Answered step by step

Verified Expert Solution

Question

1 Approved Answer

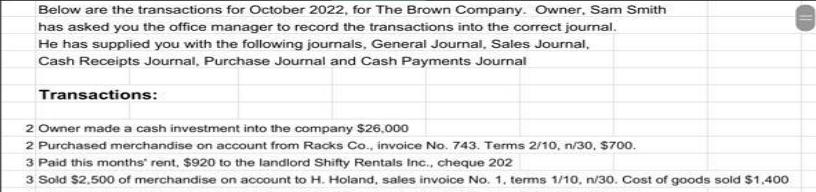

Below are the transactions for October 2022, for The Brown Company. Owner, Sam Smith has asked you the office manager to record the transactions

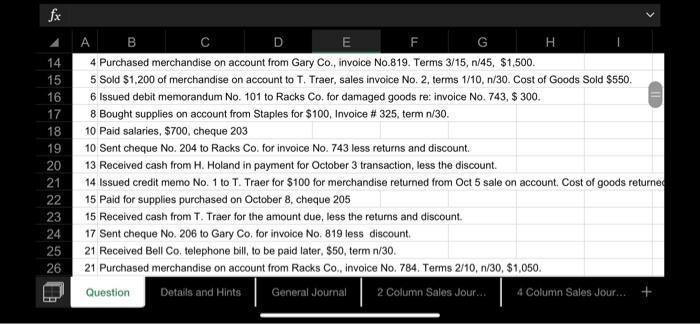

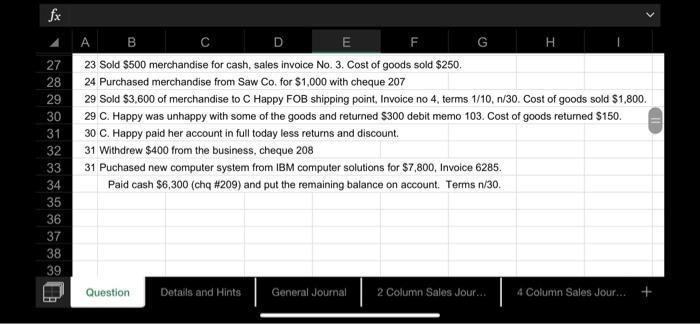

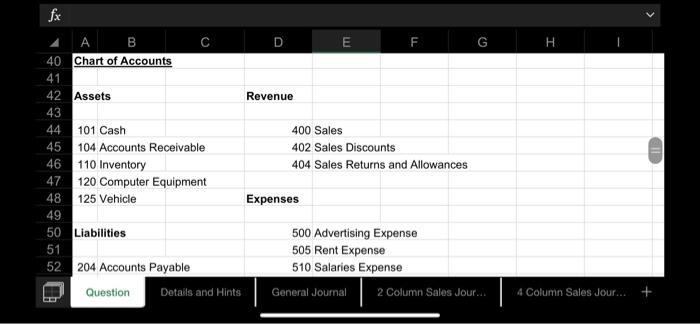

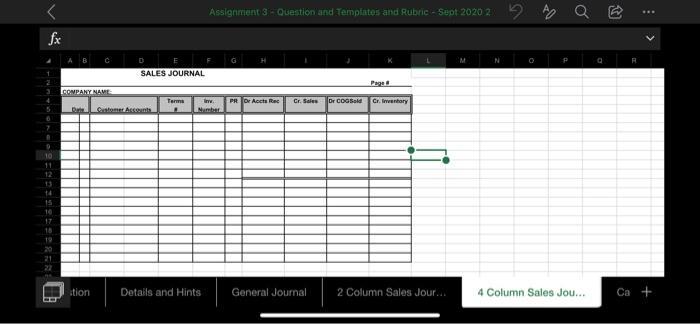

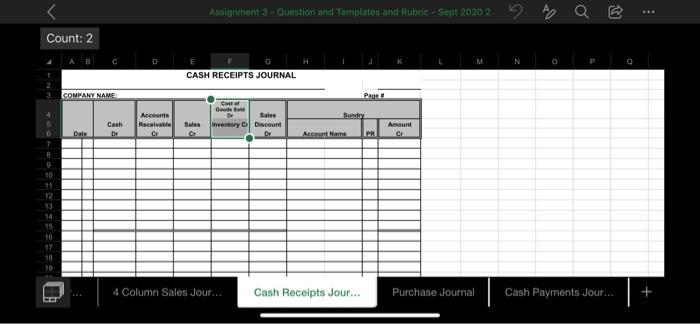

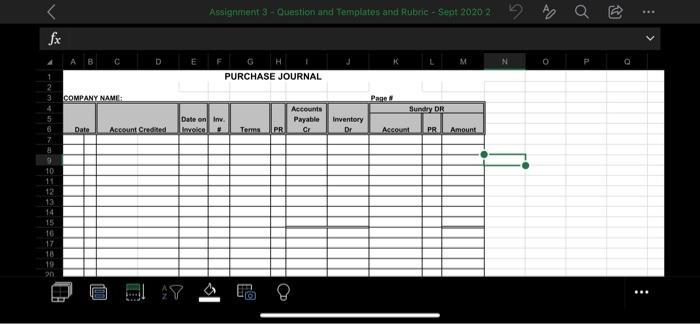

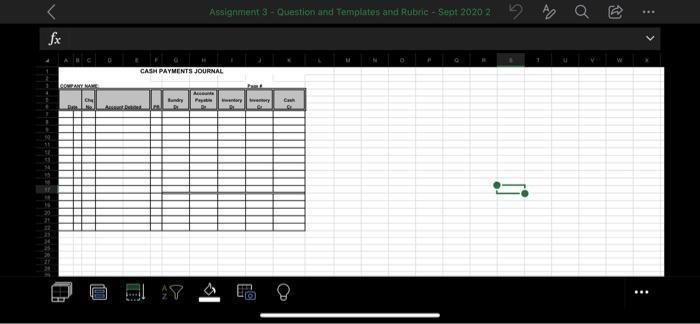

Below are the transactions for October 2022, for The Brown Company. Owner, Sam Smith has asked you the office manager to record the transactions into the correct journal. He has supplied you with the following journals, General Journal, Sales Journal, Cash Receipts Journal, Purchase Journal and Cash Payments Journal Transactions: 2 Owner made a cash investment into the company $26,000 2 Purchased merchandise on account from Racks Co., invoice No. 743. Terms 2/10, n/30, S700. 3 Paid this months' rent, $920 to the landlord Shifty Rentals Inc., cheque 202 3 Sold $2.500 of merchandise on account to H. Holand, sales invoice No. 1. terms 1/10, n/30. Cost of goods sold $1,400 fx A F G 14 4 Purchased merchandise on account from Gary Co., invoice No.819. Terms 3/15, n/45, $1,500. 15 5 Sold $1,200 of merchandise on account to T. Traer, sales invoice No. 2, terms 1/10, n/30. Cost of Goods Sold $550. 16 6 Issued debit memorandum No. 101 to Racks Co. for damaged goods re: invoice No. 743, $ 300. 17 8 Bought supplies on account from Staples for $100, Invoice # 325, term n/30. 18 10 Paid salaries, $700, cheque 203 19 10 Sent cheque No. 204 to Racks Co. for invoice No. 743 less returns and discount. 20 13 Received cash from H. Holand in payment for October 3 transaction, less the discount. 21 14 Issued credit memo No. 1 to T. Traer for $100 for merchandise returned from Oct 5 sale on account. Cost of goods returned 22 15 Paid for supplies purchased on October 8, cheque 205 23 15 Received cash from T. Traer for the amount due, less the returns and discount. 