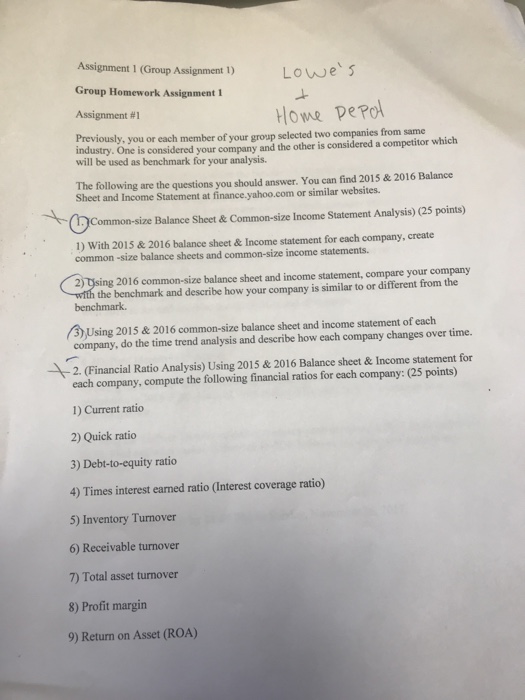

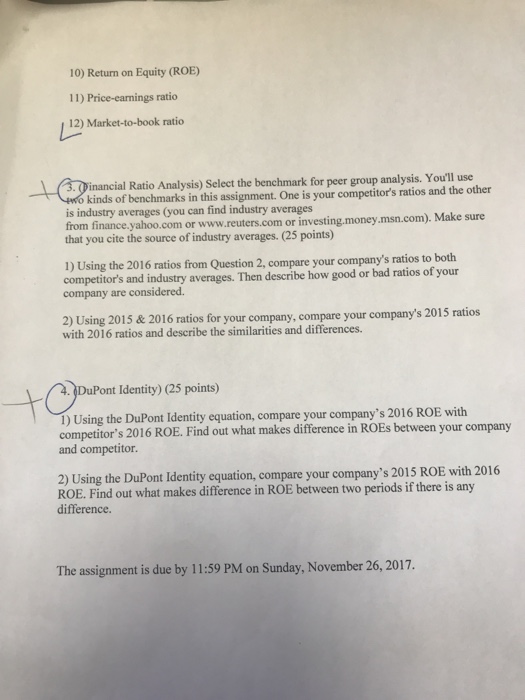

Assignment 1 (Group Assignment 1) Group Homework Assignment 1 Assignment #1 Lowes Howe Depo Previously, you or each member of your group selected two companies from same industry. will be used as benchmark for your analysis. One is considered your company and the other is considered a competitor which The following are the questions you should answer. You can find 2015 &2016 Balance Sheet and Income Statement at finance yahoo.com or similar websites. Balance Sheet&Common-size Income Statement Analysis) (25 points) 1) With 2015&2016 balance sheet & Income statement for each company, create common-size balance sheets and common-size income statements. 2) sing 2016 common-size balance sheet and income statement, compare your company the benchmark and describe how your company is similar to or different from the benchmark /3)Using 2015 & 2016 common-size balance sheet and income statement of each company, do the time trend analysis and describe how each company changes over time. each company, compute the following financial ratios for each company: (25 points) 1) Current ratio 2) Quick ratio 3) Debt-to-equity ratio 4) Times interest earned ratio (Interest coverage ratio) 5) Inventory Turnover 6) Receivable turnover 7) Total asset turnover 8) Profit margin 9) Return on Asset (ROA) 2. (Financial Ratio Analysis) Using 2015 &2016 Balance sheet & Income statement for Assignment 1 (Group Assignment 1) Group Homework Assignment 1 Assignment #1 Lowes Howe Depo Previously, you or each member of your group selected two companies from same industry. will be used as benchmark for your analysis. One is considered your company and the other is considered a competitor which The following are the questions you should answer. You can find 2015 &2016 Balance Sheet and Income Statement at finance yahoo.com or similar websites. Balance Sheet&Common-size Income Statement Analysis) (25 points) 1) With 2015&2016 balance sheet & Income statement for each company, create common-size balance sheets and common-size income statements. 2) sing 2016 common-size balance sheet and income statement, compare your company the benchmark and describe how your company is similar to or different from the benchmark /3)Using 2015 & 2016 common-size balance sheet and income statement of each company, do the time trend analysis and describe how each company changes over time. each company, compute the following financial ratios for each company: (25 points) 1) Current ratio 2) Quick ratio 3) Debt-to-equity ratio 4) Times interest earned ratio (Interest coverage ratio) 5) Inventory Turnover 6) Receivable turnover 7) Total asset turnover 8) Profit margin 9) Return on Asset (ROA) 2. (Financial Ratio Analysis) Using 2015 &2016 Balance sheet & Income statement for