Answered step by step

Verified Expert Solution

Question

1 Approved Answer

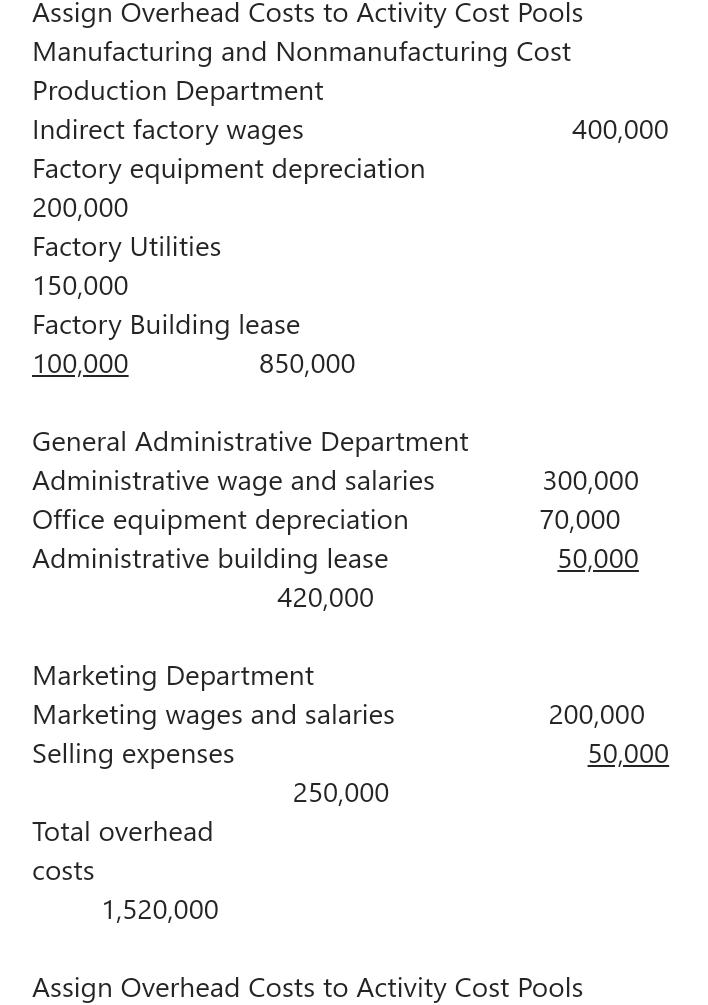

Assign Overhead Costs to Activity Cost Pools Manufacturing and Nonmanufacturing Cost Production Department Indirect factory wages 400,000 Factory equipment depreciation 200,000 Factory Utilities 150,000