24 17 Sent cheque No. 206 to Gary Co, for invoice No. 819 less discount. 25 21 Received Bell Co. telephone bill, to be paid later, $50, term n/30. 26 21 Purchased merchandise on account from Racks Co., invoice No. 784. Terms 2/10, n/30, $1,050. Question Details and Hints General Journal 2 Column Sales Jour... 4 Column Sales Jour... fx A B D F 27 23 Sold $500 merchandise for cash, sales invoice No. 3. Cost of goods sold $250. 28 24 Purchased merchandise from Saw Co. for $1,000 with cheque 207 29 29 Sold $3,600 of merchandise to C Happy FOB shipping point, Invoice no 4, terms 1/10, n/30. Cost of goods sold $1,800. 29 C. Happy was unhappy with some of the goods and returned $300 debit memo 103. Cost of goods returned $150. 30 C. Happy paid her account in full today less returns and discount. 30 31 32 31 Withdrew $400 from the business, cheque 208 33 31 Puchased new computer system from IBM computer solutions for $7,800, Invoice 6285. 34 Paid cash $6,300 (chq #209) and put the remaining balance on account. Terms n/30. 35 36 37 38 39 Question Details and Hints General Journal 2 Column Sales Jour.. 4 Column Sales Jour... fx A B F 40 Chart of Accounts 41 42 Assets Revenue 43 44 101 Cash 400 Sales 45 104 Accounts Receivable 402 Sales Discounts 46 110 Inventory 404 Sales Returns and Allowances 47 120 Computer Equipment 48 125 Vehicle Expenses 49 50 Liabilities 500 Advertising Expense 505 Rent Expense 51 52 204 Accounts Payable 510 Salaries Expense Question Details and Hints General Journal 2 Column Sales Jour... 4 Column Sales Jour... fx A B F 49 50 Liabilities 500 Advertising Expense 505 Rent Expense 51 52 204 Accounts Payable 510 Salaries Expense 53 515 Supplies Expense 54 Owner's Equity 518 Cost of Goods Sold 55 525 Telephone Expense 56 300 Sam Smith, Withdrawals 57 301 Sam Smith, Capital 58 59 60 61 Required: Question Details and Hints General Journal 2 Column Sales Jour.. 4 