Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assets January 31, 2024 Liabilities Current Assets: Current Liabilities: Cash $ 84,400 Accounts Payable Accounts Receivable 47,100 Utilities Payable Supplies 7 12,600 Dividends Payable

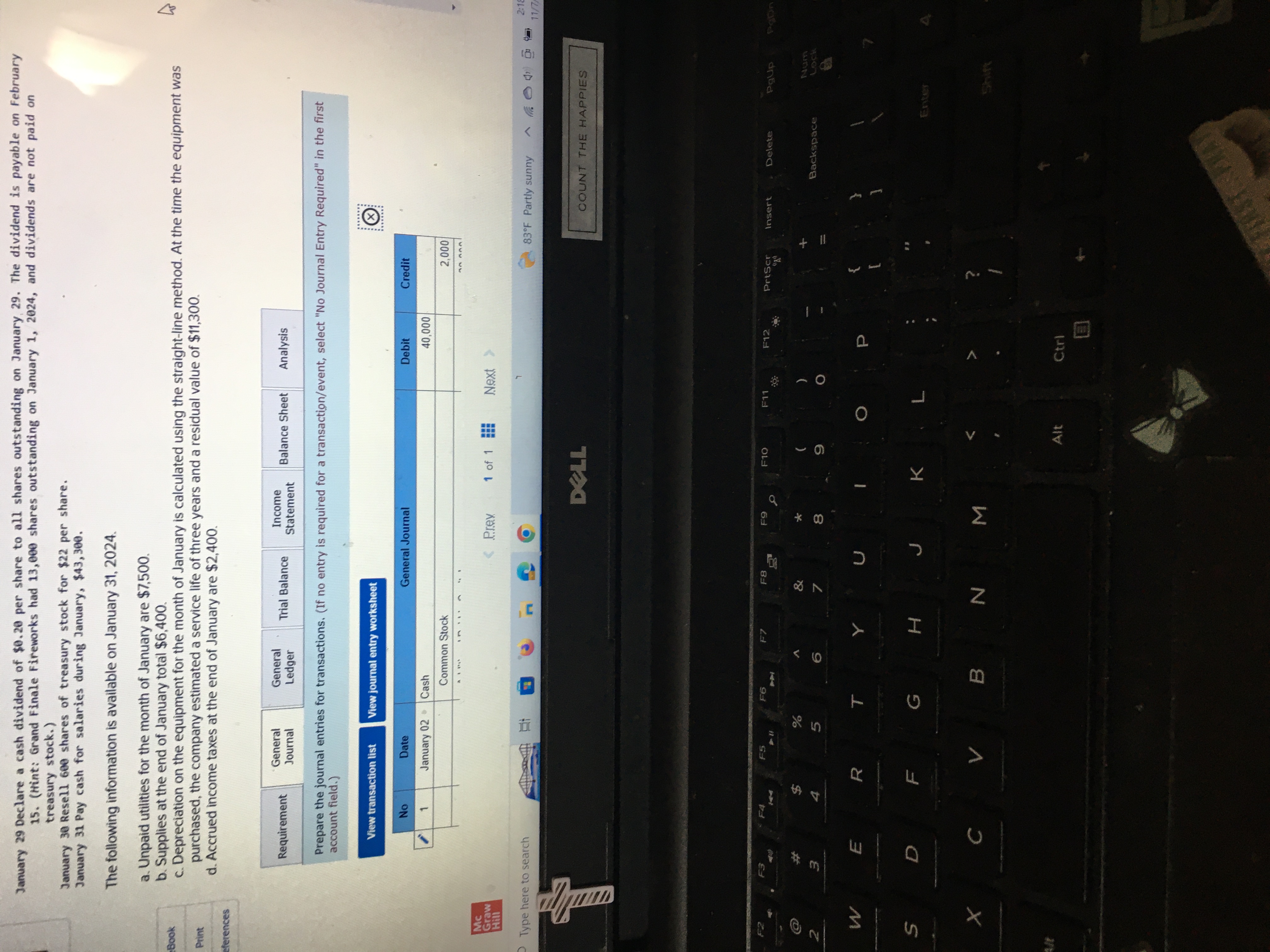

Assets January 31, 2024 Liabilities Current Assets: Current Liabilities: Cash $ 84,400 Accounts Payable Accounts Receivable 47,100 Utilities Payable Supplies 7 12,600 Dividends Payable + Income Tax Payable $ 11,800 0 4 2,800 2,400 Total Current Assets 144,100 Total Current Liabilities. 17,000 Noncurrent Assets: Stockholders' Equity 4 Equipment 77,000 Common Stock 15,000 4 Accumulated Depreciation (12,125) Additional Paid-in Capital 132.200 4 Treasury Stock (19,988) Total Stockholders' Equity 127,212 Total Assets $ 208,975 Total Liabilities & Stockholders' Equity $ 144,212 DASANL PURIFIED WATER Benced with minerals fowod 163 FL 02 (1.06 PT NATURES RATIONA Zinc 2023FA M Qu x Canalys Record Macmil The Un y On Jani C It show C On Jan C On Jan C On Jan ITC 4 y Google C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com% Accounting Cycle #3 i Saved 1 Prepare a multiple-step income statement for the period ended January 31, 2024. Choose the appropriate accounts to complete the company's income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Post-closing 100 points Grand Finale Fireworks Multiple-Step Income Statement For the Month Ended January 31, 2024 eBook Service Revenue $ 69 50,400 Print Total Revenue References Salaries Expense Utilities Expense Supplies Expense Depreciation Expense Total Operating Expenses Income Before Taxes Income Tax Expense Net Income MC Graw Hill Type here to search 4 $ 50.400 45,700 7,500 0 1,825 Prey 1 of 1 Next 85F Partly sunny DELL Esc F2 F3 F4 FS F6 F7 F8 F9 F10 F11 (a) % A 2 3 4 5 Record Macmi The Un On Jan C It show C On Jan C C On Jan On Jan ITC 4 y Google Dash acation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F# cle #3 Saved On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: Accounts Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Common Stock, $1 par value Additional Paid-in Capital Retained Earnings Totals Debit Credit $44,000 47,100 8,800 77,000 $10,300 15,900 13,000 93,000 44,700 $176,900 $176,900 During January 2024, the following transactions occur: January 2 Issue an additional 2,000 shares of $1 par value common stock for $40,000. January 9 Provide services to customers on account, $17,900. January 10 Purchase additional supplies on account, $6,200. January 12 Purchase 1,000 shares of treasury stock for $20 per share. January 15 Pay cash on accounts payable, $17,800. January 21 Provide services to customers for cash, $50,400. January 22 Receive cash on accounts receivable, $17,900. Help January 29 Declare a cash dividend of $0.20 per share to all shares outstanding on January 29. The dividend is payable on February treasury stock.) 15. (Hint: Grand Finale Fireworks had 13,000 shares outstanding on January 1, 2024, and dividends are not paid on January 30 Resell 600 shares of treasury stock for $22 per share. January 31 Pay cash for salaries during January, $43,300. e to search 3 F3 3 C Prev 1 of 1 Next 83F Partly sunny DELL COUNT T F4 F5 F6 F7 F8 F9 F10 F11 F12 PrtScr Delete A E R % 5 T Y * & 7 00 C a Backspate Record Macmi The Un CIt show On Jan C On Jan C On Jan C On Jan C On Jan | ITC 4 On Jan C y! Google Dashb: + tion.