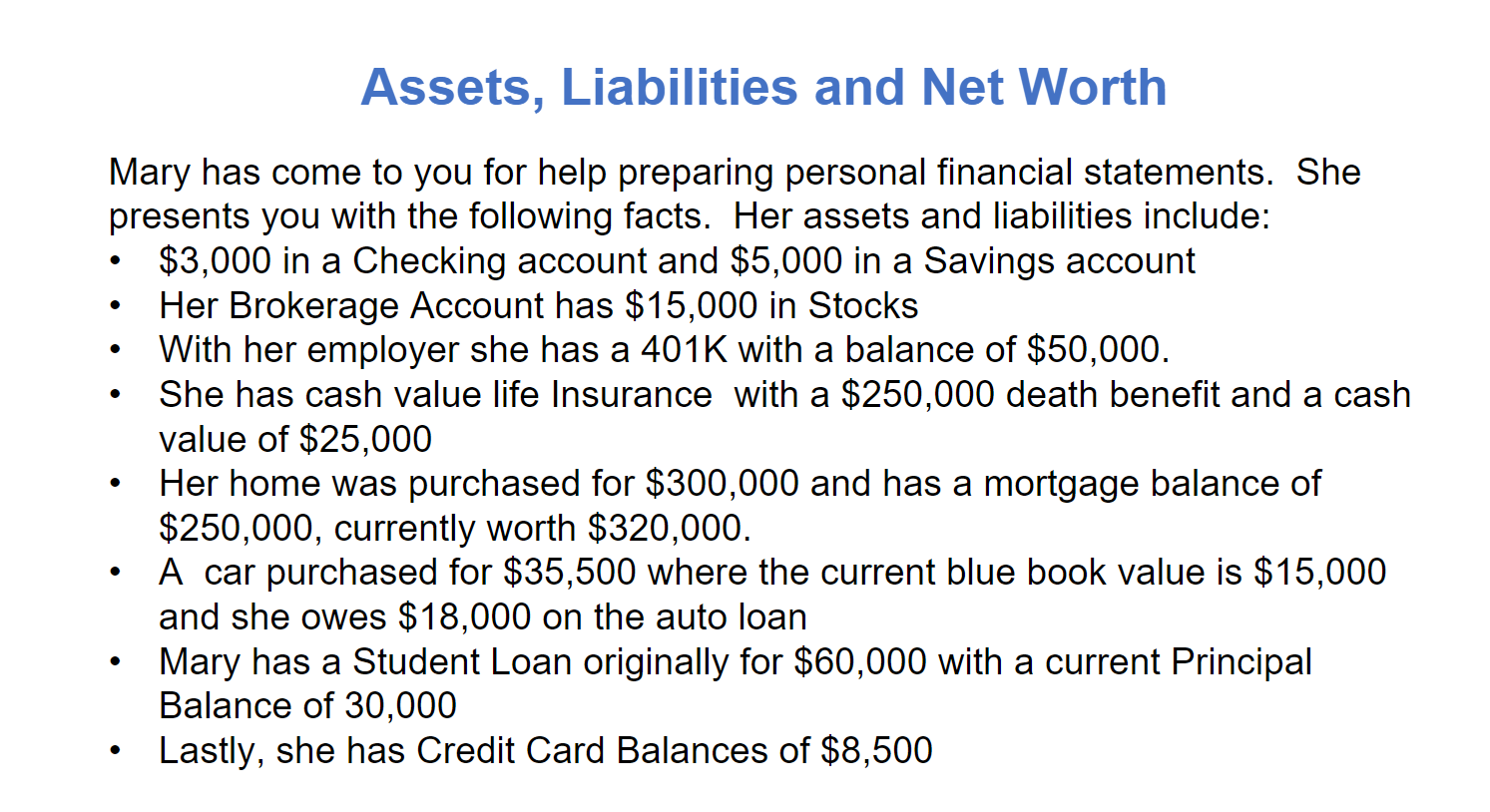

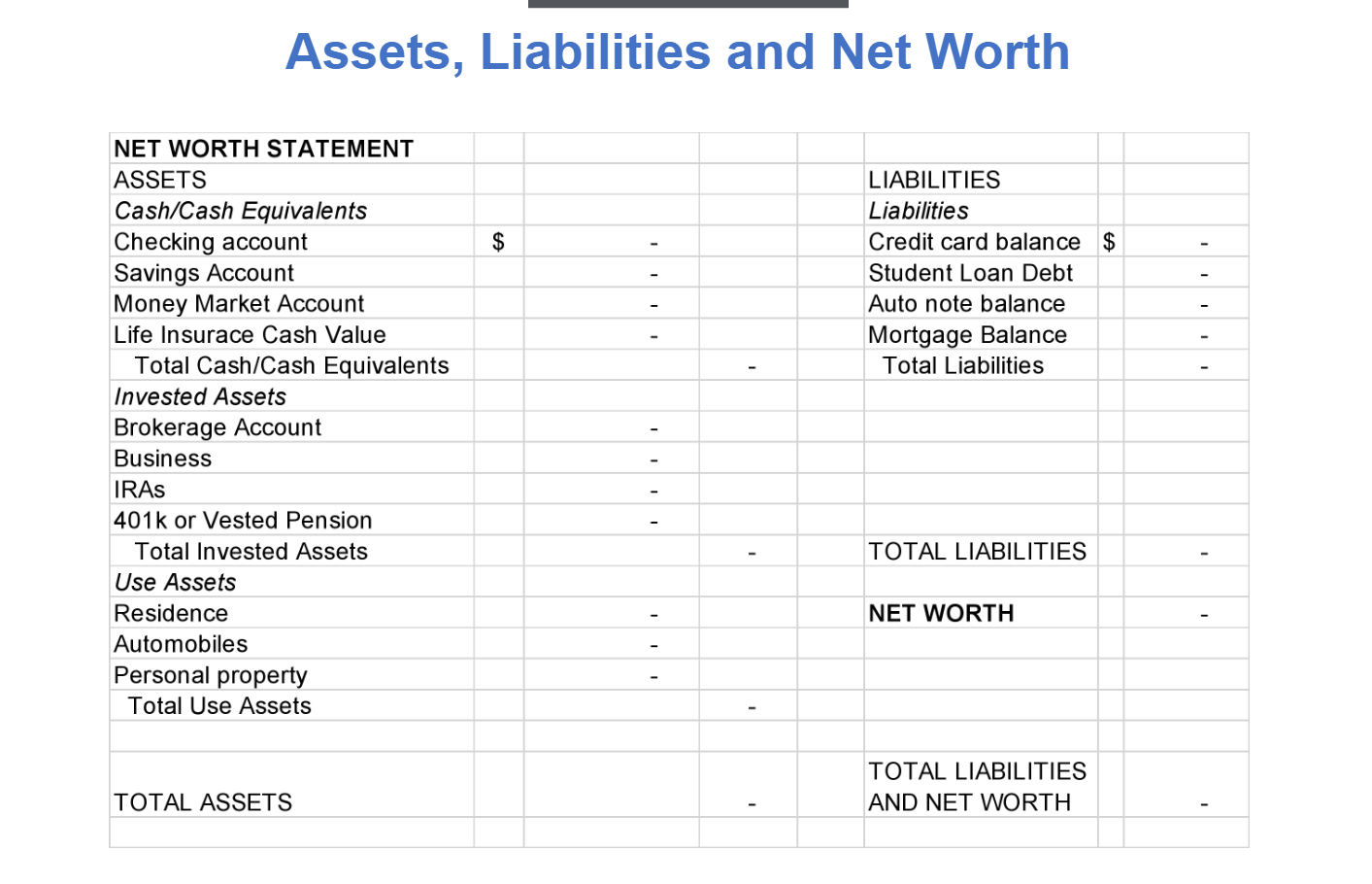

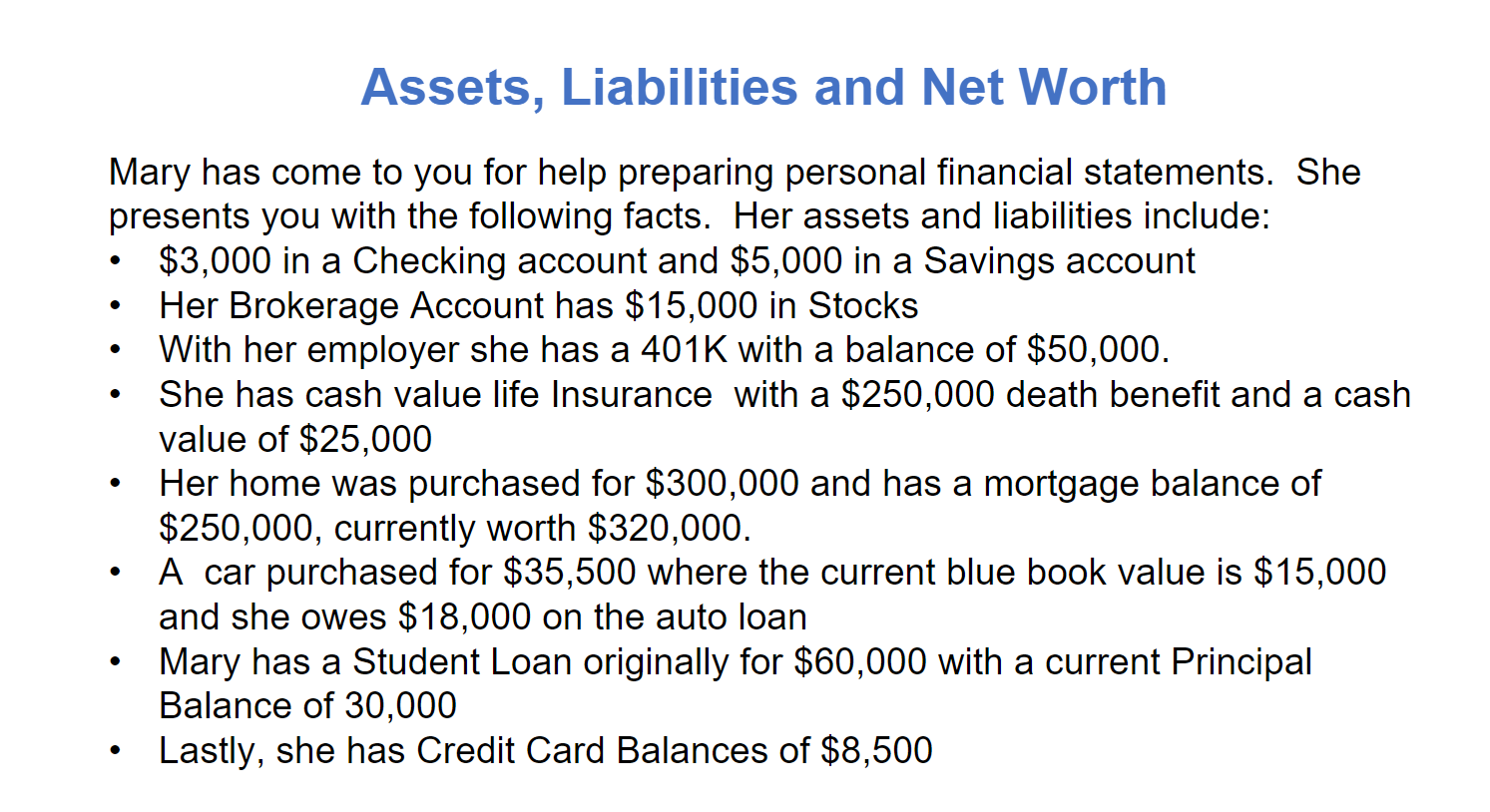

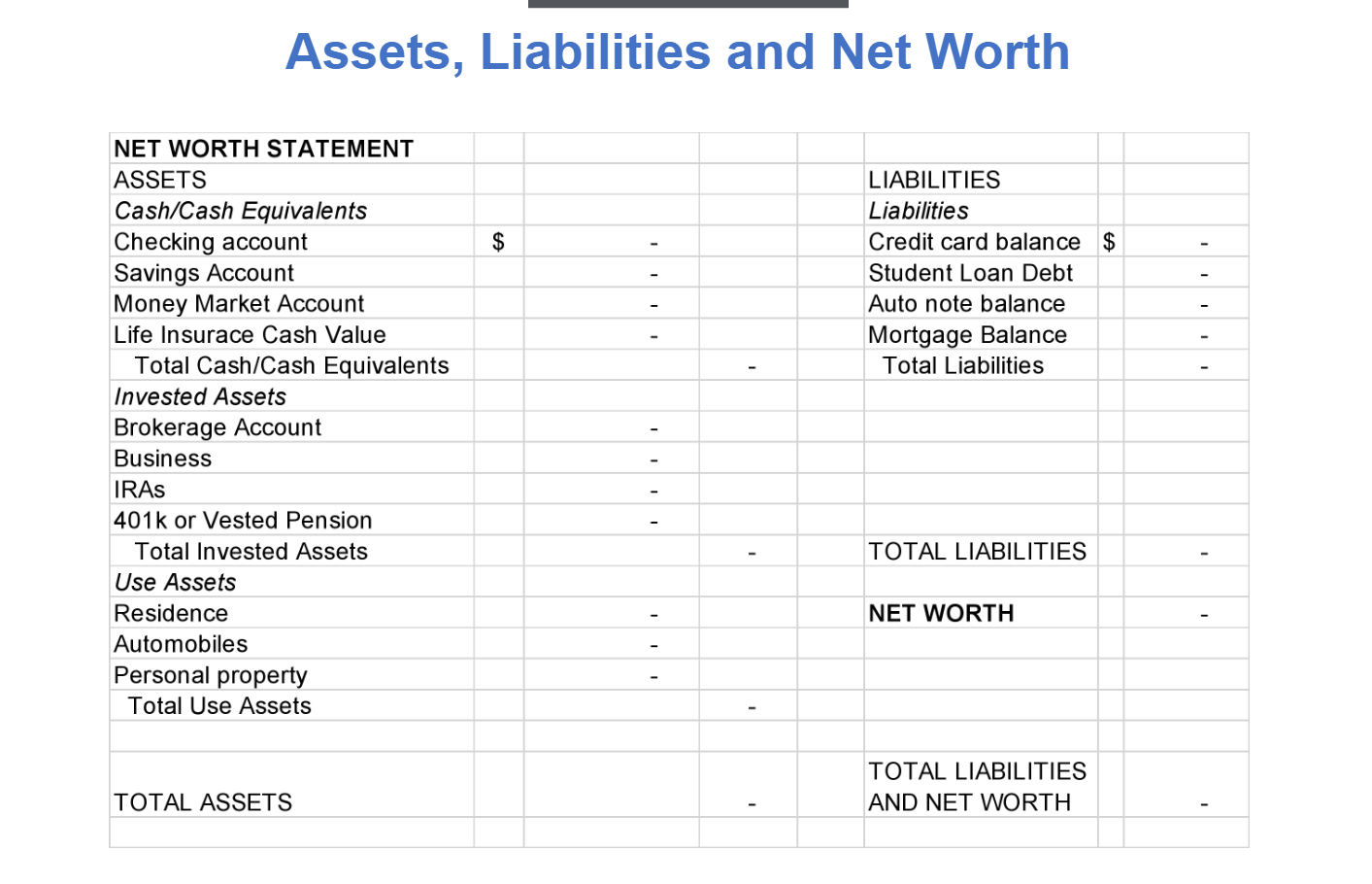

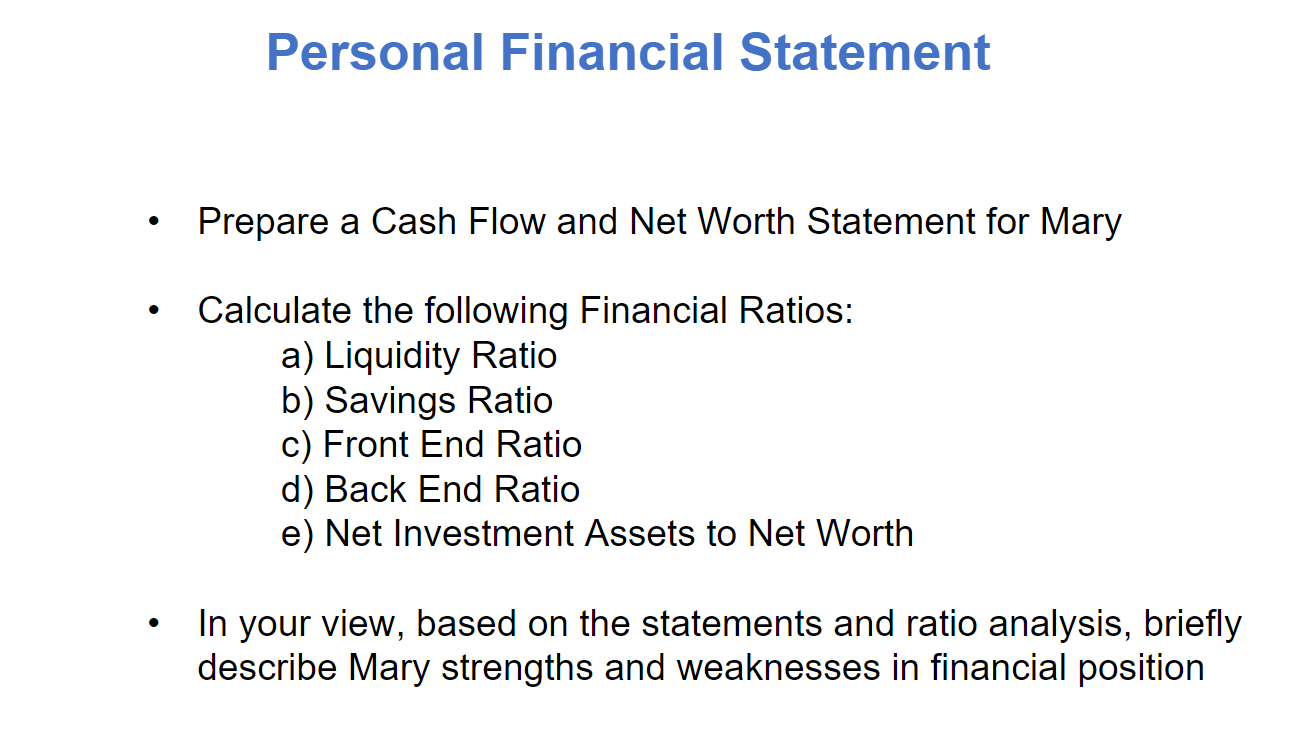

Assets, Liabilities and Net Worth . . Mary has come to you for help preparing personal financial statements. She presents you with the following facts. Her assets and liabilities include: $3,000 in a Checking account and $5,000 in a Savings account Her Brokerage Account has $15,000 in Stocks With her employer she has a 401K with a balance of $50,000. She has cash value life Insurance with a $250,000 death benefit and a cash value of $25,000 Her home was purchased for $300,000 and has a mortgage balance of $250,000, currently worth $320,000. A car purchased for $35,500 where the current blue book value is $15,000 and she owes $18,000 on the auto loan Mary has a Student Loan originally for $60,000 with a current Principal Balance of 30,000 Lastly, she has Credit Card Balances of $8,500 . Assets, Liabilities and Net Worth $ LIABILITIES Liabilities Credit card balance $ Student Loan Debt Auto note balance Mortgage Balance Total Liabilities NET WORTH STATEMENT ASSETS Cash/Cash Equivalents Checking account Savings Account Money Market Account Life Insurace Cash Value Total Cash/Cash Equivalents Invested Assets Brokerage Account Business IRAS 401k or Vested Pension Total Invested Assets Use Assets Residence Automobiles Personal property Total Use Assets TOTAL LIABILITIES NET WORTH - I TOTAL LIABILITIES AND NET WORTH TOTAL ASSETS Personal Financial Statement Prepare a Cash Flow and Net Worth Statement for Mary Calculate the following Financial Ratios: a) Liquidity Ratio b) Savings Ratio c) Front End Ratio d) Back End Ratio e) Net Investment Assets to Net Worth In your view, based on the statements and ratio analysis, briefly describe Mary strengths and weaknesses in financial position Assets, Liabilities and Net Worth . . Mary has come to you for help preparing personal financial statements. She presents you with the following facts. Her assets and liabilities include: $3,000 in a Checking account and $5,000 in a Savings account Her