Column Sales Jour... fx A B D F Journalize the - The journals required are found on the following worksheets, General Journal, 63 64 65 Sales Journal, Cash Receipts Journal, Purchase Journal 66 and Cash Payments Journal 67 - Explanations are reqired for each entry in the General Journal 68 69 Total Each Column of Each Journal as required. Apply Page Numbers 70 71 Provide Posting references as if each entry and total had been posted to the General Ledger and Subledgers. The Chart of Accounts will assist with this part. - Use an X if the amount should not be posted and a P (instead of a check mark 72 73 74 if the amount should be posted should be posted 75 General Journal Question Details and Hints 2 Column Sales Jour... 4 Column Sales Jour... Assighment 3-Questin and Templates and Rubric - Sept 2020 2 2 Q E fx GENERAL JOURNAL - : Assignment 3- Question and Templates and Rubric - Sept 2020 2 Count: 14 SALES JOURNAL Pap Tee 10 12 54 stion Details and Hints General Journal 2 Column Sales Jou... 4 Column Sales Jour... Ca + Assighment 3-Questin and Templates and Rubric - Sept 2020 2 2 Q E fx SALES JOURNAL Page COMPANY NAME Terms PR or Accts Rec Cr. Sales Dr COGSeld Cr. Inventary Inv. Dat Cstoner Acconts Number 11 stion Details and Hints General Journal 2 Column Sales Jour... 4 Column Sales Jou... Ca + Assignment 3- Question and Templates and Rubric - Sept 2020 2 Count: 2 CASH RECEIPTS JOURNAL COMPANY NAME Page Costut Geods d Accounts Sales Sundry Recelvable inventory C Discount Cash Sales Amount Date Dr Cr Dr Account Name PR Cr 10 11 12 13 14 15 4 Column Sales Jour... Cash Receipts Jour... Purchase Journal Cash Payments Jour.. Assignment 3- Question and Templates and Rubric - Sept 2020 2 fx PURCHASE JOURNAL cOMPANYN Pane Accounts Sundry DR Date on Inv. Payable Inventory Date Account Credited Inveice Terms PR Cr Dr Account PR Amount 10 11 12 13 14 15 16 17 18 19 20. : Assighment 3-Questin and Templates and Rubric - Sept 2020 2 2 Q E fx CASH PAYMENTS JOURNAL Bundy wentory ery Cah Asent :

