Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASSIGNMENT 01 (50 marks) WRITTEN ASSIGNMENT a listed South African company, is a distiller and retailer of gin and other spirits. The company has a

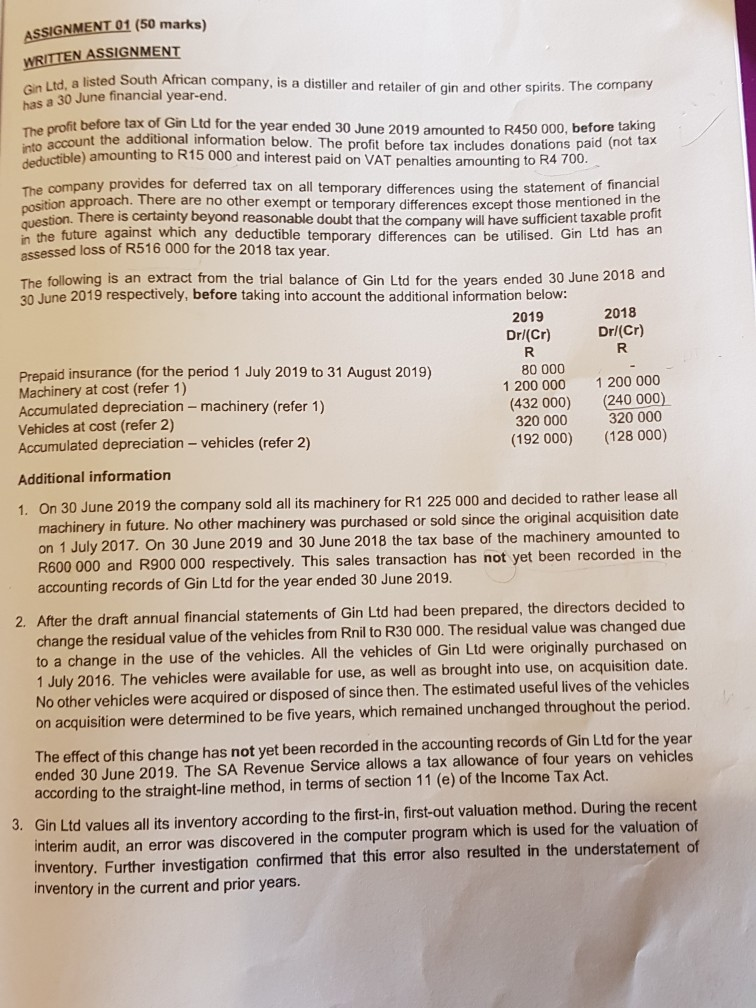

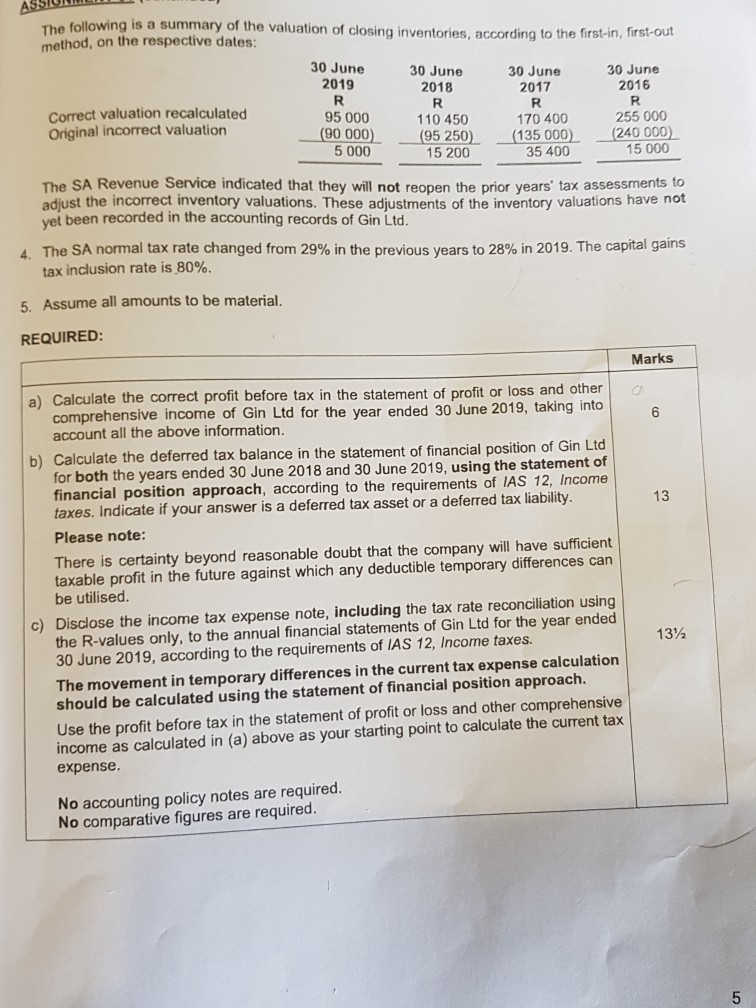

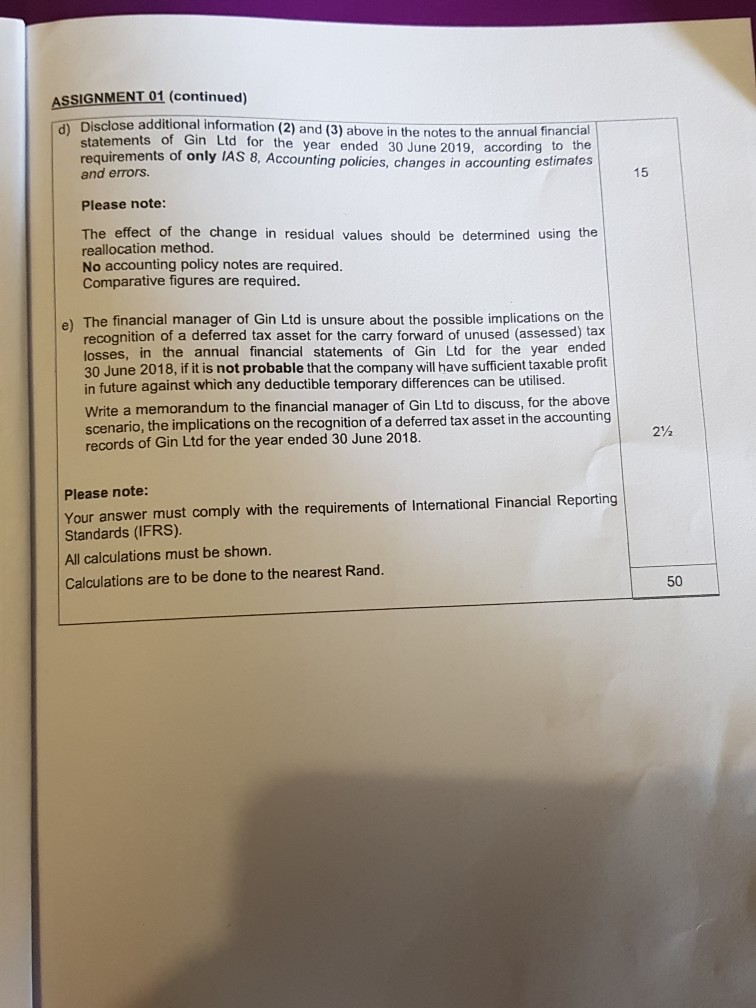

ASSIGNMENT 01 (50 marks) WRITTEN ASSIGNMENT a listed South African company, is a distiller and retailer of gin and other spirits. The company has a 30 June financial year-end. Gin Ltd, a listed sa into account the additional in be profit before tax of Gin Ltd for the year ended 30 June 2019 amounted to R450 000, before taking account the additional information below. The profit before tax includes donations paid (not tax ductible) amounting to R15 000 and interest paid on VAT penalties amounting to R4 700. The company provides for deferred tax on all temporary differences using the statement of financia sition approach. There are no other exempt or temporary differences except those mentioned in in There is certainty oeyond reasonable doubt that the company will have suficient d the future against which any deductible temporary differences can be utilised. Gin Ltd has a assessed loss of R516 000 for the 2018 tax year The following is an extract from the trial balance of Gin Ltd for the years ended 30 June 2010 and 30 June 2019 respectively, before taking into account the additional information below: 2019 2018 Drl(Cr) Dr/(Cr) R Prepaid insurance (for the period 1 July 2019 to 31 August 2019) 80 000 Machinery at cost (refer 1) 1 200 000 1 200 000 Accumulated depreciation - machinery (refer 1) (432 000) (240 000) Vehicles at cost (refer 2) 320 000 320 000 Accumulated depreciation - vehicles (refer 2) (192 000) (128 000) Additional information 1. On 30 June 2019 the company sold all its machinery for R1 225 000 and decided to rather lease all machinery in future. No other machinery was purchased or sold since the original acquisition date on 1 July 2017. On 30 June 2019 and 30 June 2018 the tax base of the machinery amounted to R600 000 and R900 000 respectively. This sales transaction has not yet been recorded in the accounting records of Gin Ltd for the year ended 30 June 2019. 2. After the draft annual financial statements of Gin Ltd had been prepared, the directors decided to change the residual value of the vehicles from Rnil to R30 000. The residual value was changed due to a change in the use of the vehicles. All the vehicles of Gin Ltd were originally purchased on 1 July 2016. The vehicles were available for use, as well as brought into use, on acquisition date. No other vehicles were acquired or disposed of since then. The estimated useful lives of the vehicles on acquisition were determined to be five years, which remained unchanged throughout the period. The effect of this change has not yet been recorded in the accounting records of Gin Ltd for the year ended 30 June 2019. The SA Revenue Service allows a tax allowance of four years on vehicles according to the straight-line method, in terms of section 11 (e) of the Income Tax Act. 3. Gin Ltd values all its inventory according to the first-in, first-out valuation method. During the recent interim audit, an error was discovered in the computer program which is used for the valuation of inventory. Further investigation confirmed