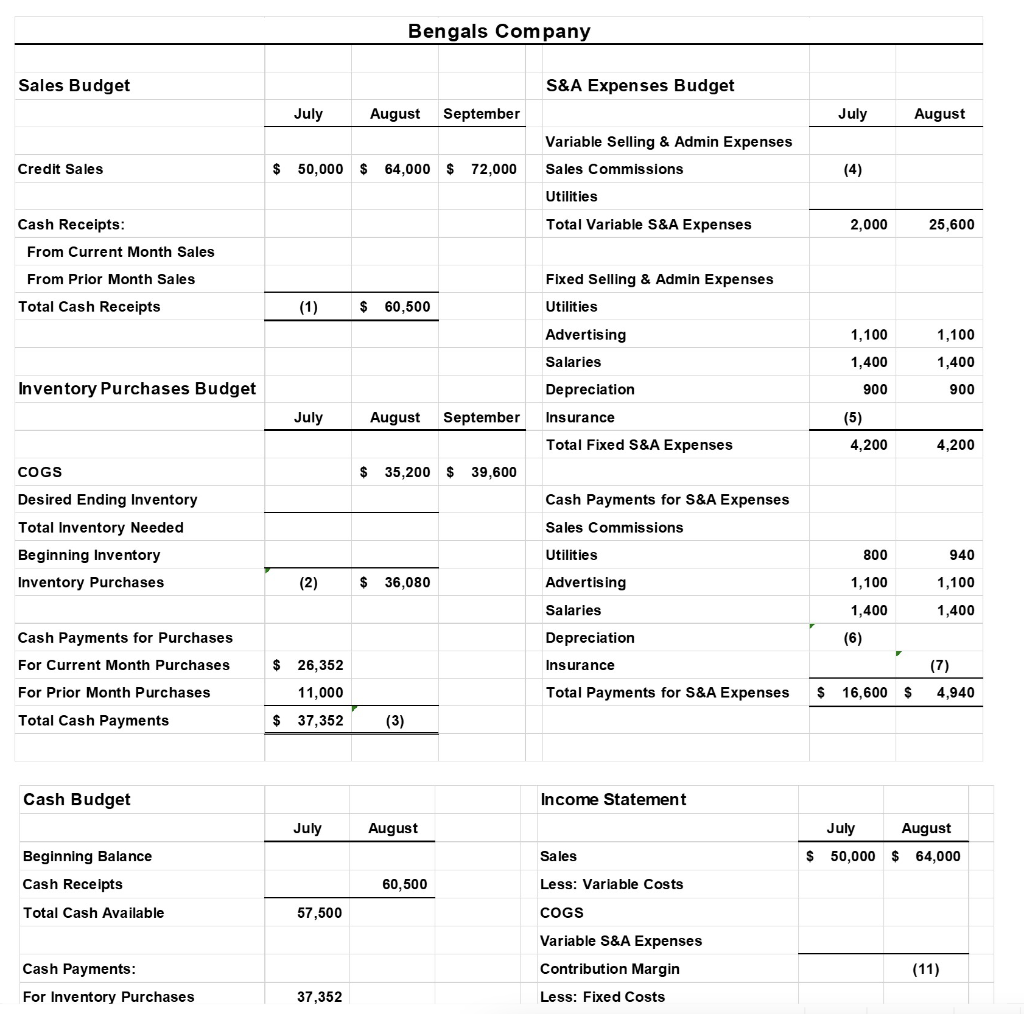

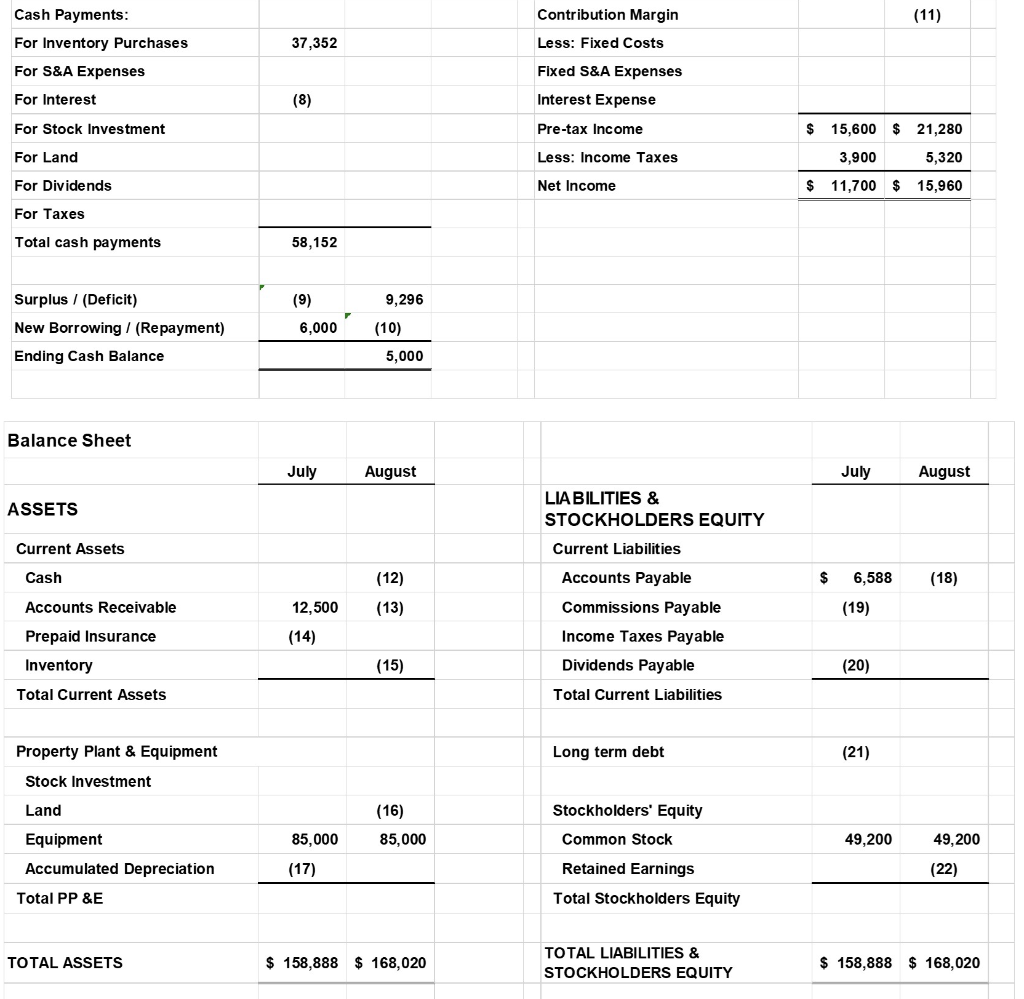

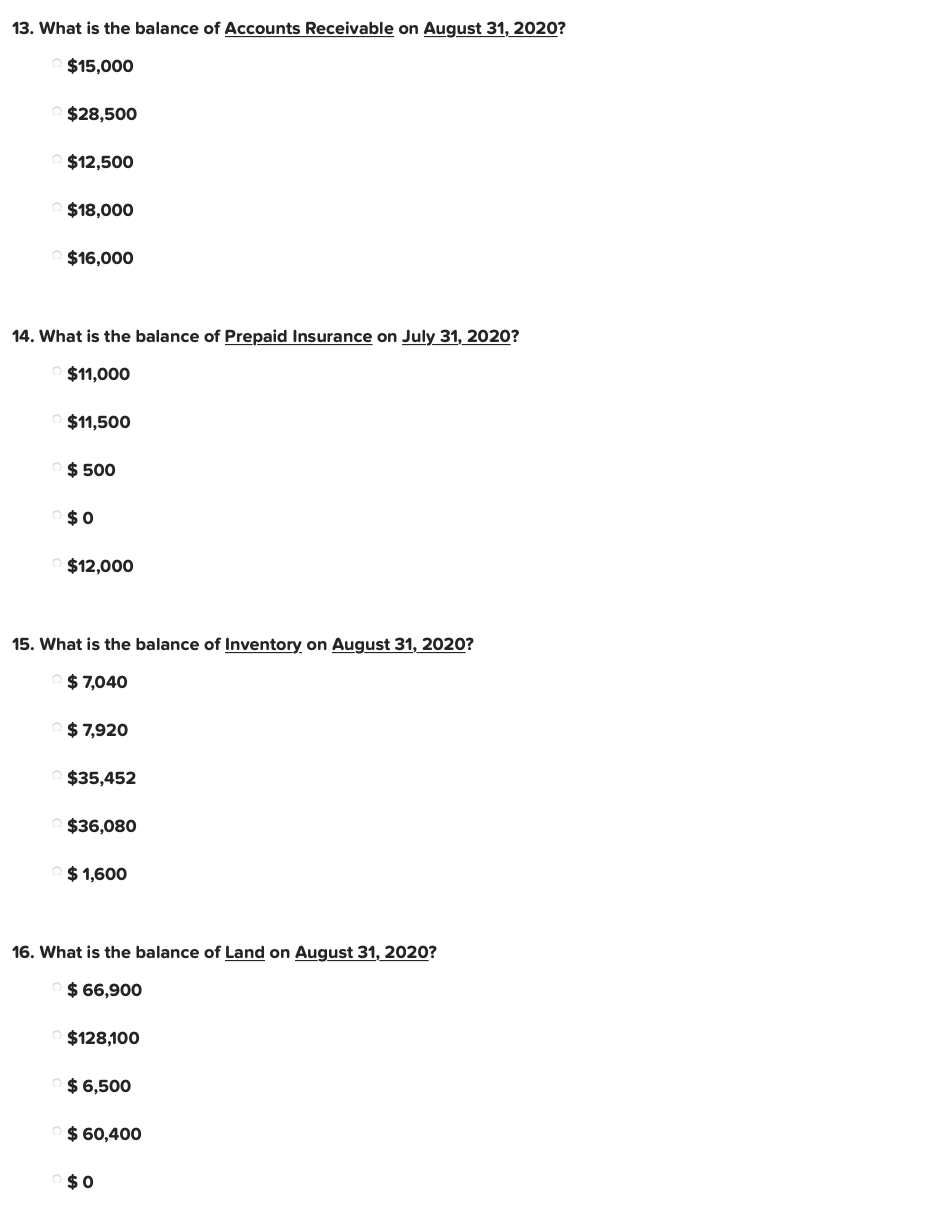

ASSETS Current Assets Cash Accounts Receivable Prepaid Insurance Inventory Total Current Assets Durance neer As of June 30, 2020 LIABILITIES & STOCKHOLDERS' EQUITY Current Liabilities $ 5,000 Accounts Payable $ 11,000 15,000 Commissions Payable 1,300 Income Taxes Payable 3,500 1,600 Dividends Payable 21,600 Total Current Liabilities 15,800 Long-term debt 70,000 Property Plant & Equipment Land Equipment Accumulated Depreciation Net PP & E 49,200 60,400 85,000 (22,000) 123,400 Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity 10,000 59,200 Total Assets $ 145,000 Total Liabilities & SE S 145,000 1. Expected sales are $50,000, $64,000, and $72,000, respectively in July, August, and September. All sales are on credit. 2. The company collects 75% of sales in the month of the sale and 25% in the month after the sale. 3. The cost of goods sold is equal to 55% of sales. 4. The company desires an ending inventory equal to 20% of the next month's cost of goods sold. 5. All purchases of inventory are on credit. The company pays for 80% of its purchases in the month of the purchase and 20% in the month after the purchase. 6. The company pays a 3% sales commission to its sales staff that is paid in the month after it is earned 7. The company also incurs a utilities expense that is equal to $300 plus 1% of sales. This expense is paid in the month it is incurred. 8. Other Selling and Administrative Expenses, paid in the month they are incurred, include Advertising $1,100 per month, Salaries $1,400 per month and Depreciation $900 per month. 9. On July 1 the company purchased an insurance policy covering 24 months for $12,000. 10. The company pays interest on its long-term debt at the end of each month. Interest is equal to 1% of the balance of long-term debt at the beginning of the month. 11. On August 10 the company will pay cash for Land, costing $6,500. 12. On July 27 the company will declare a cash dividend of $5,000 and will pay it in August. 13. The company requires a minimum cash balance of $5,000 and will use any cash surplus to pay down long-term debt. The company borrows cash in $1,000 increments. Bengals Company Sales Budget S&A Expenses Budget July August September July August Variable Selling & Admin Expenses Sales Commissions Credit Sales $ 50,000 $ 64,000 $ 72,000 (4 ) Utilities Total Variable S&A Expenses 2,000 25,600 Cash Receipts: From Current Month Sales From Prior Month Sales Fixed Selling & Admin Expenses Utilities Total Cash Receipts (1) $ 60,500 Advertising 1,100 1,100 Salaries 1,400 1,400 Inventory Purchases Budget Depreciation 900 900 July August September Insurance (5) 4,200 Total Fixed S&A Expenses 4,200 COGS $ 35,200 $ 39,600 Cash Payments for S&A Expenses Sales Commissions Desired Ending Inventory Total Inventory Needed Beginning Inventory Inventory Purchases Utilities 800 940 (2) $ 36,080 Advertising 1,100 1,100 Salaries 1,400 1,400 Cash Payments for Purchases Depreciation (6) For Current Month Purchases $ 26,352 Insurance (7) For Prior Month Purchases 11,000 Total Payments for S&A Expenses $ 16,600 $ 4,940 Total Cash Payments $ 37,352 (3) Cash Budget Income Statement July August July August Beginning Balance Sales S 50,000 $ 64,000 Cash Receipts 60,500 Less: Variable costs Total Cash Available 57,500 COGS Variable S&A Expenses Contribution Margin Cash Payments: (11) For Inventory Purchases 37,352 Less: Fixed Costs Contribution Margin (11) 37,352 Less: Fixed Costs Cash Payments: For Inventory Purchases For S&A Expenses For Interest Fixed S&A Expenses (8) Interest Expense For Stock Investment Pre-tax Income $ 15,600 21,280 For Land Less: Income