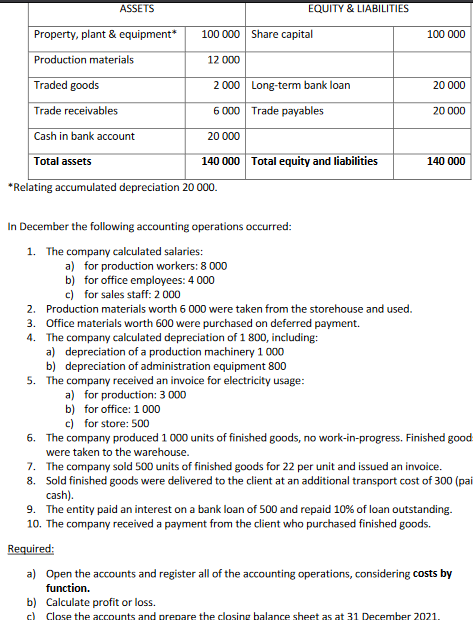

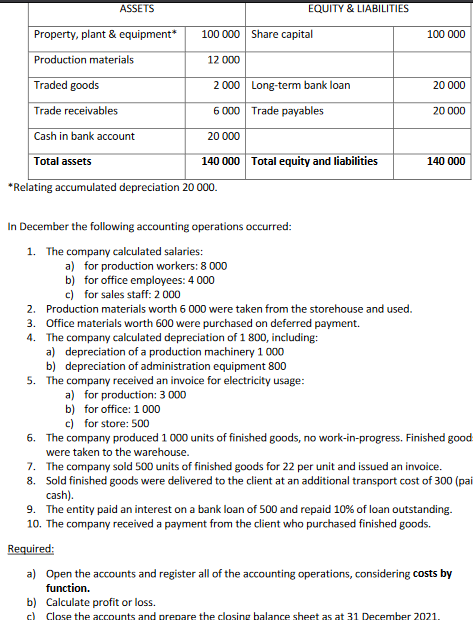

ASSETS EQUITY & LIABILITIES 100 000 20 000 Property, plant & equipment* 100 000 Share capital Production materials 12 000 Traded goods 2 000 Long-term bank loan Trade receivables 6 000 Trade payables Cash in bank account 20 000 Total assets 140 000 Total equity and liabilities *Relating accumulated depreciation 20 000. 20 000 140 000 In December the following accounting operations occurred: 1. The company calculated salaries: a) for production workers: 8 000 b) for office employees: 4 000 c) for sales staff: 2000 2. Production materials worth 6 000 were taken from the storehouse and used. 3. Office materials worth 600 were purchased on deferred payment. 4. The company calculated depreciation of 1 800, including: a) depreciation of a production machinery 1 000 b) depreciation of administration equipment 800 5. The company received an invoice for electricity usage: a) for production: 3 000 b) for office: 1 000 c) for store: 500 6. The company produced 1 000 units of finished goods, no work-in-progress. Finished good were taken to the warehouse. 7. The company sold 500 units of finished goods for 22 per unit and issued an invoice. 8. Sold finished goods were delivered to the client at an additional transport cost of 300 (pai cash). 9. The entity paid an interest on a bank loan of 500 and repaid 10% of loan outstanding. 10. The company received a payment from the client who purchased finished goods. Required: a) Open the accounts and register all of the accounting operations, considering costs by function. b) Calculate profit or loss. c) Close the accounts and prepare the closing balance sheet as at 31 December 2021. ASSETS EQUITY & LIABILITIES 100 000 20 000 Property, plant & equipment* 100 000 Share capital Production materials 12 000 Traded goods 2 000 Long-term bank loan Trade receivables 6 000 Trade payables Cash in bank account 20 000 Total assets 140 000 Total equity and liabilities *Relating accumulated depreciation 20 000. 20 000 140 000 In December the following accounting operations occurred: 1. The company calculated salaries: a) for production workers: 8 000 b) for office employees: 4 000 c) for sales staff: 2000 2. Production materials worth 6 000 were taken from the storehouse and used. 3. Office materials worth 600 were purchased on deferred payment. 4. The company calculated depreciation of 1 800, including: a) depreciation of a production machinery 1 000 b) depreciation of administration equipment 800 5. The company received an invoice for electricity usage: a) for production: 3 000 b) for office: 1 000 c) for store: 500 6. The company produced 1 000 units of finished goods, no work-in-progress. Finished good were taken to the warehouse. 7. The company sold 500 units of finished goods for 22 per unit and issued an invoice. 8. Sold finished goods were delivered to the client at an additional transport cost of 300 (pai cash). 9. The entity paid an interest on a bank loan of 500 and repaid 10% of loan outstanding. 10. The company received a payment from the client who purchased finished goods. Required: a) Open the accounts and register all of the accounting operations, considering costs by function. b) Calculate profit or loss. c) Close the accounts and prepare the closing balance sheet as at 31 December 2021