Answered step by step

Verified Expert Solution

Question

1 Approved Answer

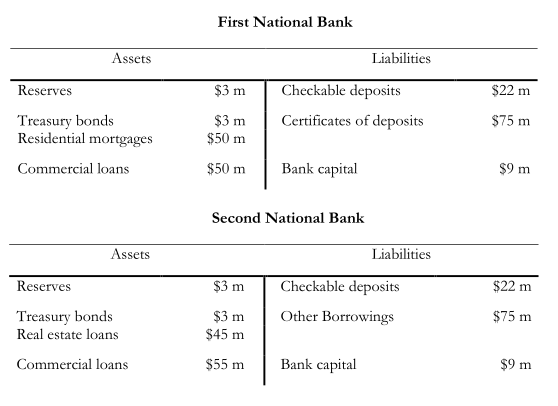

First National Bank Assets Liabilities Reserves Treasury bonds $3 m Checkable deposits $22 m $3 m Certificates of deposits $75 m Residential mortgages $50

First National Bank Assets Liabilities Reserves Treasury bonds $3 m Checkable deposits $22 m $3 m Certificates of deposits $75 m Residential mortgages $50 m Commercial loans $50 m Bank capital $9 m Second National Bank Assets Liabilities Reserves $3 m Checkable deposits $22 m Treasury bonds $3 m Other Borrowings $75 m Real estate loans $45 m Commercial loans $55 m Bank capital $9 m Use the above balance sheets to answer the following questions. The questions are unrelated with each other. A. Calculate the banks' reserve ratio. (1 point) B. If the required reserve is 10%, what is the maximum deposit outflow that each bank can handle before it has to change its asset holdings? (3 points) C. If the capital requirement is 8% of risk-adjusted assets, what is the minimum capital that each bank needs to maintain the current balance sheet? (2 points) D. If both banks suffer a loss of $3 m in the portfolio of commercial loans, which bank will be undercapitalized? And, by how much? (2 points) E. What can the bank do to meet the capital requirement? (No calculation needed) (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To calculate the banks reserve ratio we need to divide the amount of reserves by the amount of checkable deposits First National Bank Reserves 3m Checkable deposits 22m Reserve Ratio for First Natio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started