Question

ASSIGNMENT 1: PROJECT SCOPE AND SCHEDULING SECTION A (60) Read the extract below and answer the questions that follow. Case: Cory Electric Frankly speaking, Jeff,

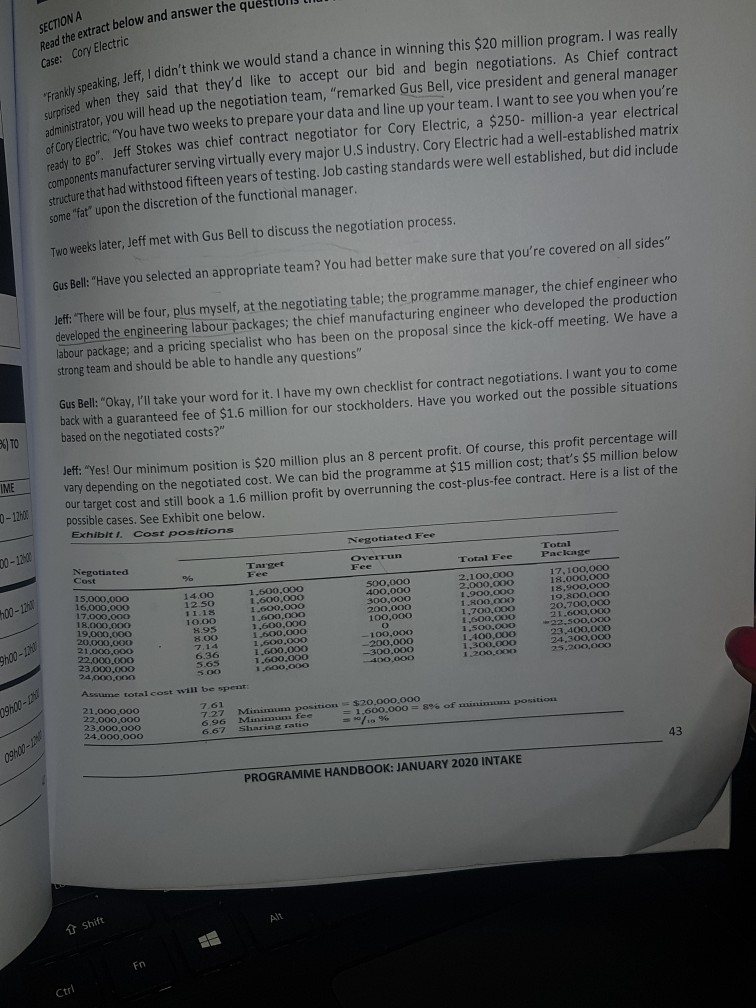

ASSIGNMENT 1: PROJECT SCOPE AND SCHEDULING SECTION A (60) Read the extract below and answer the questions that follow. Case: Cory Electric Frankly speaking, Jeff, I didnt think we would stand a chance in winning this $20 million program. I was really surprised when they said that theyd like to accept our bid and begin negotiations. As Chief contract administrator, you will head up the negotiation team, remarked Gus Bell, vice president and general manager of Cory Electric. You have two weeks to prepare your data and line up your team. I want to see you when youre ready to go. Jeff Stokes was chief contract negotiator for Cory Electric, a $250- million-a year electrical components manufacturer serving virtually every major U.S industry. Cory Electric had a well-established matrix structure that had withstood fifteen years of testing. Job casting standards were well established, but did include some fat upon the discretion of the functional manager. Two weeks later, Jeff met with Gus Bell to discuss the negotiation process. Gus Bell: Have you selected an appropriate team? You had better make sure that youre covered on all sides Jeff: There will be four, plus myself, at the negotiating table; the programme manager, the chief engineer who developed the engineering labour packages; the chief manufacturing engineer who developed the production labour package; and a pricing specialist who has been on the proposal since the kick-off meeting. We have a strong team and should be able to handle any questions Gus Bell: Okay, III take your word for it. I have my own checklist for contract negotiations. I want you to come back with a guaranteed fee of $1.6 million for our stockholders. Have you worked out the possible situations based on the negotiated costs? Jeff: Yes! Our minimum position is $20 million plus an 8 percent profit. Of course, this profit percentage will vary depending on the negotiated cost. We can bid the programme at $15 million cost; thats $5 million below our target cost and still book a 1.6 million profit by overrunning the cost-plus-fee contract. Here is a list of the possible cases. See Exhibit one below. Jeff: Ive read over all terms and conditions, and so have all the project office personnel as well as the key functional managers. The only major item is that the customer wants us to qualify some few vendors as sources for raw material procurement. We have included in the package the cost of qualifying two new raw material suppliers Gus Bell: Where are the weak points in our proposal? Im sure we have some Jeff: Last month, the customer sent in a finding team to go over all of our labour justifications. The impression that I get from our people is that were covered all the way round. The only major problem might be where well be performing on our learning curve. We put into the proposal 45 percent learning curve efficiency. The customer has indicated that we should be up around 50 to 55 percent efficiency based on our previous contracts with him. Unfortunately, those contracts the customer referred to were four years old. Several of the employees who