Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment 1 Fundamentally, engineering economy involves formulating, estimating, and evaluating the economic outcomes when alternatives to accomplish a defined purpose are available. Therefore, each group

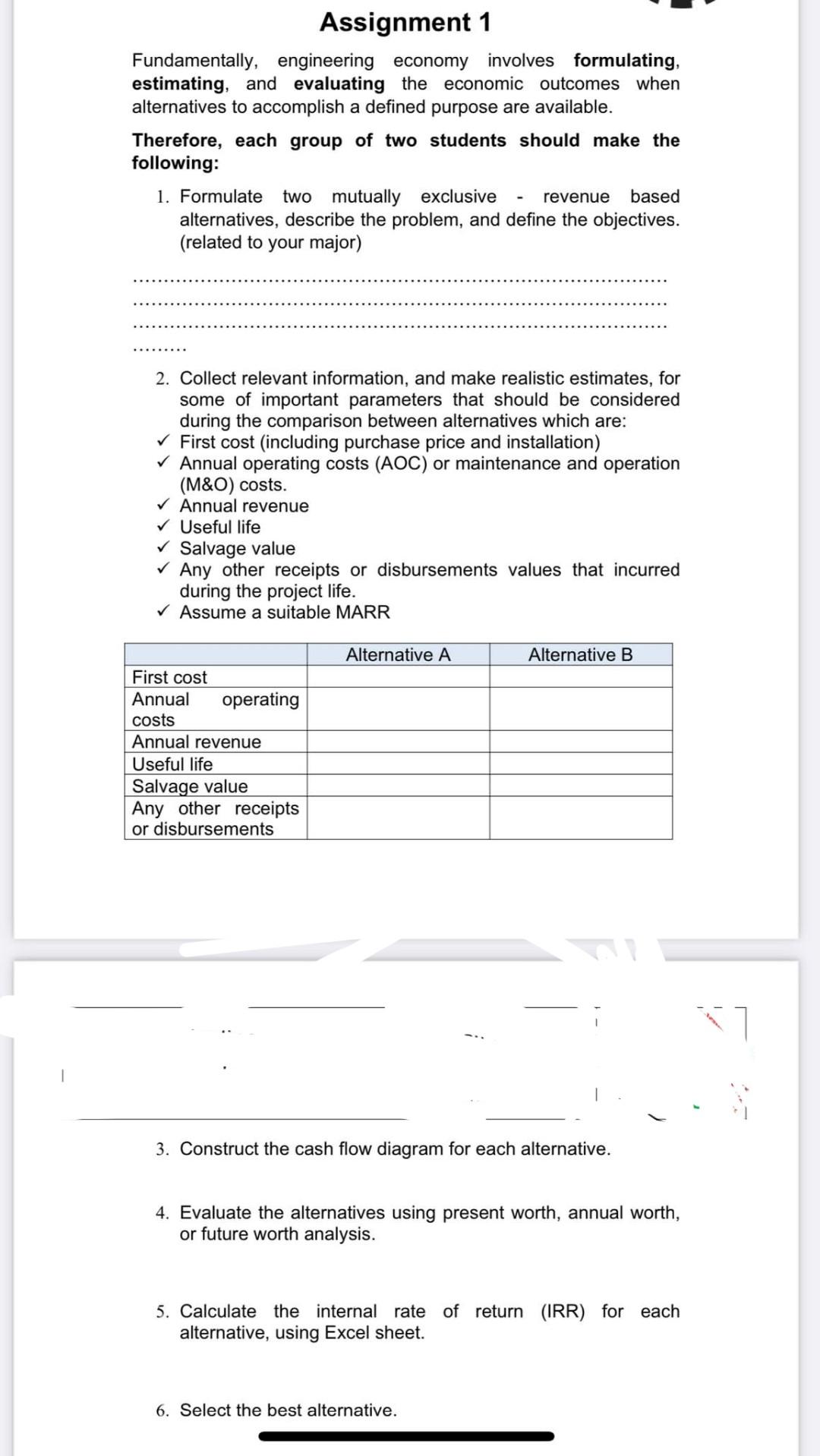

Assignment 1 Fundamentally, engineering economy involves formulating, estimating, and evaluating the economic outcomes when alternatives to accomplish a defined purpose are available. Therefore, each group of two students should make the following: 1. Formulate two mutually exclusive based alternatives, describe the problem, and define the objectives. (related to your major) revenue 2. Collect relevant information, and make realistic estimates, for some of important parameters that should be considered during the comparison between alternatives which are: First cost (including purchase price and installation) Annual operating costs (AOC) or maintenance and operation (M&O) costs. Annual revenue Useful life Salvage value Any other receipts or disbursements values that incurred during the project life. Assume a suitable MARR Alternative A Alternative B First cost Annual operating costs Annual revenue Useful life Salvage value Any other receipts or disbursements 17 3. Construct the cash flow diagram for each alternative. 4. Evaluate the alternatives using present worth, annual worth, or future worth analysis. 5. Calculate the internal rate of return (IRR) for each alternative, using Excel sheet. 6. Select the best alternative. Assignment 1 Fundamentally, engineering economy involves formulating, estimating, and evaluating the economic outcomes when alternatives to accomplish a defined purpose are available. Therefore, each group of two students should make the following: 1. Formulate two mutually exclusive based alternatives, describe the problem, and define the objectives. (related to your major) revenue 2. Collect relevant information, and make realistic estimates, for some of important parameters that should be considered during the comparison between alternatives which are: First cost (including purchase price and installation) Annual operating costs (AOC) or maintenance and operation (M&O) costs. Annual revenue Useful life Salvage value Any other receipts or disbursements values that incurred during the project life. Assume a suitable MARR Alternative A Alternative B First cost Annual operating costs Annual revenue Useful life Salvage value Any other receipts or disbursements 17 3. Construct the cash flow diagram for each alternative. 4. Evaluate the alternatives using present worth, annual worth, or future worth analysis. 5. Calculate the internal rate of return (IRR) for each alternative, using Excel sheet. 6. Select the best alternative

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started