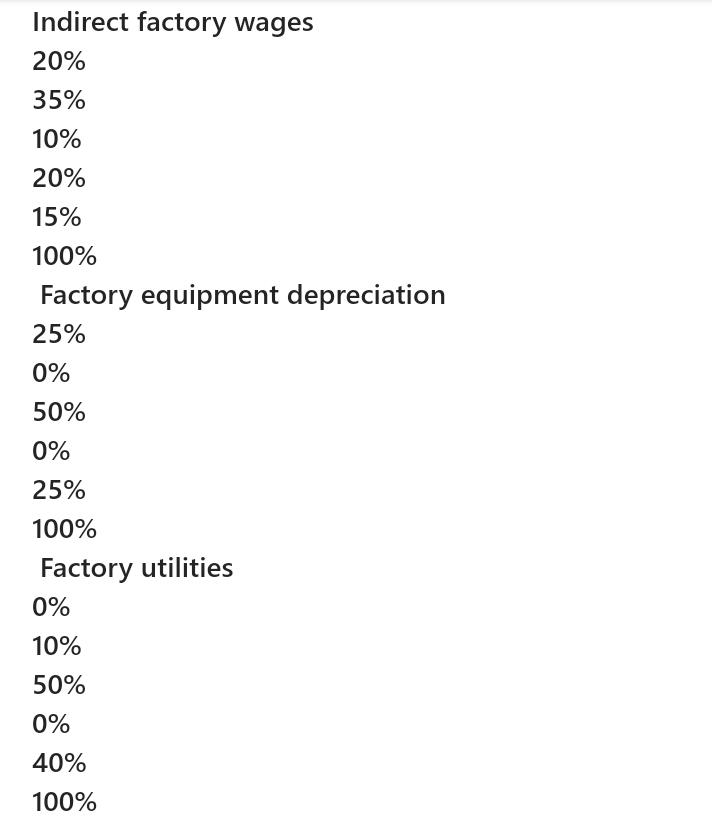

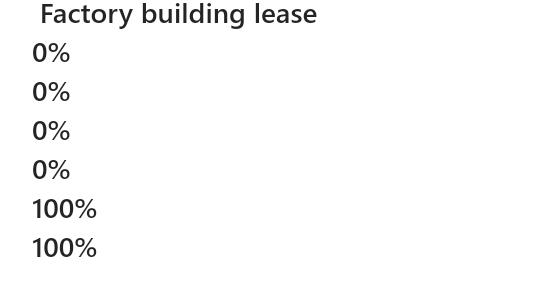

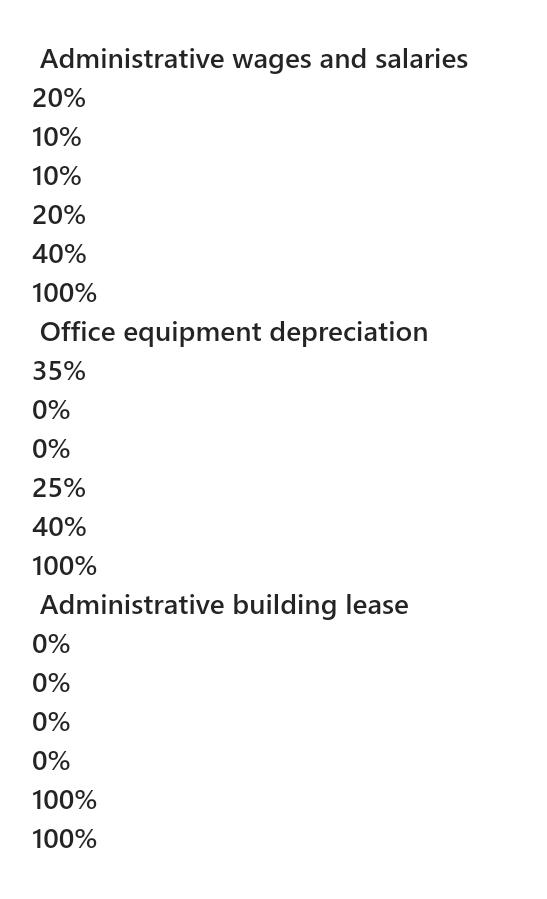

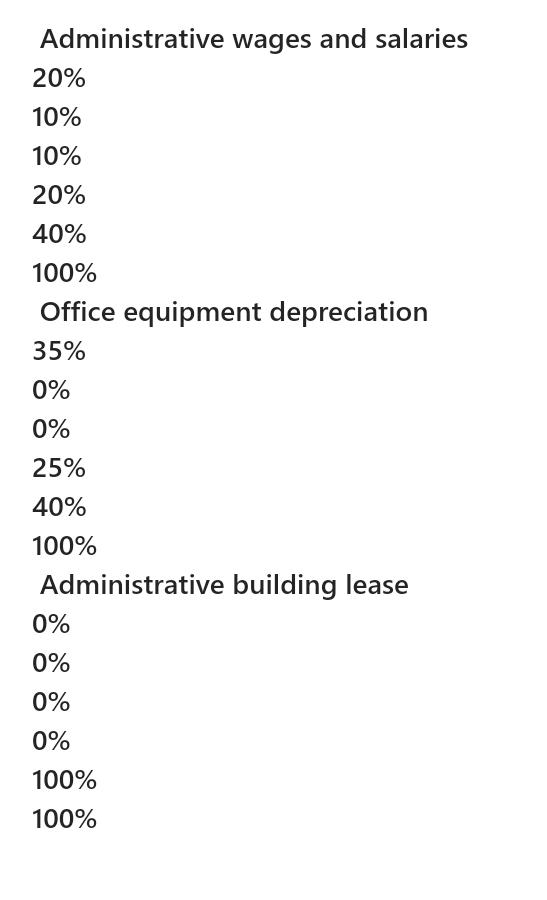

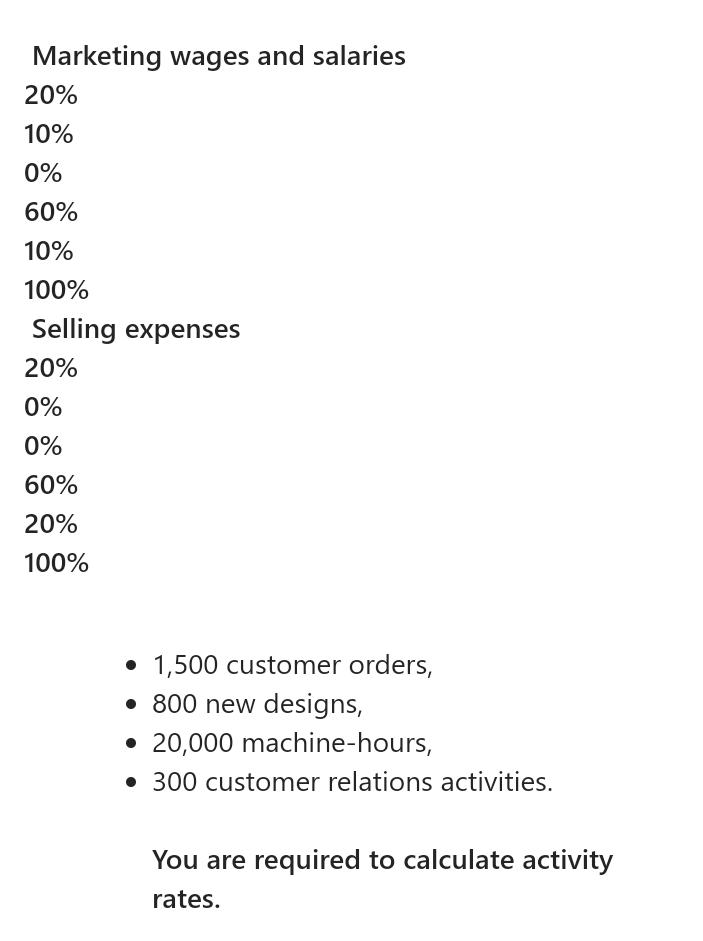

Assign Overhead Costs to Activity Cost Pools Manufacturing and Nonmanufacturing Cost Production Department Indirect factory wages 400,000 Factory equipment depreciation 200,000 Factory Utilities 150,000 Factory Building lease 100,000 850,000 General Administrative Department Administrative wage and salaries Office equipment depreciation Administrative building lease 300,000 70,000 50,000 420,000 Marketing Department Marketing wages and salaries Selling expenses 200,000 50,000 250,000 Total overhead costs 1,520,000 Assign Overhead Costs to Activity Cost Pools Indirect factory wages 20% 35% 10% 20% 15% 100% Factory equipment depreciation 25% 0% 50% 0% 25% 100% Factory utilities 0% 10% 50% 0% 40% 100% Factory building lease 0% 0% 0% 0% 100% 100% Administrative wages and salaries 20% 10% 10% 20% 40% 100% Office equipment depreciation 35% 0% 0% 25% 40% 100% Administrative building lease 0% 0% 0% 0% 100% 100% Administrative wages and salaries 20% 10% 10% 20% 40% 100% Office equipment depreciation 35% 0% 0% 25% 40% 100% Administrative building lease 0% 0% 0% 0% 100% 100% Marketing wages and salaries 20% 10% 0% 60% 10% 100% Selling expenses 20% 0% 0% 60% 20% 100% 1,500 customer orders, 800 new designs, 20,000 machine-hours, 300 customer relations activities. You are required to calculate activity rates.

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Assignment of Overhead costs to the activities Particulars Total Ratio Customer Orders New De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started