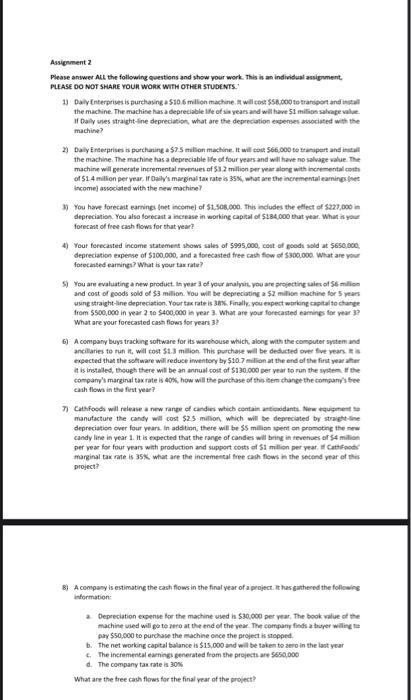

Assignent 2 Please anwer ALt the following evestions and show your work. This in an indieldual assigument. PLEAS DO NOT SHARE roUn WORE WITH OTHE STUDENTS. 1) Daly fnterpives is purthaying a 510.6 milion machine. It will cos $56000 to transpert and ingall the machine. The machise has a depreciable ife of ala yearsand wil have 51 milson sahage value. If baily uies straight-Ine depreciation, what are the deprecation expenses abociated with the machine? 2) Daly Enterprises is purtharing a $7.5 millon machine. It will dois $66,000 te trahipart and iratull the machine. The machine has a depreciable lite of four years and wil have no salvape value. The machine will generate incremental revinues of 51.2 milion per year alone with incremental cesta income) aspociated with the new machine? 3) Tou hare forecaut earnines fnet incomel of 51,306000 . This includes the edlect of s22t,000 in depreciation. You also forecast a increase in workine capital of $184,000 that year. What in your forecans of tree cash flows for that year? 4) Tour ferecasted income statemeet ahows ales of 5995,000 , coat af goodi aold at $650,000, depreciation eapense of $100000, and a forecasted free cash flow of $300.000. What are your forecaiked earnings? What is yeur tax rate? 5) You are evaluating a new product, in year 3 of your analyit, you are projecting salec of 56 milien and cost of goods sold of $3 milion. Vou will be deprecioting a $1 milion machine for 5 years wuing straight-line depreciation, Yoor tax rate is 3bx. Finally, you eapect working capital to change from $500,000 in vear 2 ne $400,000 is year 3 . What are your forteasted earmines for year 3 ? What are your forecasted cash flows for years 3 ? 6) A company buys tracking software for its warchouse which, along with the computer system and ancillaries to tun it, will cost S1.3 milion. This puechave will be deducted pres five pears is is expected thas the sot ware wil reduce inventery by $10.7 milion at the end of the firit yeat ahin it is instales, though there will be an annual cost of $130,000 per year to run the sydiem if the compary's marainal tax rate is 40%, how will the purchase of this item thange the comparyl' thee caih flow in the firt year? 7) Cathfoods will release a new ranpe of candies which eontain artiendanti. Mew dquipenent ta manufacture the candy will cost $2.5 mition, which will te depreciated by stracet-line depreciation over four veari. In addtion, there wil be 55 milion isent en promoting the me= candy line in year 1 . It is expected that the range of candies will beine in tevenues of 54 malion per vear for four years with production and suppert copts af 51 millon per year, if Cattifpods: marginal tax rate is 35%, what are the incremeetal free caih fows in the sectend vear of this project? 8) A company is estimating the cash flows in the firal vear of a peoject. It tus gathered the following information: a. Depreciation expense for the machine used is 530.000 per year, The book walue ef the machive uied will go te zero at the end of the year. The company fieds a thyoer wiline sat pary $50,000 to purchase the machine once the project is stopped. b. The net working capital balance is $15,000 and will be taken to aero in the last year c. The incremencal eaeningi generated from the prejects are 9650,000 d. The company tam rate is 300N What are the free cauh flows for the final year of the project