The yield curve for A-rated bonds is presently flat at a promised YTM of 10%. You own

Question:

The yield curve for A-rated bonds is presently flat at a promised YTM of 10%.

You own an A-rated, five-year, 10% coupon bond with annual coupon payments.

You expect rates to decrease over the next year and would like to take advantage of your expectation with a rate-anticipation swap. The bond you are considering substituting is an A-rated, 10-year, 10% coupon with annual coupon payments.

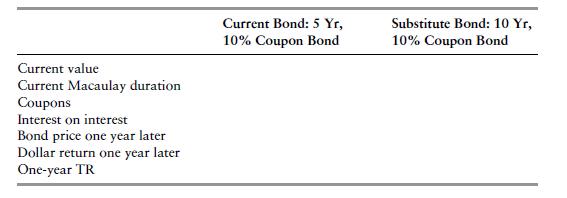

a. In the table below, evaluate your rate anticipation swap by comparing your current bond with the substitute candidate given the following scenario: The yield curve will shift down one year from now from 10% to 9%. Assume the coupon date is one year from now.

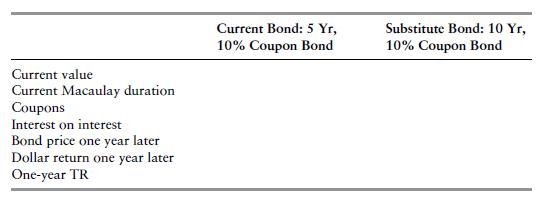

b. In the table below, evaluate your rate anticipation swap given the following scenario: The yield curve will shift up one year from now from 10% to 11%.

Assume the coupon date is one year from now.

c. Comment on your rate-anticipation swap.

Step by Step Answer: