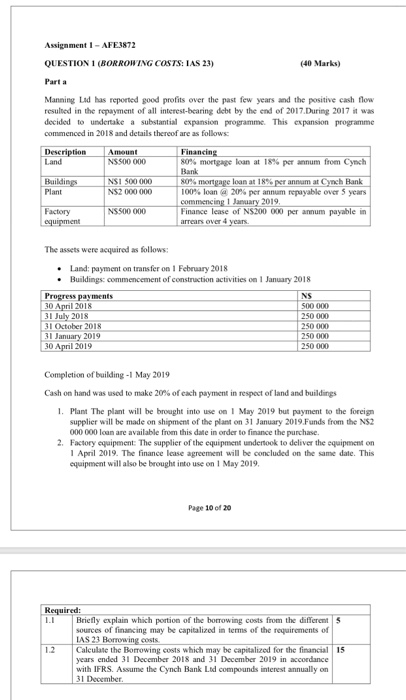

Assignment 1 - AFE3872 QUESTION 1 (BORROWING COSTS: IAS 23) (40 Marks) Parta Manning Lid has reported good profits over the past few years and the positive cash flow resulted in the repayment of all interest-bearing debt by the end of 2017. During 2017 it was decided to undertake a substantial expansion programme. This expansion programme commenced in 2018 and details thereof are as follows: Description Amount Financing Land NS500 000 80% mortgage loan at 18% per annum from Cynch Bank Building NSI 500 000 80% mortgage loan at 18% per annum at Cynch Bank Plant NS2 000 000 100% loan 20% per annum repayable over 5 years commencing 1 January 2019, Factory NS500 000 Finance lease of NS200 000 per annum payable in equipment arrears over 4 years The assets were acquired as follows: Land: payment on transfer on 1 February 2018 Buildings commencement of construction activities on 1 January 2018 Progress payments NS 30 April 2018 500 000 31 July 2018 250 000 31 October 2018 250 000 31 January 2019 250 000 30 April 2019 250 000 Completion of building - 1 May 2019 Cash on hand was used to make 20% of each payment in respect of land and buildings 1. Plant The plant will be brought into use on 1 May 2019 but payment to the foreign supplier will be made on shipment of the plant on 31 January 2019.Funds from the NS2 000 000 loan are available from this date in order to finance the purchase. 2. Factory equipment: The supplier of the equipment undertook to deliver the equipment on 1 April 2019. The finance lease agreement will be concluded on the same date. This equipment will also be brought into use on May 2019, Page 10 of 20 Required: Briefly explain which portion of the borrowing costs from the different sources of financing may be capitalized in terms of the requirements of IAS 23 Borrowing costs. 1.2 Calculate the Borrowing costs which may be capitalized for the financial 15 years ended 31 December 2018 and 31 December 2019 in accordance with IFRS. Assume the Cynch Bank Ltd compounds interest annually on 31 December Assignment 1 - AFE3872 QUESTION 1 (BORROWING COSTS: IAS 23) (40 Marks) Parta Manning Lid has reported good profits over the past few years and the positive cash flow resulted in the repayment of all interest-bearing debt by the end of 2017. During 2017 it was decided to undertake a substantial expansion programme. This expansion programme commenced in 2018 and details thereof are as follows: Description Amount Financing Land NS500 000 80% mortgage loan at 18% per annum from Cynch Bank Building NSI 500 000 80% mortgage loan at 18% per annum at Cynch Bank Plant NS2 000 000 100% loan 20% per annum repayable over 5 years commencing 1 January 2019, Factory NS500 000 Finance lease of NS200 000 per annum payable in equipment arrears over 4 years The assets were acquired as follows: Land: payment on transfer on 1 February 2018 Buildings commencement of construction activities on 1 January 2018 Progress payments NS 30 April 2018 500 000 31 July 2018 250 000 31 October 2018 250 000 31 January 2019 250 000 30 April 2019 250 000 Completion of building - 1 May 2019 Cash on hand was used to make 20% of each payment in respect of land and buildings 1. Plant The plant will be brought into use on 1 May 2019 but payment to the foreign supplier will be made on shipment of the plant on 31 January 2019.Funds from the NS2 000 000 loan are available from this date in order to finance the purchase. 2. Factory equipment: The supplier of the equipment undertook to deliver the equipment on 1 April 2019. The finance lease agreement will be concluded on the same date. This equipment will also be brought into use on May 2019, Page 10 of 20 Required: Briefly explain which portion of the borrowing costs from the different sources of financing may be capitalized in terms of the requirements of IAS 23 Borrowing costs. 1.2 Calculate the Borrowing costs which may be capitalized for the financial 15 years ended 31 December 2018 and 31 December 2019 in accordance with IFRS. Assume the Cynch Bank Ltd compounds interest annually on 31 December