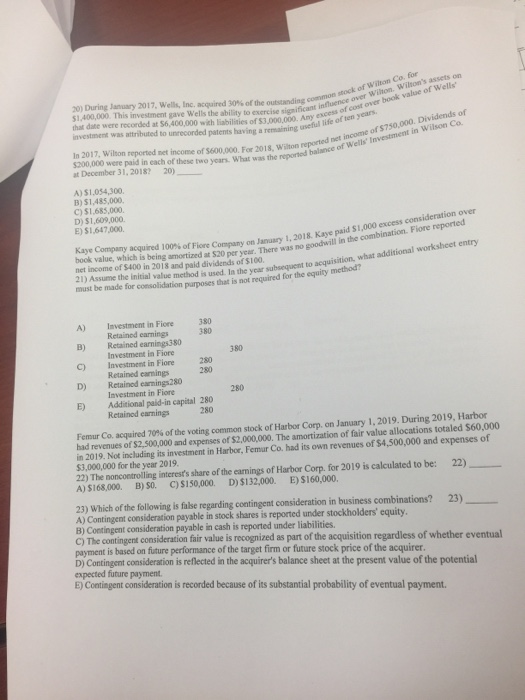

assets on Wilton's 20) During lan ary 2017, Wells, Inc. acquired 30% ofthe outstanding common s ver wilt ook al e $1,400,000 This investment gave Wells the ability to exercise sigtss of cost that date were recorded at $6,400,000 with liabilities of $3,000,000 Amy ie of ten y investment was attributed to unrecorded patents having a remaining intluenet over net income of $750,000. Dividends of balance of Wells' Investment in Wilson Co. In 2017, Wilton reported net income of $600,000 For 2018, Wilton repo 200,000 were paid in each of these two years. What was the reported balian at December 31,2018? 20) A) $1,04,300 B) $1,485,000 C) $1,685,000. D) $1,609,000. E) $1,647,000. excess consideration over ed iore report Kaye C mpany acquired 100% of Fiore Company onlar uary 1, 2018. Kaye paidsi 000 combination. F goodwill in the book value, which is being amortized at $20 per year. There net income of $400 in 2018 and paid dividends of s100 21) Assume the initial value method is used. Ia the year subsequent to was no entry acquisition, what additional worksheet for consolidation parposes that is not required for the equity method A) Investment in Fiore 380 B) C) D) E) Retainod earnings Retained earnings380 Investment in Fiore Investment in Fiore 280 Retained earnings Retained carnings280 Investment in Fiore Additional paid-in capital 280 Retainod earnings 280 280 Femur Co. acquired 70% of the voting common stock of Harbor Corp. on January 1, 2019, During 2019, Harbor had revenues of $2,500,000 and expenses of $2,000,000. The amortization of fair value allocations totaled $60,000 in 2019. Not inclading its investment in Harbor, Femur Co. had its own revenues of $4,500,000 and expenses of $3,000,000 for the year 2019 22) The noncontrolling interest's share of the earnings of Harbor Corp. for 2019 is calculated to be: 22) A) 5168,000. B)SO. C)$150,000. D)$132,000. E)S160,000. 23) Which of the following is false regarding contingent consideration in business combinations? A) Contingent consideration payable in stock shares is reported under stockholders' equity. B) Contingent consideration payable in cash is reported under liabilities. C) The contingent consideration fair value is recognized as part of the acquisition regardless of whether eventual payment is based on future performance of the target firm or future stock price of the acquirer D) Contingent consideration is reflected in the acquirer's balance sheet at the present value of the potential expected future payment E) Contingent consideration is recorded because of its substantial probability of eventual payment. 23)