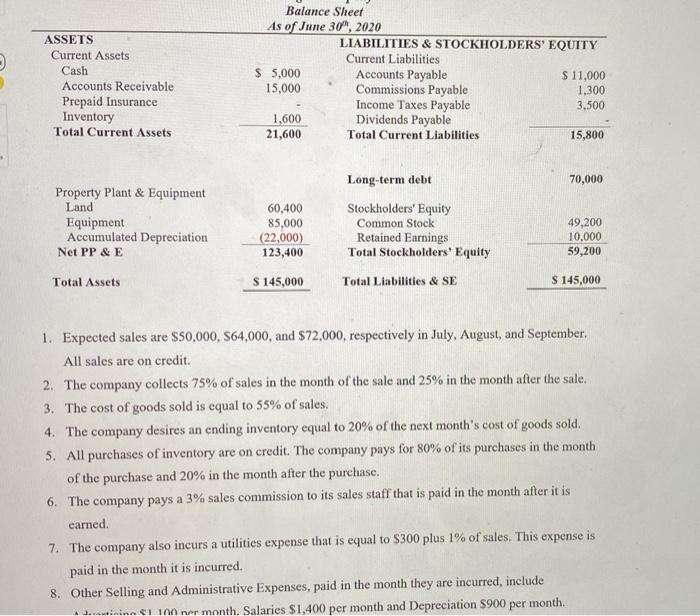

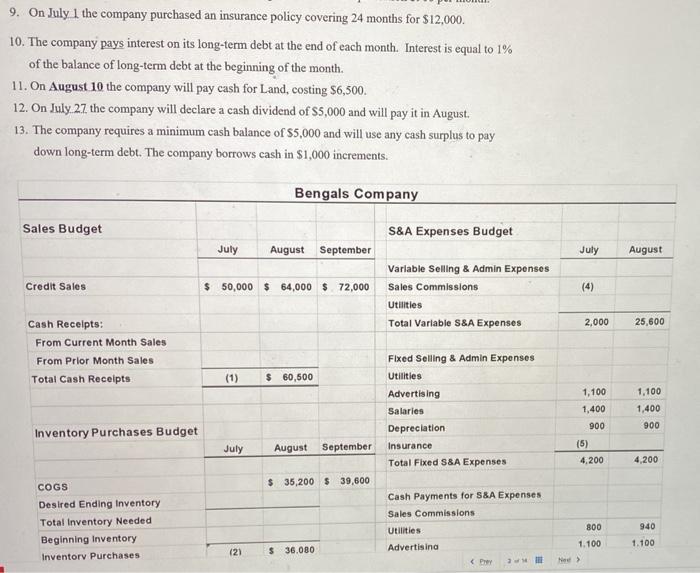

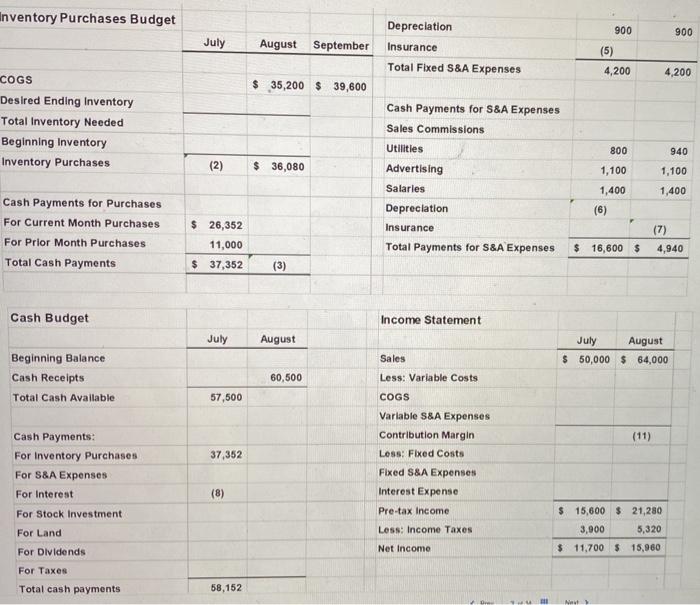

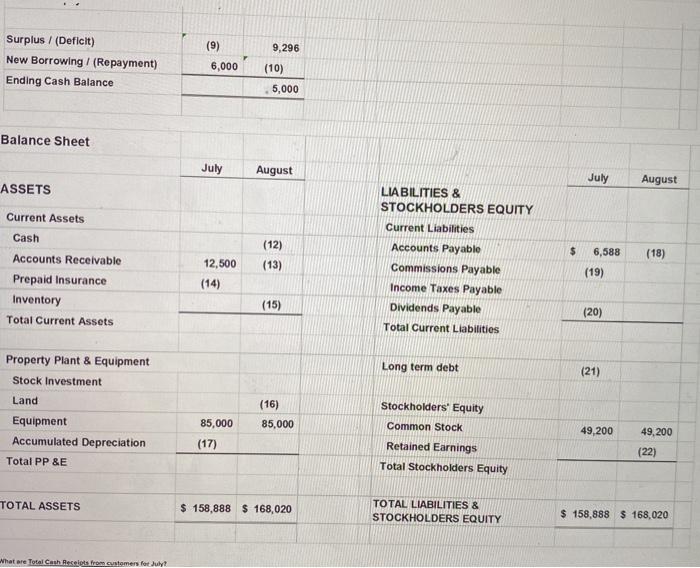

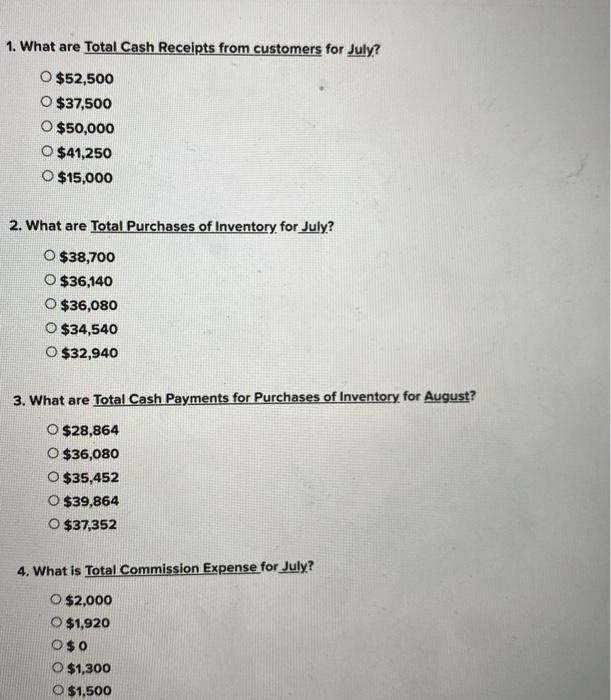

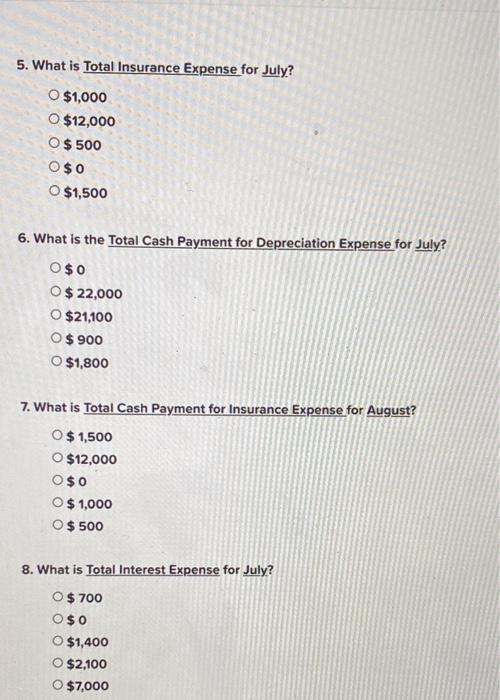

ASSETS Current Assets Cash Accounts Receivable Prepaid Insurance Inventory Total Current Assets Balance Sheet As of June 30, 2020 LIABILITIES & STOCKHOLDERS' EQUITY Current Liabilities $ 5,000 Accounts Payable $ 11,000 15,000 Commissions Payable 1,300 Income Taxes Payable 3,500 1,600 Dividends Payable 21,600 Total Current Liabilities 15,800 70,000 Property Plant & Equipment Land Equipment Accumulated Depreciation Net PP & E 60,400 85,000 (22,000) 123,400 Long-term debt Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity 49,200 10.000 59,200 Total Assets $ 145,000 Total Liabilities & SE $ 145,000 1. Expected sales are $50,000, S64,000, and $72,000, respectively in July, August, and September. All sales are on credit. 2. The company collects 75% of sales in the month of the sale and 25% in the month after the sale. 3. The cost of goods sold is equal to 55% of sales. 4. The company desires an ending inventory equal to 20% of the next month's cost of goods sold. 5. All purchases of inventory are on credit. The company pays for 80% of its purchases in the month of the purchase and 20% in the month after the purchase. 6. The company pays a 3% sales commission to its sales staff that is paid in the month after it is earned 7. The company also incurs a utilities expense that is equal to $300 plus 1% of sales. This expense is paid in the month it is incurred. 8. Other Selling and Administrative Expenses, paid in the month they are incurred, include in cu 100 ner month. Salaries $1,400 per month and Depreciation $900 per month 9. On July 1 the company purchased an insurance policy covering 24 months for $12,000. 