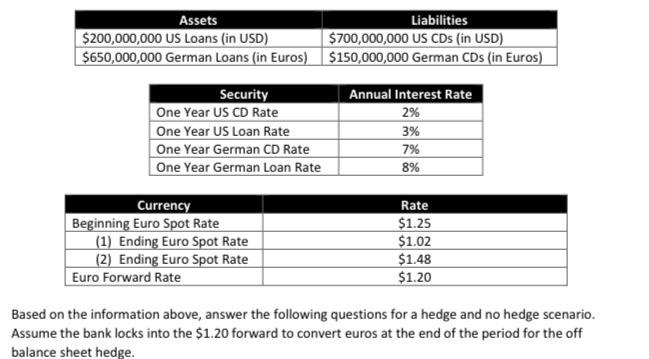

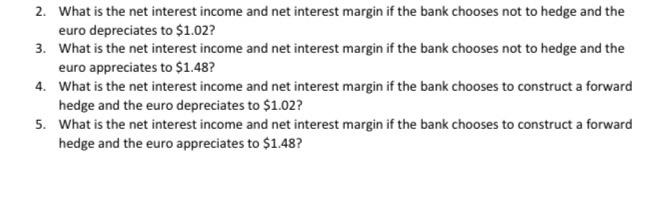

Assets Liabilities $200,000,000 US Loans (in USD) $700,000,000 US CDs (in USD) $650,000,000 German Loans (in Euros) $150,000,000 German CDs (in Euros) Security One Year US CD Rate One Year US Loan Rate One Year German CD Rate One Year German Loan Rate Annual Interest Rate 2% 3% 7% 8% Currency Beginning Euro Spot Rate (1) Ending Euro Spot Rate (2) Ending Euro Spot Rate Euro Forward Rate Rate $1.25 $1.02 $1.48 $1.20 Based on the information above, answer the following questions for a hedge and no hedge scenario. Assume the bank locks into the $1.20 forward to convert euros at the end of the period for the off balance sheet hedge. 2. What is the net interest income and net interest margin if the bank chooses not to hedge and the euro depreciates to $1.02? 3. What is the net interest income and net interest margin if the bank chooses not to hedge and the euro appreciates to $1.48? 4. What is the net interest income and net interest margin if the bank chooses to construct a forward hedge and the euro depreciates to $1.02? 5. What is the net interest income and net interest margin if the bank chooses to construct a forward hedge and the euro appreciates to $1.48? Assets Liabilities $200,000,000 US Loans (in USD) $700,000,000 US CDs (in USD) $650,000,000 German Loans (in Euros) $150,000,000 German CDs (in Euros) Security One Year US CD Rate One Year US Loan Rate One Year German CD Rate One Year German Loan Rate Annual Interest Rate 2% 3% 7% 8% Currency Beginning Euro Spot Rate (1) Ending Euro Spot Rate (2) Ending Euro Spot Rate Euro Forward Rate Rate $1.25 $1.02 $1.48 $1.20 Based on the information above, answer the following questions for a hedge and no hedge scenario. Assume the bank locks into the $1.20 forward to convert euros at the end of the period for the off balance sheet hedge. 2. What is the net interest income and net interest margin if the bank chooses not to hedge and the euro depreciates to $1.02? 3. What is the net interest income and net interest margin if the bank chooses not to hedge and the euro appreciates to $1.48? 4. What is the net interest income and net interest margin if the bank chooses to construct a forward hedge and the euro depreciates to $1.02? 5. What is the net interest income and net interest margin if the bank chooses to construct a forward hedge and the euro appreciates to $1.48