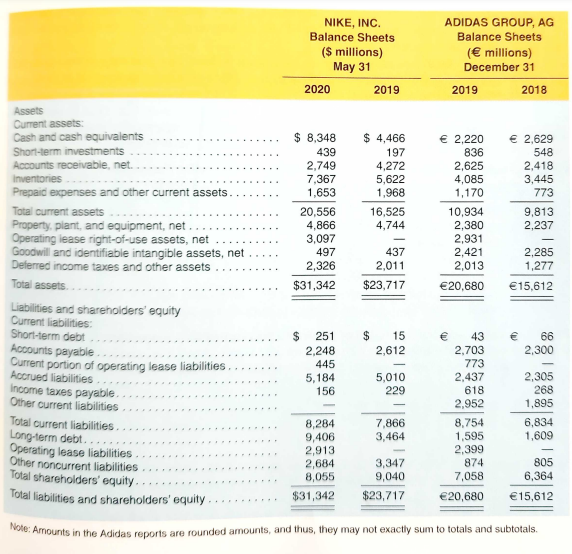

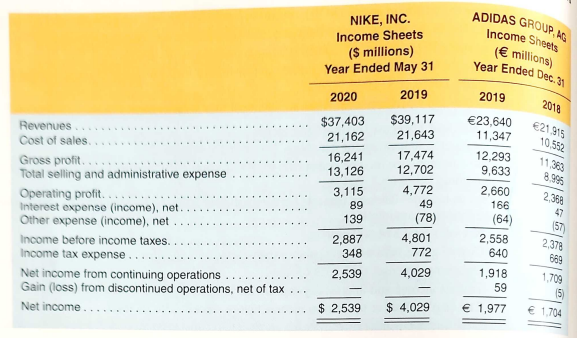

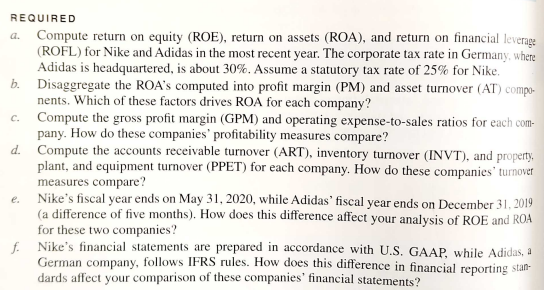

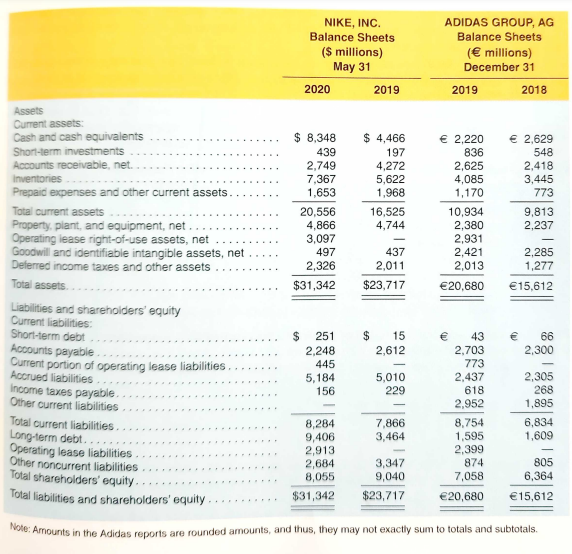

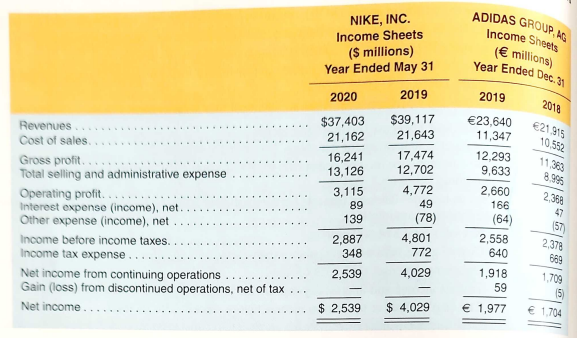

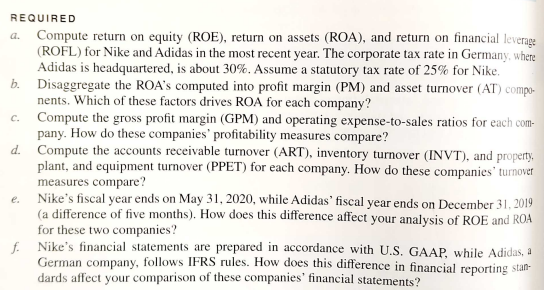

Assets Liabilities and shareholders' equity Current liabilities: Note: Amounts in the Adidas reporis are rounded amounts, and thus, they may not exactly sum to totals and subtotals. REQUIRED a. Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for Nike and Adidas in the most recent year. The corporate tax rate in Germany, where Adidas is headquartered, is about 30%. Assume a statutory tax rate of 25% for Nike. b. Disaggregate the ROA's computed into profit margin (PM) and asset turnover (AT) components. Which of these factors drives ROA for each company? c. Compute the gross profit margin (GPM) and operating expense-to-sales ratios for each company. How do these companies' profitability measures compare? d. Compute the accounts receivable turnover (ART), inventory turnover (INVT), and property, plant, and equipment turnover (PPET) for each company. How do these companies' turnover measures compare? e. Nike's fiscal year ends on May 31, 2020, while Adidas' fiscal year ends on December 31, 2019 (a difference of five months). How does this difference affect your analysis of ROE and ROA for these two companies? f. Nike's financial statements are prepared in accordance with U.S. GAAP, while Adidas, a German company, follows IFRS rules. How does this difference in financial reporting standards affect your comparison of these companies' financial statements? Assets Liabilities and shareholders' equity Current liabilities: Note: Amounts in the Adidas reporis are rounded amounts, and thus, they may not exactly sum to totals and subtotals. REQUIRED a. Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for Nike and Adidas in the most recent year. The corporate tax rate in Germany, where Adidas is headquartered, is about 30%. Assume a statutory tax rate of 25% for Nike. b. Disaggregate the ROA's computed into profit margin (PM) and asset turnover (AT) components. Which of these factors drives ROA for each company? c. Compute the gross profit margin (GPM) and operating expense-to-sales ratios for each company. How do these companies' profitability measures compare? d. Compute the accounts receivable turnover (ART), inventory turnover (INVT), and property, plant, and equipment turnover (PPET) for each company. How do these companies' turnover measures compare? e. Nike's fiscal year ends on May 31, 2020, while Adidas' fiscal year ends on December 31, 2019 (a difference of five months). How does this difference affect your analysis of ROE and ROA for these two companies? f. Nike's financial statements are prepared in accordance with U.S. GAAP, while Adidas, a German company, follows IFRS rules. How does this difference in financial reporting standards affect your comparison of these companies' financial statements