worked on those programs have left the company. Others are assigned to on-going projects here at Cory. I estimate that we could put together about 10 percent of people we used previously. That learning curve percentage will be a big point for disagreements. We finished off the previous programs with the customer at 35 percent learning curve position. I dont see how they can expect us to be smarter, given these circumstances. Gus Bell: If thats the only weakness, then were in good shape. It sounds like we have a fool proof audit trail. Thats good! Whats your negotiation sequence going to be? Jeff: Id like to negotiate the bottom line only, but thats a dream. Well probably negotiate the raw materials, the man-hours and the learning curve, the overhead rate, and finally the profit percentage. Hopefully, we can do it in that order. Gus Bell: Do you think that well be able to negotiate a cost above our minimum position? Jeff: Our proposal was $22.2 million. I dont foresee any problem that will prevent us from coming out ahead of the minimum position. The 5 percent change in learning curve efficiency amounts to approximately $ 1 million. We should be well covered. The first move will be up to them. I expect that theyll come in with an offer of $ 18 to $19 million. Using the binary chop procedure, thatll give us our guaranteed minimum position. Gus Bell: Do you know the guys who youll be negotiating with? Jeff: Yes, Ive dealt with them before. The last time, the negotiations took three days. I think we both got what we wanted. I expect this one to go just smoothly Gus Bell: Okay, Jeff. Im convinced were prepared for negotiations. Have a good trip The negotiations began at 9:00 A .M on Monday morning. The customer countered the original proposal of $22.2 million with an offer of $15 million. After six solid hours of arguments, Jeff and his team adjourned. Jeff immediately called Gus Bell at Cory Electric. Jeff: Their counteroffer to our bid is absurd. Theyve asked us to make a counteroffer to their offer. We cant do that. The instant we give them a counter-offer, we are in fact giving credibility to their absurd bid. Now, theyre claiming that, if we dont give them a counteroffer, then were not bargaining in good faith. I think were in trouble Gus Bell: Has the customer done their homework to justify their bid? Jeff: Yes, very well. Tomorrow were going to discuss every element of the proposal, task by task. Unless something drastically changes in their position within the next day or two, contract negotiations will probably take up to a month Gus Bell: Perhaps this is one program that should be negotiated at the top levels of management. Find out if the person that youre negotiating with reports to a vice president and general manager, as you do. If not, break off contract negotiations until the customer gives us someone at your level. Well negotiate this at my level, if necessary. Source: John Wiley & Sons Inc.

QUESTION 1 (20)

Id like to negotiate the bottom line only, but thats a dream. Well probably negotiate the raw materials, the man-hours and the learning curve, the overhead rate, and finally the profit percentage. Hopefully, we can do it in that order. If so much variability (uncertainty) was on man-hours, discuss an appropriate time estimating approach using an example.

