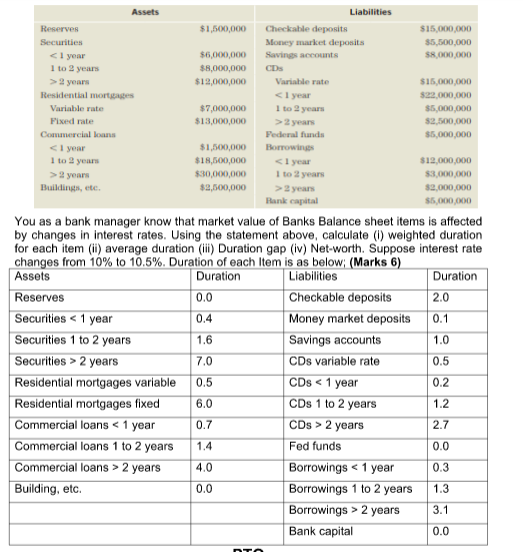

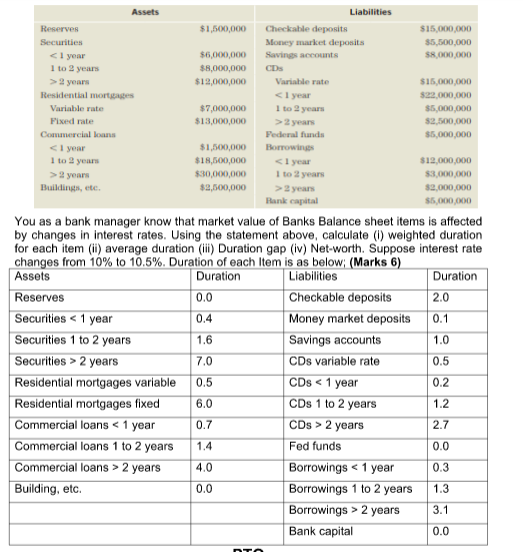

Assets Liabilities Reserves $1,500,000 Checkable deposits $15,000,000 Securities Money market deposits $6,000,000 $5,500,000 $8.000.000 Savings accounts $8,000,000 CDs 2 years Residential morts $12,000,000 Variable rate $15,000,000 $22,000,000 Variable rate $7,000,000 $5,000,000 2 years Federal funds Fixed rate $13,000,000 $2,500,000 Commercial loans $5,000,000 years $18,500,000 $30,000,000 $2,500,000 2 years Rank capital $5,000,000 You as a bank manager know that market value of Banks Balance sheet items is affected by changes in interest rates. Using the statement above, calculate (1) weighted duration for each item (ii) average duration (1) Duration gap (iv) Net-worth. Suppose interest rate changes from 10% to 10.5%. Duration of each item is as below: (Marks 6) Assets Duration Liabilities Duration 0.0 2.0 0.4 Checkable deposits Money market deposits Savings accounts 0.1 1.6 1.0 7.0 CDs variable rate 0.5 Reserves Securities 2 years Residential mortgages variable Residential mortgages fixed Commercial loans 2 years Fed funds Borrowings 2 years Bank capital Commercial loans > 2 years 4.0 0.3 Building, etc. 0.0 1.3 3.1 0.0 OTO Assets Liabilities Reserves $1,500,000 Checkable deposits $15,000,000 Securities Money market deposits $6,000,000 $5,500,000 $8.000.000 Savings accounts $8,000,000 CDs 2 years Residential morts $12,000,000 Variable rate $15,000,000 $22,000,000 Variable rate $7,000,000 $5,000,000 2 years Federal funds Fixed rate $13,000,000 $2,500,000 Commercial loans $5,000,000 years $18,500,000 $30,000,000 $2,500,000 2 years Rank capital $5,000,000 You as a bank manager know that market value of Banks Balance sheet items is affected by changes in interest rates. Using the statement above, calculate (1) weighted duration for each item (ii) average duration (1) Duration gap (iv) Net-worth. Suppose interest rate changes from 10% to 10.5%. Duration of each item is as below: (Marks 6) Assets Duration Liabilities Duration 0.0 2.0 0.4 Checkable deposits Money market deposits Savings accounts 0.1 1.6 1.0 7.0 CDs variable rate 0.5 Reserves Securities 2 years Residential mortgages variable Residential mortgages fixed Commercial loans 2 years Fed funds Borrowings 2 years Bank capital Commercial loans > 2 years 4.0 0.3 Building, etc. 0.0 1.3 3.1 0.0 OTO