Taxes 3,900 5,320 For Dividends Net Income $ 11,700 $ 15,960 For Taxes Total cash payments 58,152 (9) 9,296 Surplus/ (Deficit) New Borrowing / (Repayment) Ending Cash Balance 6,000 (10) 5,000 Balance Sheet July August July August ASSETS LIABILITIES & STOCKHOLDERS EQUITY Current Liabilities Current Assets Cash (12) $ 6,588 (18) 12,500 (13) (19) Accounts Receivable Prepaid Insurance Inventory Accounts Payable Commissions Payable Income Taxes Payable Dividends Payable (14) (15) (20) Total Current Assets Total Current Liabilities Property Plant & Equipment Long term debt (21) Stock Investment Land (16) Stockholders' Equity 85,000 85,000 Common Stock 49,200 49,200 Equipment Accumulated Depreciation (17) (22) Retained Earnings Total Stockholders Equity Total PP &E TOTAL ASSETS $ 158,888 $ 168,020 TOTAL LIABILITIES & STOCKHOLDERS EQUITY $ 158,888 $ 168,020 13. What is the balance of Accounts Receivable on August 31, 2020? $15,000 $28,500 $12,500 $18,000 $16,000 14. What is the balance of Prepaid Insurance on July 31, 2020? $11,000 $11,500 $ 500 $ 0 $12,000 15. What is the balance of Inventory on August 31, 2020? $ 7,040 $ 7,920 $35,452 $36,080 $ 1,600 16. What is the balance of Land on August 31, 2020? $ 66,900 $128,100 $ 6,500 $ 60,400 $ 0