Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the above balance sheet, determine the following: a. The weighted duration of assets (2 marks) b. The weighted duration of liabilities (2 marks)

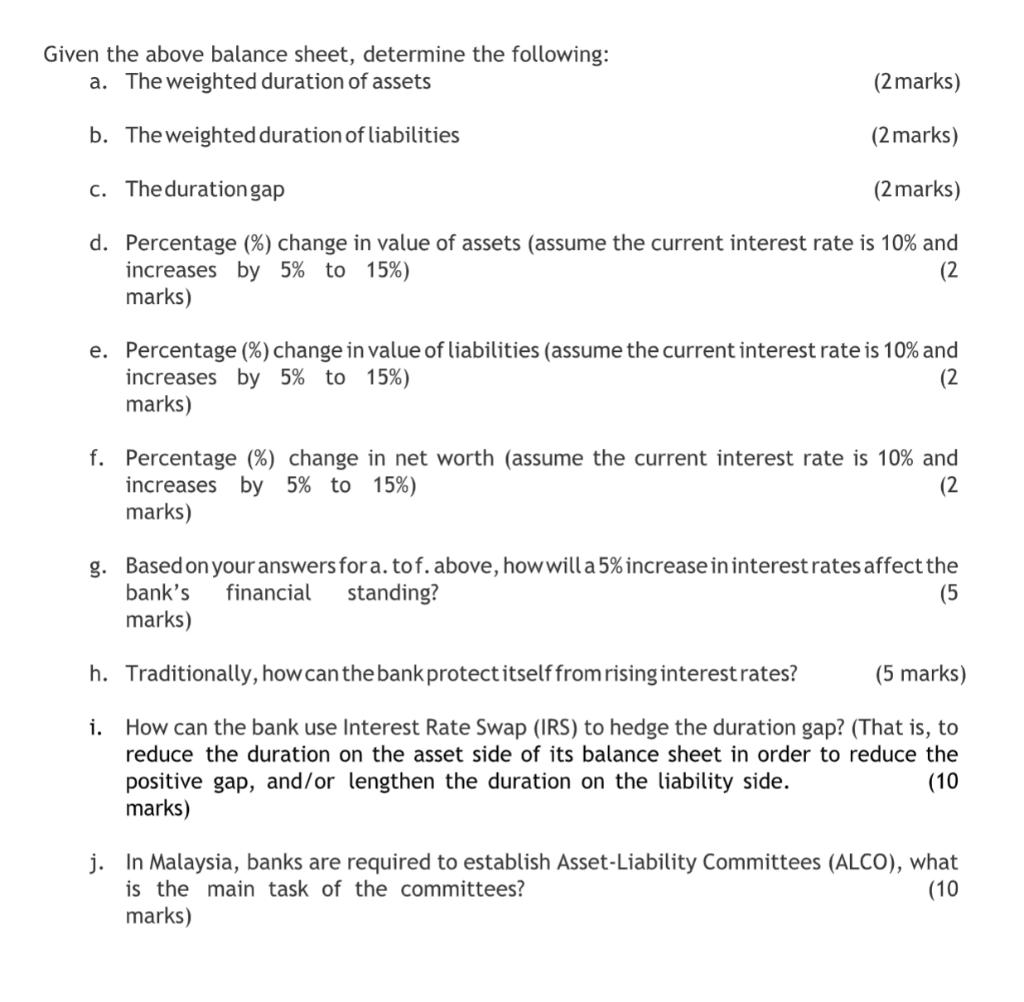

Given the above balance sheet, determine the following: a. The weighted duration of assets (2 marks) b. The weighted duration of liabilities (2 marks) c. The duration gap (2 marks) d. Percentage (%) change in value of assets (assume the current interest rate is 10% and increases by 5% to 15%) marks) (2 e. Percentage (%) change in value of liabilities (assume the current interest rate is 10% and increases by 5% to 15%) marks) (2 f. Percentage (%) change in net worth (assume the current interest rate is 10% and increases by 5% to 15%) marks) (2 g. Based on your answers for a. tof. above, how will a 5% increase in interest rates affect the bank's financial standing? marks) (5 h. Traditionally, how can the bank protect itself from rising interest rates? (5 marks) i. How can the bank use Interest Rate Swap (IRS) to hedge the duration gap? (That is, to reduce the duration on the asset side of its balance sheet in order to reduce the positive gap, and/or lengthen the duration on the liability side. marks) (10 j. In Malaysia, banks are required to establish Asset-Liability Committees (ALCO), what is the main task of the committees? (10 marks) Assets* Short-term loans Medium-term loans Long-term loans Total assets Liabilities* Current accounts Saving accounts Fixed deposits Total liabilities Simplified Bank Balance Sheet Amount Proportion (RM'million) /Weight 400 200 400 1,000 0.4 0.2 0.4 Amount Proportion (RM'million) /Weight 0.4 0.2 0.4 400 200 400 1,000 * For purpose of simplicity, we ignore the non-operational items of the balance sheets Estimated Estimated Duration Average Maturit y 1.5 years 4.0 years 25 years 1 year 3 year 20 years Estimated Estimated Average Duration Maturity 0 1.5 years 5 1 year 4 years

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a The weighted duration of assets can be calculated as follows 04 15 02 1 04 4 06 02 16 24 So the weighted duration of assets is 24 years b The weighted duration of liabilities can be calculated as fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started