that this error also resulted in the understatement of inventory in the current and prior years. ASSIUNWLW The following is a summary of the valuation of closing inventories, according to the first-in, first-out method, on the respective dates: 30 June 30 June 30 June 30 June 2019 2018 2017 2016 R Correct valuation recalculated 95 000 110 450 170 400 255 000 Original incorrect valuation (90 000) (95 250) (135 000 (240 000) 5 000 15 200 35 400 15 000 R The SA Revenue Service indicated that they will not reopen the prior years' tax assessments adjust the incorrect inventory valuations. These adjustments of the inventory valuations have not vet been recorded in the accounting records of Gin Ltd. The SA normal tax rate changed from 29% in the previous years to 28% in 2019. The capital gains tax inclusion rate is 80%. 5. Assume all amounts to be material. REQUIRED: Marks 13 a) Calculate the correct profit before tax in the statement of profit or loss and other comprehensive income of Gin Ltd for the year ended 30 June 2019, taking into account all the above information. b) Calculate the deferred tax balance in the statement of financial position of Gin Ltd for both the years ended 30 June 2018 and 30 June 2019, using the statement of financial position approach, according to the requirements of IAS 12, Income taxes. Indicate if your answer is a deferred tax asset or a deferred tax liability. Please note: There is certainty beyond reasonable doubt that the company will have sufficient taxable profit in the future against which any deductible temporary differences can be utilised. c) Disclose the income tax expense note, including the tax rate reconciliation using the R-values only, to the annual financial statements of Gin Ltd for the year ended 30 June 2019, according to the requirements of IAS 12, Income taxes. The movement in temporary differences in the current tax expense calculation should be calculated using the statement of financial position approach. Use the profit before tax in the statement of profit or loss and other comprehensive income as calculated in (a) above as your starting point to calculate the current tax expense. 1372 No accounting policy notes are required. No comparative figures are required. ASSIGNMENT 01 (continued) dDisclose additional information (2) and (3) above in the notes to the annual financial statements of Gin Ltd for the year ended 30 June 2019, according to the requirements of only IAS 8, Accounting policies, changes in accounting estimates and errors. Please note: The effect of the change in residual values should be determined using the reallocation method. No accounting policy notes are required. Comparative figures are required. e) The financial manager of Gin Ltd is unsure about the possible implications on the recognition of a deferred tax asset for the carry forward of unused (assessed) tax losses, in the annual financial statements of Gin Ltd for the year ended 30 June 2018, if it is not probable that the company will have sufficient taxable pront in future against which any deductible temporary differences can be utilised. Write a memorandum to the financial manager of Gin Ltd to discuss, for the above scenario, the implications on the recognition of a deferred tax asset in the accounting records of Gin Ltd for the year ended 30 June 2018. 