You manage a fund in which you currently have $5 million invested in AA-rated, 15-year, 7% coupon

Question:

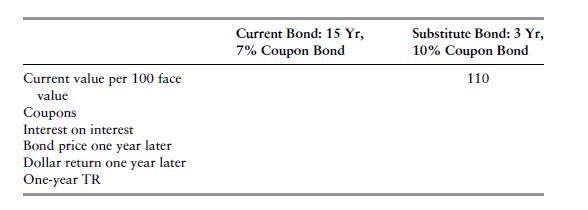

You manage a fund in which you currently have $5 million invested in AA-rated, 15-year, 7% coupon bonds with semiannual coupon payments and currently priced to yield 6%. Interest rates have been decreasing over the last several years and you believe that they are near a trough and will increase over the next year. Currently, the yield curve for AA-rated bonds is flat at 6%. Given your expectation, you are considering a rate-anticipation swap. The bond you are considering substituting is an AA-rated, three-year, 10% callable bond with semiannual coupon payments and priced at its call price of 110.

a. In the table below, evaluate your rate-anticipation swap by comparing your current bond with the substitute candidate given the following scenario: The yield curve will shift up one year from now from 6% to 7%. Assume the coupon date is one year from now.

b. Comment on your rate-anticipation swap. What term is used to describe the three-year, 10% bond?

Step by Step Answer: