Answered step by step

Verified Expert Solution

Question

1 Approved Answer

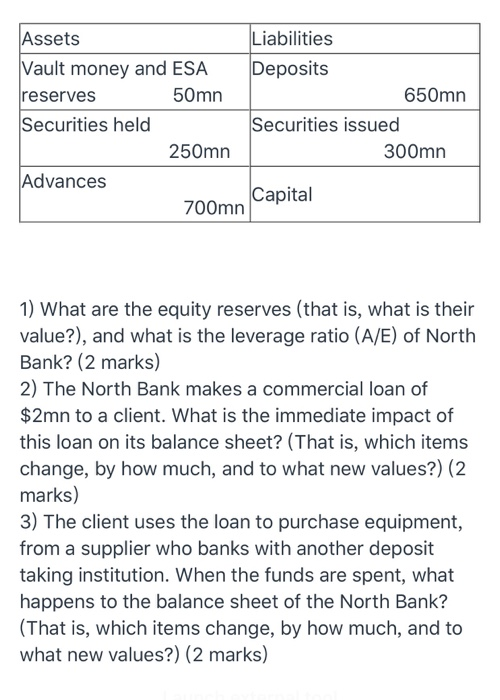

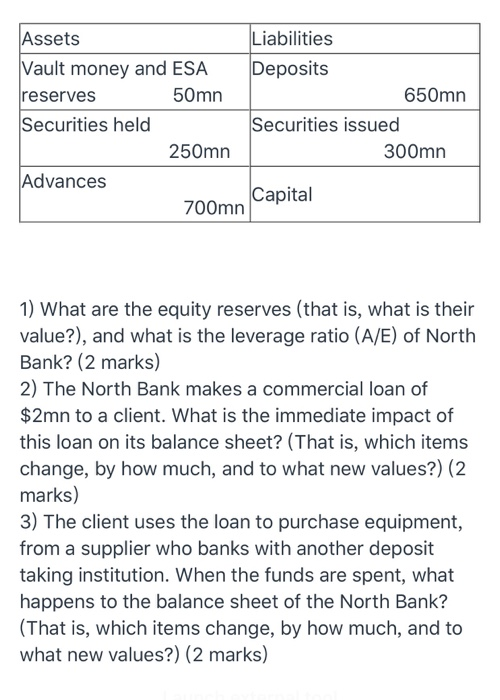

Assets Vault money and ESA reserves 50mn Securities held 250mn Advances Liabilities Deposits 650mn Securities issued 300mn 700mn Capital 1) What are the equity reserves

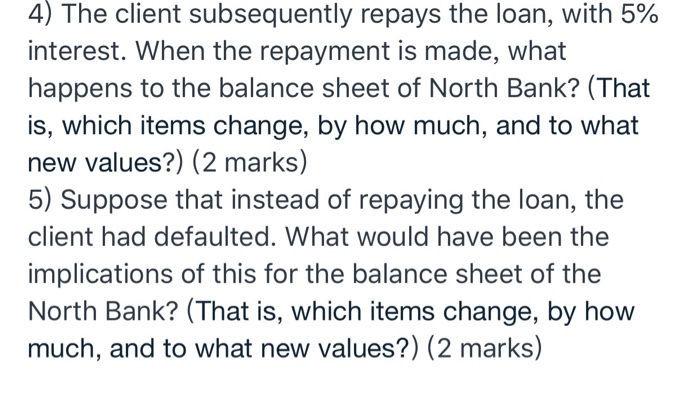

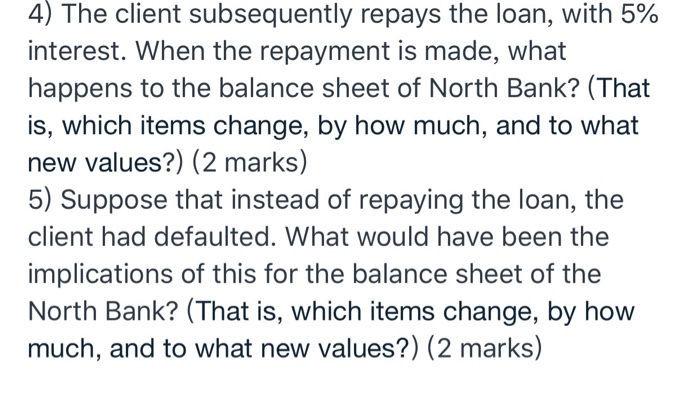

Assets Vault money and ESA reserves 50mn Securities held 250mn Advances Liabilities Deposits 650mn Securities issued 300mn 700mn Capital 1) What are the equity reserves (that is, what is their value?), and what is the leverage ratio (A/E) of North Bank? (2 marks) 2) The North Bank makes a commercial loan of $2mn to a client. What is the immediate impact of this loan on its balance sheet? (That is, which items change, by how much, and to what new values?) (2 marks) 3) The client uses the loan to purchase equipment, from a supplier who banks with another deposit taking institution. When the funds are spent, what happens to the balance sheet of the North Bank? (That is, which items change, by how much, and to what new values?) (2 marks) 4) The client subsequently repays the loan, with 5% interest. When the repayment is made, what happens to the balance sheet of North Bank? (That is, which items change, by how much, and to what new values?) (2 marks) 5) Suppose that instead of repaying the loan, the client had defaulted. What would have been the implications of this for the balance sheet of the North Bank? (That is, which items change, by how much, and to what new values?) (2 marks)

Assets Vault money and ESA reserves 50mn Securities held 250mn Advances Liabilities Deposits 650mn Securities issued 300mn 700mn Capital 1) What are the equity reserves (that is, what is their value?), and what is the leverage ratio (A/E) of North Bank? (2 marks) 2) The North Bank makes a commercial loan of $2mn to a client. What is the immediate impact of this loan on its balance sheet? (That is, which items change, by how much, and to what new values?) (2 marks) 3) The client uses the loan to purchase equipment, from a supplier who banks with another deposit taking institution. When the funds are spent, what happens to the balance sheet of the North Bank? (That is, which items change, by how much, and to what new values?) (2 marks) 4) The client subsequently repays the loan, with 5% interest. When the repayment is made, what happens to the balance sheet of North Bank? (That is, which items change, by how much, and to what new values?) (2 marks) 5) Suppose that instead of repaying the loan, the client had defaulted. What would have been the implications of this for the balance sheet of the North Bank? (That is, which items change, by how much, and to what new values?) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started