2472 Please note: Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). All calculations must be shown. Calculations are to be done to the nearest Rand. ASSIGNMENT 01 (50 marks) WRITTEN ASSIGNMENT a listed South African company, is a distiller and retailer of gin and other spirits. The company has a 30 June financial year-end. Gin Ltd, a listed sa into account the additional in be profit before tax of Gin Ltd for the year ended 30 June 2019 amounted to R450 000, before taking account the additional information below. The profit before tax includes donations paid (not tax ductible) amounting to R15 000 and interest paid on VAT penalties amounting to R4 700. The company provides for deferred tax on all temporary differences using the statement of financia sition approach. There are no other exempt or temporary differences except those mentioned in in There is certainty oeyond reasonable doubt that the company will have suficient d the future against which any deductible temporary differences can be utilised. Gin Ltd has a assessed loss of R516 000 for the 2018 tax year The following is an extract from the trial balance of Gin Ltd for the years ended 30 June 2010 and 30 June 2019 respectively, before taking into account the additional information below: 2019 2018 Drl(Cr) Dr/(Cr) R Prepaid insurance (for the period 1 July 2019 to 31 August 2019) 80 000 Machinery at cost (refer 1) 1 200 000 1 200 000 Accumulated depreciation - machinery (refer 1) (432 000) (240 000) Vehicles at cost (refer 2) 320 000 320 000 Accumulated depreciation - vehicles (refer 2) (192 000) (128 000) Additional information 1. On 30 June 2019 the company sold all its machinery for R1 225 000 and decided to rather lease all machinery in future. No other machinery was purchased or sold since the original acquisition date on 1 July 2017. On 30 June 2019 and 30 June 2018 the tax base of the machinery amounted to R600 000 and R900 000 respectively. This sales transaction has not yet been recorded in the accounting records of Gin Ltd for the year ended 30 June 2019. 2. After the draft annual financial statements of Gin Ltd had been prepared, the directors decided to change the residual value of the vehicles from Rnil to R30 000. The residual value was changed due to a change in the use of the vehicles. All the vehicles of Gin Ltd were originally purchased on 1 July 2016. The vehicles were available for use, as well as brought into use, on acquisition date. No other vehicles were acquired or disposed of since then. The estimated useful lives of the vehicles on acquisition were determined to be five years, which remained unchanged throughout the period. The effect of this change has not yet been recorded in the accounting records of Gin Ltd for the year ended 30 June 2019. The SA Revenue Service allows a tax allowance of four years on vehicles according to the straight-line method, in terms of section 11 (e) of the Income Tax Act. 3. Gin Ltd values all its inventory according to the first-in, first-out valuation method. During the recent interim audit, an error was discovered in the computer program which is used for the valuation of inventory. Further investigation confirmed that this error also resulted in the understatement of inventory in the current and prior years. ASSIUNWLW The following is a summary of the valuation of closing inventories, according to the