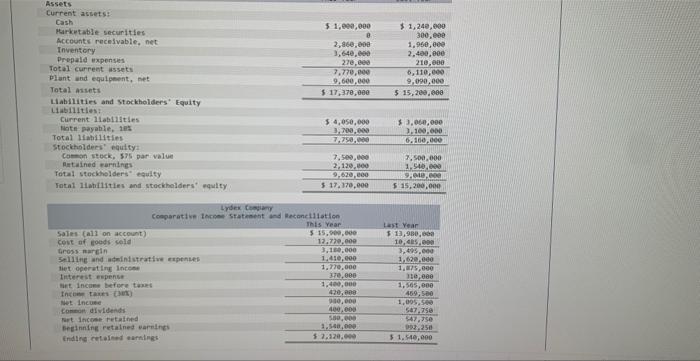

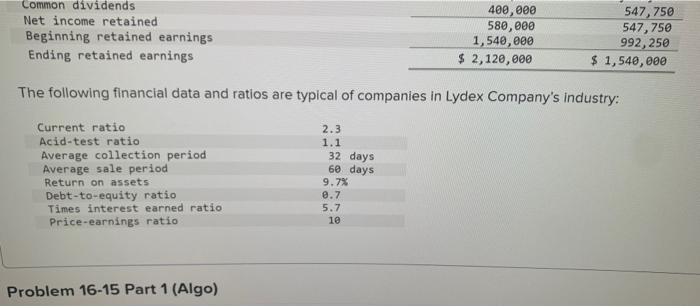

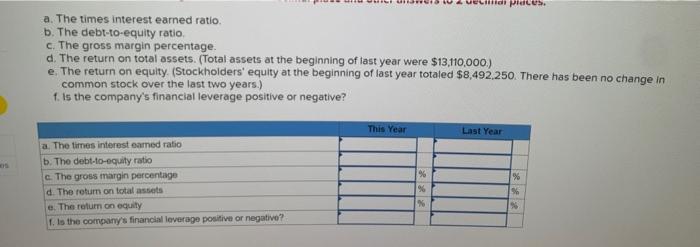

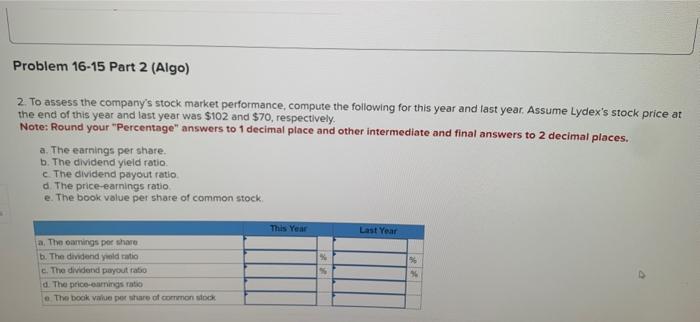

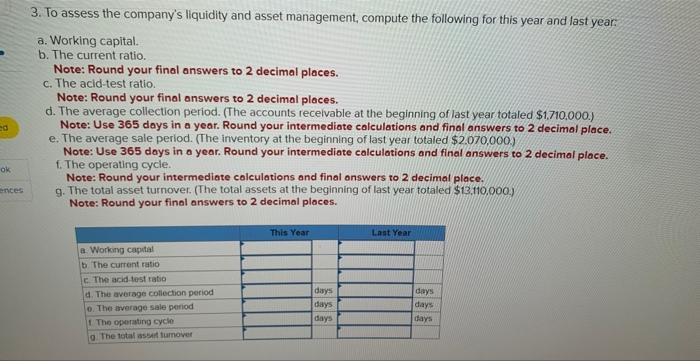

Assets Current assets: Cash Markutable secuinities Accounts recelvable, net: Tnventory Prepala uxpenses Fotal curreet assets phant and equipoent, net Total assets Labilities and Stockholders' Equity tiabilities: current Ilablisties fiote payable, ats Total lifarilities Stockholders' equilya comen steck, $75 par value antained earnitres fotal stockholders" equlty Fotal 1tahtifties and stockholders' equity \$ 1, eca, eo $1,240,000 300 , eve 2,980,000 3,640,600 270,800 7,770,000 9,600,000 17,370,000 5. 17,378,000 515,200,900 \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ triex copiay } \\ \hline Cenparative i 1 & Increas statienst and & Eecanctilation & \multirow[b]{2}{*}{ Lest Year } \\ \hline & & This Year & \\ \hline Soles (all on account) & & 515,960,000 & i 13,980,000 \\ \hline cevt af eoods seld ? & & 12,720,000 & 10,414,000 \\ \hline Gross: nareln & & 3,180,000 & 3,465,000 \\ \hline Selline and adeindstrative expentes & & 1,490,000 & 1,620,000 \\ \hline liet operatins Intene & & 1,770,000 & 1,ar/5,000 \\ \hline Interest espense & & ye, 000 & \\ \hline net, incane before tanes & & 1,400,000 & 1,565,000 \\ \hline thesen taves-(aex) & & 420,008 & 469,500 \\ \hline Net Incuere. & & 900,009 & 1,005,560 \\ \hline Conton dividends. & & 400,000 & 547,758 \\ \hline Fert Incoer retalined & & & 47,750 \\ \hline Beginning retalned varnines & & 3,540,009 & 002,25a \\ \hline Endirg cetornet earnings. & & 52,228,000 & $1,540,000 \\ \hline \end{tabular} The following financial data and ratios are typical of companies in Lydex Company's industry: Problem 16-15 Part 1 (Algo) a. The times interest earned ratio. b. The debt-to-equity ratio. c. The gross margin percentage. d. The return on total assets. (Total assets at the beginning of last year were $13,110,000 ) e. The return on equity. (Stockholders' equity at the beginning of last year totaled $8,492,250. There has been no change in common stock over the last two years.) f. is the company's financial leverage positive or negative? 2. To assess the company's stock market performance, compute the following for this year and last year. Assume Lydex's stock price at the end of this year and last year was $102 and $70, respectlvely. Note: Round your "Percentage" answers to 1 decimal place and other intermediate and final answers to 2 decimal places. a. The earnings per share. b. The dividend yield ratio c. The dividend payout ratio d. The price-earnings ratio e. The book value per share of common stock. 3. To assess the company's liquidity and asset management, compute the following for this year and last year: a. Working capital. b. The current ratio. Note: Round your final answers to 2 decimal places. c. The acid-test ratio. Note: Round your final answers to 2 decimal places. d. The average collection period. (The accounts recelvable at the beginning of last year totaled $1,710,000.) Note: Use 365 days in a year. Round your intermediate calculations and final answers to 2 decimal place. e. The average sale period. (The inventory at the beginning of last year totaled $2.070,000 ) Note: Use 365 days in o year. Round your intermediate calculations and final answers to 2 decimal place. f. The operating cycle. Note: Round your intermediate colculations and final answers to 2 decimal place. g. The total asset turnover. (The total assets at the beginning of last year totaled $13,110,000 ) Note: Round your final answers to 2 decimal places