Answered step by step

Verified Expert Solution

Question

1 Approved Answer

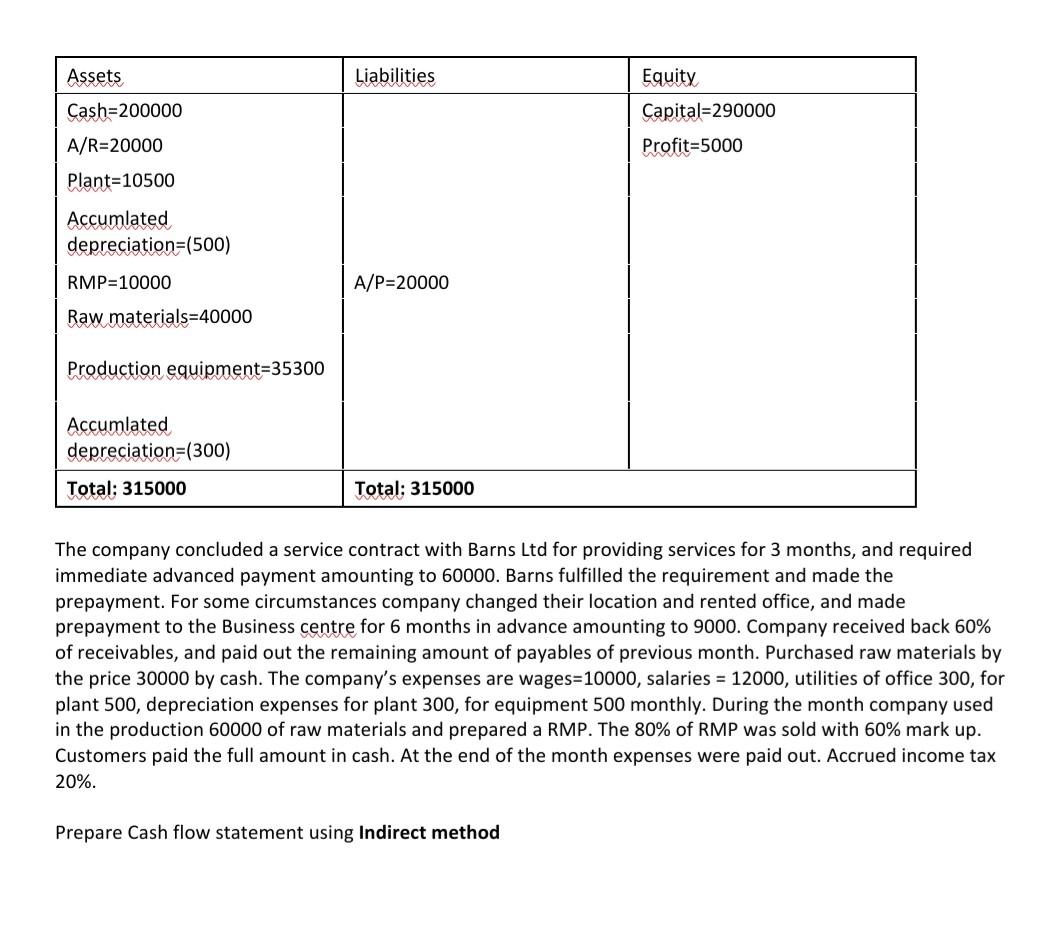

Assets Liabilities Equity Cash=200000 Capital=290000 A/R=20000 Profit=5000 Plant=10500 Accumlated depreciation=(500) RMP=10000 A/P=20000 Raw materials=40000 Production equipment=35300 Accumlated depreciation=(300) Total: 315000 Total: 315000 The company concluded

Assets Liabilities Equity Cash=200000 Capital=290000 A/R=20000 Profit=5000 Plant=10500 Accumlated depreciation=(500) RMP=10000 A/P=20000 Raw materials=40000 Production equipment=35300 Accumlated depreciation=(300) Total: 315000 Total: 315000 The company concluded a service contract with Barns Ltd for providing services for 3 months, and required immediate advanced payment amounting to 60000. Barns fulfilled the requirement and made the prepayment. For some circumstances company changed their location and rented office, and made prepayment to the Business centre for 6 months in advance amounting to 9000. Company received back 60% of receivables, and paid out the remaining amount of payables of previous month. Purchased raw materials by the price 30000 by cash. The company's expenses are wages=10000, salaries = 12000, utilities of office 300, for plant 500, depreciation expenses for plant 300, for equipment 500 monthly. During the month company used in the production 60000 of raw materials and prepared a RMP. The 80% of RMP was sold with 60% mark up. Customers paid the full amount in cash. At the end of the month expenses were paid out. Accrued income tax 20%. Prepare Cash flow statement using Indirect method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started