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/acti... #3 d. Accrued income taxes at the end of January are $2,400. aw Saved Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Analysis Help Sav Using the information from the requirements above, complete the 'Analysis' tab. (Enter your return on equity value to one decimal place and earnings per share value to 2 decimal places.) Analyze the following for Grand Finale Fireworks: (a) Calculate the return on equity for the month of January. If the average return on equity for the industry for January is 2.50%, is the company more or less profitable than other companies in the same industry? The return on equity is: Is the company more or less profitable than other companies? (b) How many shares of common stock are outstanding as of January 31, 2024? The number of common shares outstanding as of January 31 2024 is % (c) Calculate earnings per share for the month of January (Hint: To calculate average shares of common stock outstanding take the beginning shares outstanding plus the ending shares outstanding and divide the total by 2.) If earnings per share was $3.60 last year (ie. an average of $0.30 per month), is earnings per share for January 2024 better or worse than last year's average? Earnings per share is: Is earnings per share for January 2024 better or worse than last year's average? e here to search C Balance Sheet Pray 1 of 1 Next 83F Partly sunny DELL COUNT THE F3 F4 F5 F6 F7 F8 F9 F10 F11 F12 Prisce Insert Delete % P 4 5 3 E R & 7 8 * 00 Y U ( January 29 Declare a cash dividend of $0.20 per share to all shares outstanding on January, 29. The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 13,000 shares outstanding on January 1, 2024, and dividends are not paid on treasury stock.) January 30 Resell 600 shares of treasury stock for $22 per share. January 31 Pay cash for salaries during January, $43,300. The following information is available on January 31, 2024. a. Unpaid utilities for the month of January are $7,500. c. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $11,300. b. Supplies at the end of January total $6,400. Book Print eferences d. Accrued income taxes at the end of January are $2,400. Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Analysis ******** Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet No 1 Date January 02 Cash General Journal Common Stock Mc Graw Hill Type here to search AIM F3 F4 FS F6 3 * m 2 A 4 744 5 don % 6 < 10 Debit Credit 40,000 < Prev 1 of 1 Next > DELL 2,000 AA AAA 83F Partly sunny COUNT THE HAPPIES 2:19 11/7- F7 F8 F9 F10 F11 F12 PrtScr Insert Delete PgUp PgDn & W E R T Y U S D G H X C V B Alt * 00 8 N M 6 K L Alt Backspace Num Lock P { } [ ? >> Ctrl Enter Shift FIRST SPRAY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is the multiplestep income statement with full workings shown in details Revenue Service Revenu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started