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Cash Payment Journal Accounts Chq Sundry PR Inventory Inventory Cash Date Account Debited Payable No ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

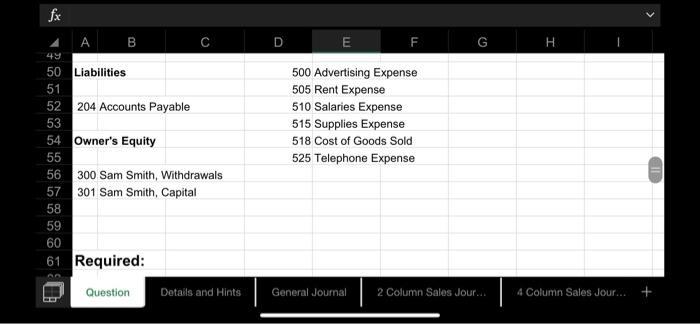

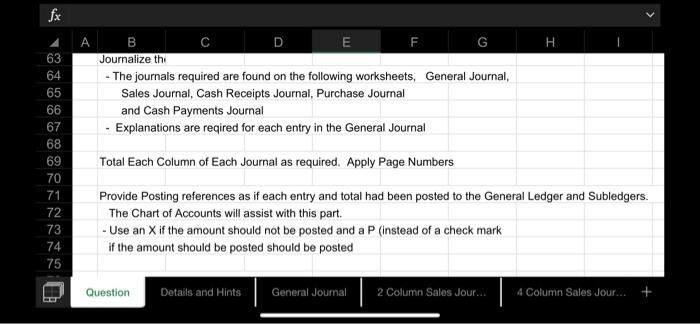

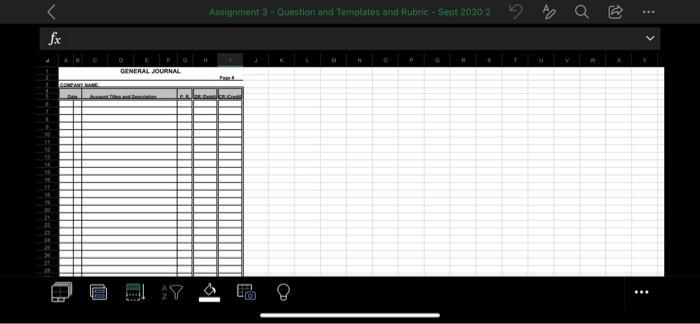

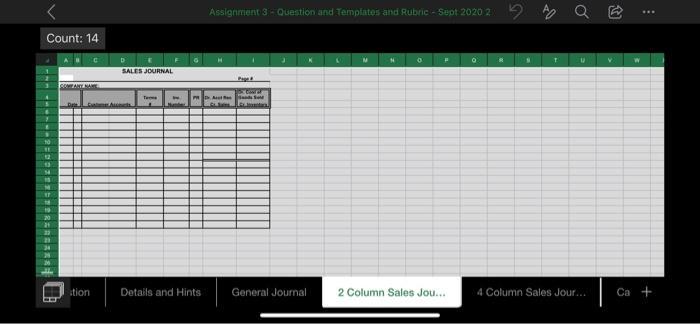

Get Started