10. The company pays interest on its long-term debt at the end of each month. Interest is equal to 1% of the balance of long-term debt at the beginning of the month. 11. On August 10 the company will pay cash for Land, costing $6,500 12. On July 27 the company will declare a cash dividend of $5,000 and will pay it in August. 13. The company requires a minimum cash balance of $5,000 and will use any cash surplus to pay down long-term debt. The company borrows cash in $1,000 increments. Bengals Company Sales Budget S&A Expenses Budget July August September July August Variable Selling & Admin Expenses Sales Commissions Credit Sales $ 50,000 $ 64,000 $ 72,000 (4) Utilities Total Variable S&A Expenses 2,000 25,600 Cash Receipts: From Current Month Sales From Prior Month Sales Total Cash Receipts (1) $ 60,500 Fixed Selling & Admin Expenses Utilities Advertising Salaries Depreciation Insurance Total Fixed S&A Expenses 1,100 1,400 900 (5) 4,200 1,100 1,400 900 Inventory Purchases Budget July August September 4,200 $ 35,200 $ 39,600 COGS Desired Ending Inventory Total Inventory Needed Beginning Inventory Inventory Purchases Cash Payments for S&A Expenses Sales Commissions Utilities Advertising 800 940 1.100 1.100 121 $36.080 Ne Inventory Purchases Budget 900 900 July August September Depreciation Insurance Total Fixed S&A Expenses (5) 4,200 4,200 $ 35,200 $ 39,600 COGS Desired Ending Inventory Total Inventory Needed Beginning Inventory Inventory Purchases 800 940 (2) $ 36,080 Cash Payments for S&A Expenses Sales Commissions Utilities Advertising Salarles Depreciation Insurance Total Payments for S&A Expenses 1,100 1,100 1,400 1,400 (6) Cash Payments for Purchases For Current Month Purchases For Prior Month Purchases $ 26,352 11,000 $ 37,352 (7) 4,940 $ 16,600 $ Total Cash Payments (3) Cash Budget Income Statement July August July August $ 50,000 $ 64,000 Beginning Balance Cash Receipts Total Cash Available 60,500 57,500 (11) 37,352 Cash Payments For Inventory Purchases