QUESTION 2 (20)

or the case study above, Create a PERT schedule with the key activities for the $20 million contract negotiation project. There should be between 6 to 10 activities identified from the case study. Additional relevant activities may be included. Create an AON network diagram and find the critical path using slack once estimated activity time is established.

QUESTION 3 (20)

Analyse the various types of Gantt charts Gus bell and Jeff can use to schedule preparations for the above negotiation.

SECTION B (40)

QUESTION 4 (20)

With the aid of an example, critically discuss how making cost and schedule trade-offs may accelerate project duration.

QUESTION 5 (20)

With the aid of an example, critically discuss how performing activities in parallel may accelerate project duration.

tract below and answer the questions the SECTION A Read the extract belowa Case: Cory Electric "Frankly speaking, Jeff, I didn't + surprised when they said that administrator, you will head un of Cory Electric, "You have ready to go". Jeff Stokes components manufacture off I didn't think we would stand a chance in winning this $20 million program. I was really ev said that they'd like to accept our bid and begin negotiations. As Chief contract s will head up the negotiation team, "remarked Gus Bell, vice president and general manager You have two weeks to prepare your data and line up your team. I want to see you when you're leff Stokes was chief contract negotiator for Cory Electric, a $250-million-a year electrical hts manufacturer serving virtually every major U.S industry. Cory Electric had a well-established matrix that had withstood fifteen years of testing. Job casting standards were well established, but did include some "fat" upon the discretion of the functional manager. Two weeks later, Jeff met with Gus Bell to discuss the negotiation process. Gus Bell: "Have you selected an appropriate team? You had better make sure that you're covered on all sides" Jeff: "There will be four, plus myself, at the negotiating table; the programme manager, the chief engineer who developed the engineering labour packages; the chief manufacturing engineer who developed the production labour package; and a pricing specialist who has been on the proposal since the kick-off meeting. We have a strong team and should be able to handle any questions" Gus Bell: "Okay, I'll take your word for it. I have my own checklist for contract negotiations. I want you to come back with a guaranteed fee of $1.6 million for our stockholders. Have you worked out the possible situations based on the negotiated costs?" 6) To IME Jeft: "Yes! Our minimum position is $20 million plus an 8 percent profit. Of course, this profit percentage will vary depending on the negotiated cost. We can bid the programme at $15 million cost; that's $5 million below our target cost and still book a 1.6 million profit by overrunning the cost-plus-fee contract. Here is a list of the possible cases. See Exhibit one below. Exhibiti. Cost positions Negotiated Fee Total Target Overrun Total Fee Paclase Fee 2.100.000 500.000 17,100,000 15.000.000 1.600.000 14.00 18.000.000 2.000.000 16.000.000 400,000 1.600.000 1250 1.900.000 18.900.000 300,000 1.600.000 11.18 200,000 1.800.000 19.800.000 18.000.000 10.00 1,600,000 20.700.000 1,700,000 100,000 19,000,000 $1.95 1,600,000 1.500.000 21.600.000 8.00 1.600.000 500,000 1.500.000 -100,000 1,600.000 23.400.000 1.400.000 200,000 1.600.000 6.36 24.300.000 1,300.000 300.000 23,000,000 1.600.000 5.65 25,200,000 1.600.000 400,000 1.200,00 Negotiated Cost hoo- 17.000.000 20,000,000 21.000.000 22.000.000 Shoo-IN 2.4 OXOCO Assume total cost will be spent 7.61 21.000.000 22.000.000 23.000.000 24.000.000 7.27 Minimun position 696 Man fee 6.67 Sharing ratio $20.000.000 = 1.600.000 = 896 of minimum position = 9% 43 OMVAN PROGRAMME HANDBOOK: JANUARY 2020 INTAKE Shift L BALIE LE LOW 4 |||| TW6 t. No nestone UU Jeff: "Ive lead functional managers. The only majuri for raw material procurement. We have included in the package suppliers" Jeff: "Yes, ve something dr take up to ar Gus Bell: "Where are the weak points in our proposal? I'm sure we have some" labour justifications. The lv major problem might be where ning curve efficiency. The use on our previous contracts several of the employee on-going projects here to eviously. That learning grams with the customer parter, given these circumstances