first-in, first-out method, on the respective dates: 30 June 30 June 30 June 30 June 2019 2018 2017 2016 R Correct valuation recalculated 95 000 110 450 170 400 255 000 Original incorrect valuation (90 000) (95 250) (135 000 (240 000) 5 000 15 200 35 400 15 000 R The SA Revenue Service indicated that they will not reopen the prior years' tax assessments adjust the incorrect inventory valuations. These adjustments of the inventory valuations have not vet been recorded in the accounting records of Gin Ltd. The SA normal tax rate changed from 29% in the previous years to 28% in 2019. The capital gains tax inclusion rate is 80%. 5. Assume all amounts to be material. REQUIRED: Marks 13 a) Calculate the correct profit before tax in the statement of profit or loss and other comprehensive income of Gin Ltd for the year ended 30 June 2019, taking into account all the above information. b) Calculate the deferred tax balance in the statement of financial position of Gin Ltd for both the years ended 30 June 2018 and 30 June 2019, using the statement of financial position approach, according to the requirements of IAS 12, Income taxes. Indicate if your answer is a deferred tax asset or a deferred tax liability. Please note: There is certainty beyond reasonable doubt that the company will have sufficient taxable profit in the future against which any deductible temporary differences can be utilised. c) Disclose the income tax expense note, including the tax rate reconciliation using the R-values only, to the annual financial statements of Gin Ltd for the year ended 30 June 2019, according to the requirements of IAS 12, Income taxes. The movement in temporary differences in the current tax expense calculation should be calculated using the statement of financial position approach. Use the profit before tax in the statement of profit or loss and other comprehensive income as calculated in (a) above as your starting point to calculate the current tax expense. 1372 No accounting policy notes are required. No comparative figures are required. ASSIGNMENT 01 (continued) dDisclose additional information (2) and (3) above in the notes to the annual financial statements of Gin Ltd for the year ended 30 June 2019, according to the requirements of only IAS 8, Accounting policies, changes in accounting estimates and errors. Please note: The effect of the change in residual values should be determined using the reallocation method. No accounting policy notes are required. Comparative figures are required. e) The financial manager of Gin Ltd is unsure about the possible implications on the recognition of a deferred tax asset for the carry forward of unused (assessed) tax losses, in the annual financial statements of Gin Ltd for the year ended 30 June 2018, if it is not probable that the company will have sufficient taxable pront in future against which any deductible temporary differences can be utilised. Write a memorandum to the financial manager of Gin Ltd to discuss, for the above scenario, the implications on the recognition of a deferred tax asset in the accounting records of Gin Ltd for the year ended 30 June 2018. 2472 Please note: Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). All calculations must be shown. Calculations are to be done to the nearest Rand

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started