Answered step by step

Verified Expert Solution

Question

1 Approved Answer

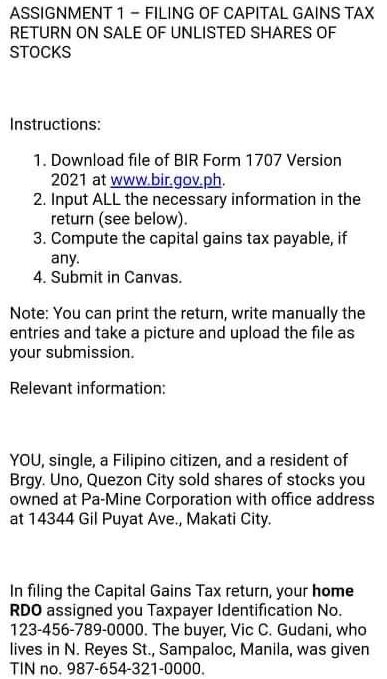

ASSIGNMENT 1 - FILING OF CAPITAL GAINS TAX RETURN ON SALE OF UNLISTED SHARES OF STOCKS Instructions: 1. Download file of BIR Form 1707

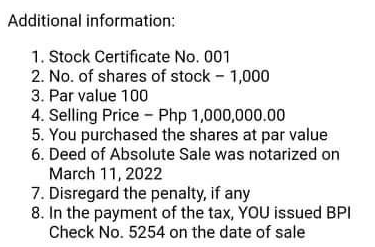

ASSIGNMENT 1 - FILING OF CAPITAL GAINS TAX RETURN ON SALE OF UNLISTED SHARES OF STOCKS Instructions: 1. Download file of BIR Form 1707 Version 2021 at www.bir.gov.ph. 2. Input ALL the necessary information in the return (see below). 3. Compute the capital gains tax payable, if any. 4. Submit in Canvas. Note: You can print the return, write manually the entries and take a picture and upload the file as your submission. Relevant information: YOU, single, a Filipino citizen, and a resident of Brgy. Uno, Quezon City sold shares of stocks you owned at Pa-Mine Corporation with office address at 14344 Gil Puyat Ave., Makati City. In filing the Capital Gains Tax return, your home RDO assigned you Taxpayer Identification No. 123-456-789-0000. The buyer, Vic C. Gudani, who lives in N. Reyes St., Sampaloc, Manila, was given TIN no. 987-654-321-0000. Additional information: 1. Stock Certificate No. 001 2. No. of shares of stock - 1,000 3. Par value 100 4. Selling Price - Php 1,000,000.00 5. You purchased the shares at par value 6. Deed of Absolute Sale was notarized on March 11, 2022 7. Disregard the penalty, if any 8. In the payment of the tax, YOU issued BPI Check No. 5254 on the date of sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided heres a stepbystep guide to filing the Capital Gains Tax return on the sale of unlisted shares of stocks 1 Download ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started