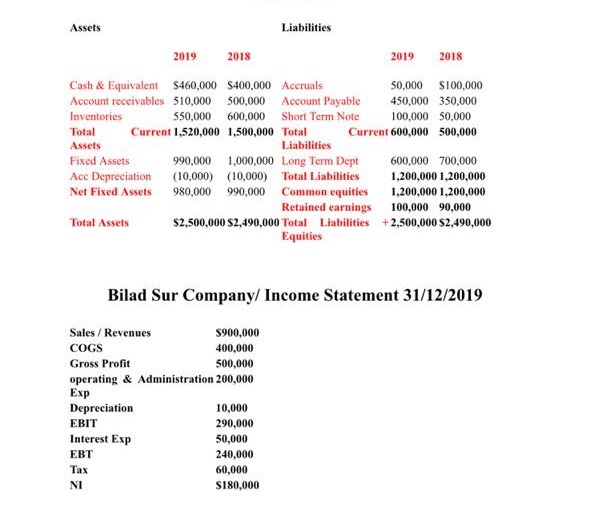

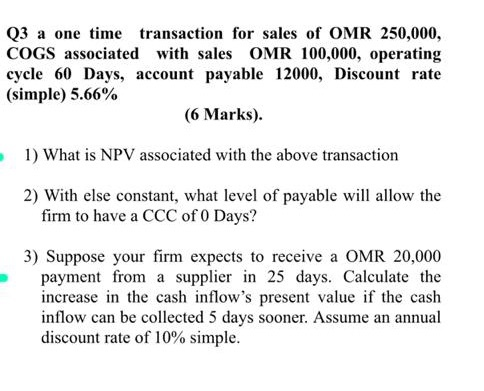

Assets Liabilities 2019 2018 2019 2018 Cash & Equivalent S460,000 $400,000 Accruals 50,000 $100,000 Account receivables 510,000 500,000 Account Payable 450,000 350,000 Inventories 550,000 600,000 Short Term Note 100,000 50,000 Total Current 1,520,000 1,500,000 Total Current 600,000 500,000 Assets Liabilities Fixed Assets 990,000 1,000,000 Long Term Dept 600,000 700.000 Acc Depreciation (10,000) (10.000) Total Liabilities 1,200,000 1,200,000 Net Fixed Assets 980,000 990,000 Common equities 1,200,000 1,200,000 Retained earnings 100,000 90,000 Total Assets $2,500,000 $2,490,000 Total Liabilities +2,500,000 $2,490,000 Equities Bilad Sur Company/ Income Statement 31/12/2019 Sales / Revenues $900,000 COGS 400,000 Gross Profit 500,000 operating & Administration 200,000 Exp Depreciation 10,000 EBIT 290,000 Interest Exp 50,000 EBT 240,000 Tax 60,000 NI $180,000 Q3 a one time transaction for sales of OMR 250,000, COGS associated with sales OMR 100,000, operating cycle 60 Days, account payable 12000, Discount rate (simple) 5.66% (6 Marks). 1) What is NPV associated with the above transaction 2) With else constant, what level of payable will allow the firm to have a CCC of 0 Days? 3) Suppose your firm expects to receive a OMR 20,000 payment from a supplier in 25 days. Calculate the increase in the cash inflow's present value if the cash inflow can be collected 5 days sooner. Assume an annual discount rate of 10% simple. Assets Liabilities 2019 2018 2019 2018 Cash & Equivalent S460,000 $400,000 Accruals 50,000 $100,000 Account receivables 510,000 500,000 Account Payable 450,000 350,000 Inventories 550,000 600,000 Short Term Note 100,000 50,000 Total Current 1,520,000 1,500,000 Total Current 600,000 500,000 Assets Liabilities Fixed Assets 990,000 1,000,000 Long Term Dept 600,000 700.000 Acc Depreciation (10,000) (10.000) Total Liabilities 1,200,000 1,200,000 Net Fixed Assets 980,000 990,000 Common equities 1,200,000 1,200,000 Retained earnings 100,000 90,000 Total Assets $2,500,000 $2,490,000 Total Liabilities +2,500,000 $2,490,000 Equities Bilad Sur Company/ Income Statement 31/12/2019 Sales / Revenues $900,000 COGS 400,000 Gross Profit 500,000 operating & Administration 200,000 Exp Depreciation 10,000 EBIT 290,000 Interest Exp 50,000 EBT 240,000 Tax 60,000 NI $180,000 Q3 a one time transaction for sales of OMR 250,000, COGS associated with sales OMR 100,000, operating cycle 60 Days, account payable 12000, Discount rate (simple) 5.66% (6 Marks). 1) What is NPV associated with the above transaction 2) With else constant, what level of payable will allow the firm to have a CCC of 0 Days? 3) Suppose your firm expects to receive a OMR 20,000 payment from a supplier in 25 days. Calculate the increase in the cash inflow's present value if the cash inflow can be collected 5 days sooner. Assume an annual discount rate of 10% simple