For S&A Expenses For Interest Sales Less: Variable Costs COGS Variable S&A Expenses Contribution Margin Less: Fixed Costs Fixed S&A Expenses Interest Expense Pre-tax Income Less: Income Taxes Net Income (8) For Stock Investment For Land $ 15,600 $ 21,280 3,900 5,320 $ 11,700 $ 15,960 For Dividends For Taxes Total cash payments 58,152 (9) 9,296 Surplus/ (Deficit) New Borrowing / (Repayment) Ending Cash Balance 6,000 (10) 5,000 Balance Sheet July August July August ASSETS Current Assets $ (12) (13) (18) LIABILITIES & STOCKHOLDERS EQUITY Current Liabilities Accounts Payable Commissions Payable Income Taxes Payable Dividends Payable Total Current Liabilities Cash Accounts Receivable Prepaid Insurance Inventory Total Current Assets 12,500 (14) 6,588 (19) (15) (20) Long term debt (21) Property Plant & Equipment Stock Investment Land Equipment Accumulated Depreciation Total PP &E (16) 85,000 85,000 Stockholders' Equity Common Stock Retained Earnings Total Stockholders Equity 49,200 (17) 49,200 (22) TOTAL ASSETS $ 158,888 $ 168,020 TOTAL LIABILITIES & STOCKHOLDERS EQUITY $ 158,888 $ 168,020 What are Total Cash Recelets from customers for July 1. What are Total Cash Receipts from customers for July? O $52,500 O $37,500 O $50,000 O $41,250 O $15,000 2. What are Total Purchases of Inventory for July? O $38,700 $36,140 $36,080 O $34,540 O $32,940 3. What are Total Cash Payments for Purchases of Inventory for August? O $28,864 $36,080 $35,452 $39,864 O $37,352 4. What is Total Commission Expense for July? O $2,000 O $1,920 O $0 O $1,300 O $1,500 5. What is Total Insurance Expense for July? O $1,000 O $12,000 O $500 O $0 $1,500 6. What is the Total Cash Payment for Depreciation Expense for July? O $0 $ 22,000 $21,100 O $ 900 O $1,800 7. What is Total Cash Payment for Insurance Expense for August? O $1,500 O $12,000 O$o O $1,000 O $500 8. What is Total Interest Expense for July? O $ 700 O$0 O $1,400 O $2,100 O $7,000