Brokerage Account has $15,000 in Stocks With her employer she has a 401K with a balance of $50,000. She has cash value life Insurance with a $250,000 death benefit and a cash value of $25,000 Her home was purchased for $300,000 and has a mortgage balance of $250,000, currently worth $320,000. A car purchased for $35,500 where the current blue book value is $15,000 and she owes $18,000 on the auto loan Mary has a Student Loan originally for $60,000 with a current Principal Balance of 30,000 Lastly, she has Credit Card Balances of $8,500 . Assets, Liabilities and Net Worth $ LIABILITIES Liabilities Credit card balance $ Student Loan Debt Auto note balance Mortgage Balance Total Liabilities NET WORTH STATEMENT ASSETS Cash/Cash Equivalents Checking account Savings Account Money Market Account Life Insurace Cash Value Total Cash/Cash Equivalents Invested Assets Brokerage Account Business IRAS 401k or Vested Pension Total Invested Assets Use Assets Residence Automobiles Personal property Total Use Assets TOTAL LIABILITIES NET WORTH - I TOTAL LIABILITIES AND NET WORTH TOTAL ASSETS Personal Financial Statement Prepare a Cash Flow and Net Worth Statement for Mary Calculate the following Financial Ratios: a) Liquidity Ratio b) Savings Ratio c) Front End Ratio d) Back End Ratio e) Net Investment Assets to Net Worth In your view, based on the statements and ratio analysis, briefly describe Mary strengths and weaknesses in financial position