Question

Assignment #1 FILL IN THE ANSWERS BELOW. ALSO SHOW YOUR WORK! Do not just hand in the filled-in answers. Each of the two cases below

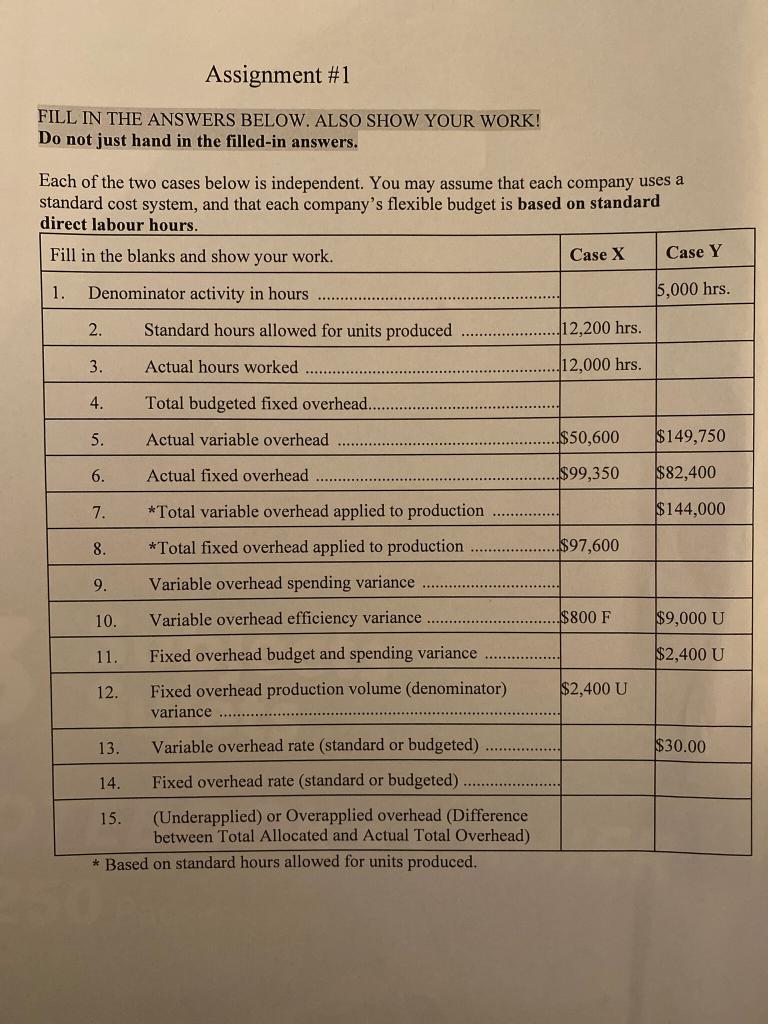

Assignment #1 FILL IN THE ANSWERS BELOW. ALSO SHOW YOUR WORK! Do not just hand in the filled-in answers. Each of the two cases below is independent. You may assume that each company uses a standard cost system, and that each company's flexible budget is based on standard direct labour hours. Fill in the blanks and show your work. Case X Case Y 1. Denominator activity in hours 5,000 hrs. 2. Standard hours allowed for units produced 12,200 hrs. 3. Actual hours worked 12,000 hrs. 4. Total budgeted fixed overhead 5. Actual variable overhead $50,600 $149,750 6. Actual fixed overhead $99,350 $82,400 7. $144,000 8. *Total variable overhead applied to production *Total fixed overhead applied to production Variable overhead spending variance ..$97,600 9. 10. Variable overhead efficiency variance |$800 F $9,000 U $2,400 U $2,400 U $30.00 11. Fixed overhead budget and spending variance 12. Fixed overhead production volume (denominator) variance 13. Variable overhead rate (standard or budgeted) 14. Fixed overhead rate (standard or budgeted) 15. (Underapplied) or Overapplied overhead (Difference between Total Allocated and Actual Total Overhead) * Based on standard hours allowed for units produced. Assignment #1 Variances Case X and Y

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started