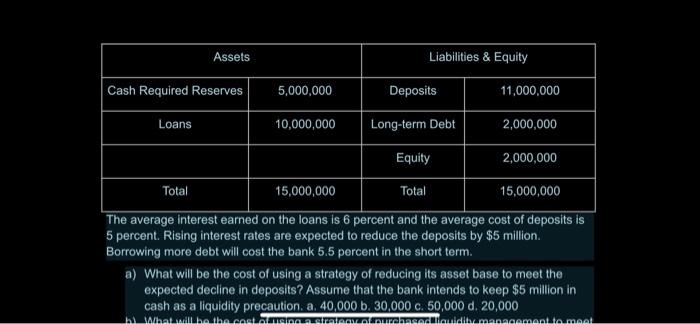

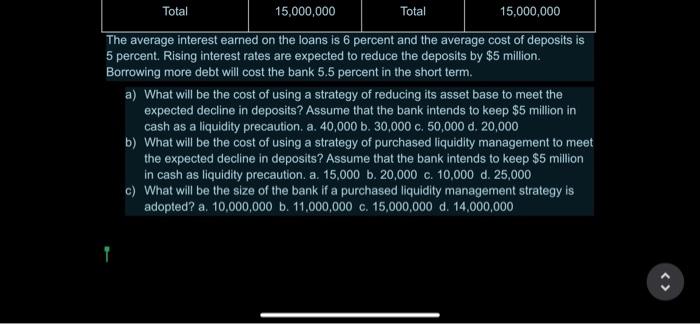

Assets Liabilities & Equity Cash Required Reserves 5,000,000 Deposits 11,000,000 Loans 10,000,000 Long-term Debt 2,000,000 Equity 2,000,000 Total 15,000,000 Total 15,000,000 The average interest earned on the loans is 6 percent and the average cost of deposits 5 percent. Rising interest rates are expected to reduce the deposits by $5 million Borrowing more debt will cost the bank 5.5 percent in the short term. a) What will be the cost of using a strategy of reducing its asset base to meet the expected decline in deposits? Assume that the bank intends to keep $5 million in cash as a liquidity precaution, a 40,000 b. 30,000 c. 50,000 d. 20,000 What will be the collageTAGORCAG auidity magagandang Total 15,000,000 Total 15,000,000 The average interest earned on the loans is 6 percent and the average cost of deposits is 5 percent. Rising interest rates are expected to reduce the deposits by $5 million. Borrowing more debt will cost the bank 5.5 percent in the short term. a) What will be the cost of using a strategy of reducing its asset base to meet the expected decline in deposits? Assume that the bank intends to keep $5 million in cash as a liquidity precaution. a. 40,000 b. 30,000 c. 50,000 d. 20,000 b) What will be the cost of using a strategy of purchased liquidity management to meet the expected decline in deposits? Assume that the bank intends to keep $5 million in cash as liquidity precaution. a. 15,000 b. 20,000 c. 10,000 d. 25,000 c) What will be the size of the bank if a purchased liquidity management strategy is adopted? a. 10,000,000 b. 11,000,000 c. 15,000,000 d. 14,000,000 Assets Liabilities & Equity Cash Required Reserves 5,000,000 Deposits 11,000,000 Loans 10,000,000 Long-term Debt 2,000,000 Equity 2,000,000 Total 15,000,000 Total 15,000,000 The average interest earned on the loans is 6 percent and the average cost of deposits 5 percent. Rising interest rates are expected to reduce the deposits by $5 million Borrowing more debt will cost the bank 5.5 percent in the short term. a) What will be the cost of using a strategy of reducing its asset base to meet the expected decline in deposits? Assume that the bank intends to keep $5 million in cash as a liquidity precaution, a 40,000 b. 30,000 c. 50,000 d. 20,000 What will be the collageTAGORCAG auidity magagandang Total 15,000,000 Total 15,000,000 The average interest earned on the loans is 6 percent and the average cost of deposits is 5 percent. Rising interest rates are expected to reduce the deposits by $5 million. Borrowing more debt will cost the bank 5.5 percent in the short term. a) What will be the cost of using a strategy of reducing its asset base to meet the expected decline in deposits? Assume that the bank intends to keep $5 million in cash as a liquidity precaution. a. 40,000 b. 30,000 c. 50,000 d. 20,000 b) What will be the cost of using a strategy of purchased liquidity management to meet the expected decline in deposits? Assume that the bank intends to keep $5 million in cash as liquidity precaution. a. 15,000 b. 20,000 c. 10,000 d. 25,000 c) What will be the size of the bank if a purchased liquidity management strategy is adopted? a. 10,000,000 b. 11,000,000 c. 15,000,000 d. 14,000,000