Given a current flat yield curve for AAA bonds at 6% and the following bonds: a. What

Question:

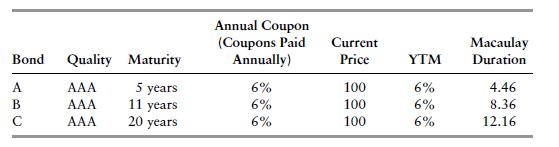

Given a current flat yield curve for AAA bonds at 6% and the following bonds:

a. What is the portfolio duration of a barbell portfolio formed with equal allocation to Bonds A and C? How does the barbell portfolio’s duration compare with a bullet portfolio consisting of Bond B?

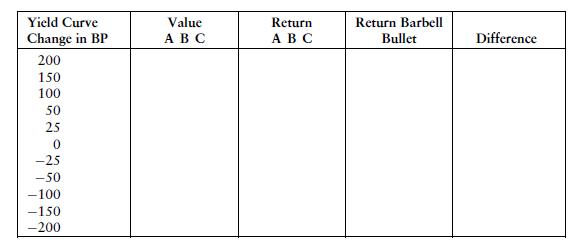

b. In the table below, calculate (using Excel) each bond’s and the barbell portfolio’s values and dollar returns one year later given the parallel shifts in the yield curve shown in the table. What differences do you observe between the barbell portfolio and the bullet portfolio formed with Bond B? What bond or portfolio would you select if you expected a significant downward shift in the yield curve? What bond or portfolio would give you the greatest protection in value if you expected a significant upward shift in the yield curve? Comment on your findings.

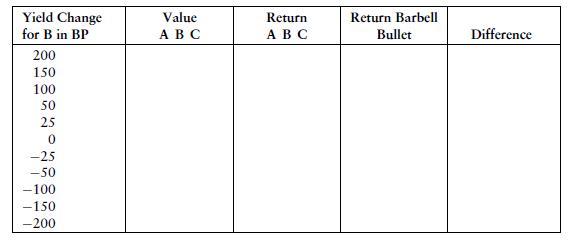

c. Suppose yield curve shifts are characterized by a flattening where for each change in Bond B (intermediate bond), Bond A increases 25 bp more and Bond C decreases by 25 bp less:

yA = yB + 25bp yC = yB − 25bp In the table below, calculate using Excel each bond’s and the barbell portfolio’s values and dollar returns one year later given the yield changes in Bond B shown in the table. What differences do you observe between the barbell portfolio and bullet portfolio formed with Bond B? How do the differences with the twist compare to the differences with the parallel shifts?

Step by Step Answer: