Question

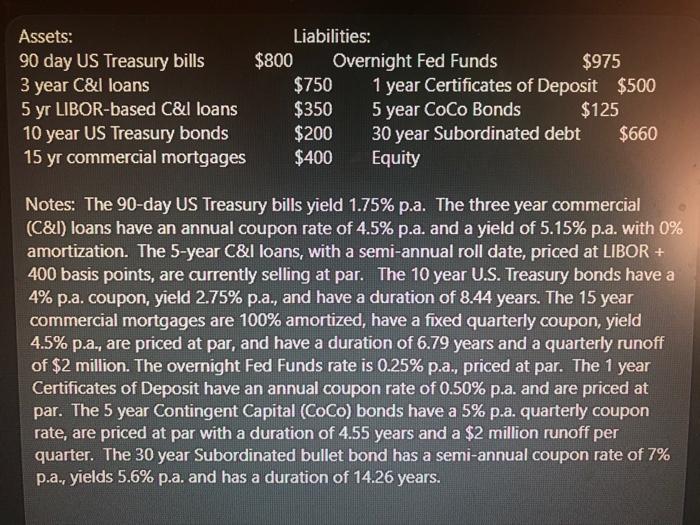

Assets: Liabilities: 90 day US Treasury bills $800 Overnight Fed Funds $975 3 year C&I loans $750 1 year Certificates of Deposit $500 5 yr

Assets: Liabilities: 90 day US Treasury bills $800 Overnight Fed Funds $975 3 year C&I loans $750 1 year Certificates of Deposit $500 5 yr LIBOR-based C&I loans $350 5 year CoCo Bonds $125 10 year US Treasury bonds $200 30 year Subordinated debt $660 15 yr commercial mortgages $400 Equity

Notes: The 90-day US Treasury bills yield 1.75% p.a. The three year commercial (C&I) loans have an annual coupon rate of 4.5% p.a. and a yield of 5.15% p.a. with 0% amortization. The 5-year C&I loans, with a semi-annual roll date, priced at LIBOR + 400 basis points, are currently selling at par. The 10 year U.S. Treasury bonds have a 4% p.a. coupon, yield 2.75% p.a., and have a duration of 8.44 years. The 15 year commercial mortgages are 100% amortized, have a fixed quarterly coupon, yield 4.5% p.a., are priced at par, and have a duration of 6.79 years and a quarterly runoff of $2 million. The overnight Fed Funds rate is 0.25% p.a., priced at par. The 1 year Certificates of Deposit have an annual coupon rate of 0.50% p.a. and are priced at par. The 5 year Contingent Capital (CoCo) bonds have a 5% p.a. quarterly coupon rate, are priced at par with a duration of 4.55 years and a $2 million runoff per quarter. The 30 year Subordinated bullet bond has a semi-annual coupon rate of 7% p.a., yields 5.6% p.a. and has a duration of 14.26 years.

1) What is the duration of the banks liabilities? a. 2.83 years b. 2.77 years c. 5.17 years d. 4.39 years e. 3.24 years

2) What is the banks duration gap? a. 2.67 years b. 1.36 years c. -2.12 years d. -2.18 years e. 3.63 years

3) What is the impact on the banks equity values if interest rates decrease 25 basis points? (That is, R/(1+R) equals a 25 basis point decrease.) a. -$13.26 million b. +$29.14 million c. -$13.63 million d. +$28.15 million e. -$750,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started