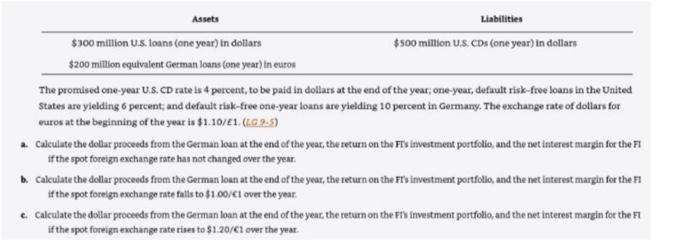

Assets Labilities $300 million U.S. toans (one year) in dollars $500 mition us. CDs (one year) in dollar $200 million equivalent German loans (one year) in eutos The promised one-year U.S. CD rate is 4 percent, to be paid in dollars at the end of the year; one-year, default risk-free loans in the United States are yielding 6 percent, and defautt risk-free one-year loans are yielding 10 percent in Germary. The exchange rate of dollars for euros at the beginning of the yeat is $1.10/f1,(k.9.9.5) Calculate the dollar proceeds from the German loan at the end of the year, the return on the Frs invertment portfolio, and the net interest margin for the FI if the spot foreign exchange rate has not changed over the year. Calculate the dollar proceds from the Cerman loan at the end of the year, the return on the Fri inveitment portfollo, and the net interest margin for the FI if the spot foreign exchange rate falls to $1.00/6}1 over the year. 4 Calculate the dollar proceds from the Cerman loan at the end of the year, the returm on the Fik investment portfolio, and the net interest margin for the FI if the spot foreign exchange rate rives to $1:20/Cl over the year. Assets Labilities $300 million U.S. toans (one year) in dollars $500 mition us. CDs (one year) in dollar $200 million equivalent German loans (one year) in eutos The promised one-year U.S. CD rate is 4 percent, to be paid in dollars at the end of the year; one-year, default risk-free loans in the United States are yielding 6 percent, and defautt risk-free one-year loans are yielding 10 percent in Germary. The exchange rate of dollars for euros at the beginning of the yeat is $1.10/f1,(k.9.9.5) Calculate the dollar proceeds from the German loan at the end of the year, the return on the Frs invertment portfolio, and the net interest margin for the FI if the spot foreign exchange rate has not changed over the year. Calculate the dollar proceds from the Cerman loan at the end of the year, the return on the Fri inveitment portfollo, and the net interest margin for the FI if the spot foreign exchange rate falls to $1.00/6}1 over the year. 4 Calculate the dollar proceds from the Cerman loan at the end of the year, the returm on the Fik investment portfolio, and the net interest margin for the FI if the spot foreign exchange rate rives to $1:20/Cl over the year