Gus Bell: "P the person ti off contract necessary." Source: John Jeff: "Last month, the customer sent in a finding team to go over all of our labour that I get from our people is that we're covered all the way round. The only maior be performing on our learning curve. We put into the proposal 45 percent learning has indicated that we should be up around 50 to 55 percent efficiency based on our Unfortunately, those contracts the customer referred to were four years old. Several worked on those programs have left the company. Others are assigned to on-going estimate that we could put together about 10 percent of people we used previous percentage will be a big point for disagreements. We finished off the previous programs with percent learning curve position. I don't see how they can expect us to be smarter, given the QUESTION 1 I'd like to man-hours in that orde If so much v example. Gus Bell: "If that's the only weakness, then we're in good shape. It sounds like we have a fool That's good! What's your negotiation sequence going to be? QUESTION For the case project. Th may be incl time is esta Jeff: "I'd like to negotiate the bottom line only, but that's a dream. We'll probably negotiate the the man-hours and the learning curve, the overhead rate, and finally the profit percentage. Hopeful it in that order." QUESTION Analyse th negotiatior Gus Bell: "Do you think that we'll be able to negotiate a cost above our minimum position?" Jeff: "Our proposal was $22.2 million. I don't foresee any problem that will prevent us from coming out the the minimum position. The 5 percent change in learning curve efficiency amounts to approximately Sime We should be well covered. "The first move will be up to them. I expect that they'll come in with an offer of $ 18 to 519 million US binary chop procedure, that'll give us our guaranteed minimum position, SECTION B QUESTION With the a duration. Gus Bell: "Do you know the guys who you'll be negotiating with?" QUESTION With the duration Jeff: "Yes, I've dealt with them before. The last time, the negotiations took three days. I think web we wanted. I expect this one to go just smoothly" Gus Bell: "Okay, Jeff. I'm convinced we're prepared for negotiations. Have a good trip" ered the original pro velf and his team around The negotiations began at 9:00 AM on Monday morning. The customer countered theo million with an offer of $15 million. After six solid hours of arguments, Jeff and immediately called Gus Bell at Cory Electric. Counteroffer to their offer Colbility to their abad Edining in good faith Jeff: "Their counteroffer to our bid is absurd. They've asked us to make a counter do that. The instant we give them a counter-offer, we are in fact giving credib they're claiming that, if we don't give them a counteroffer, then we're not bargain in trouble" PROGRAMME HANDBOOK: JANUARY 2020 INTAKE Work to justify then bid? MANAGEMENT 22 very well". Tomorrow drastically changes in their w we're going to discuss every element of the proposal ya des in their position within the next day or two, contract negotiations will probably Jeff: Yes, very something drastic rate up to a month perhaps this is one program that sh on that you're negotiating with aram that should be negotiated at the top levels of management Find out ng with reports to a vice president and general manager, as you do if not, break the customer gives us someone at your level. We'll negotiate this at my level ion tract negotiations until the ci Gus Bell: "Perhe the person that you off contract nep necessary Source: John Wila ner John Wiley & Sons Inc. im who QUESTION 1 om line only, but that's a dream. We'll probably negotiate the raw materials, the urve, the overhead rate, and finally the profit percentage. Hopefully, we can do it e to negotiate the bottom linee ours and the learning curve, the ov arve 135 mun-hours and that order stainty) was on man-hours, discuss an appropriate time estimating approach using an (20) so much variability (uncerta -rail. pumple. QUESTION 2 -ials, for the case study above, Create a PERT (20) a PERT schedule with the key activities for the $20 million contract negotiation an 6 to 10 activities identified from the case study. Additional relevant activities AON network diagram and find the critical path using stack once estimated activity in do project. There should be be included. Create an AON netwe time is established. QUESTION 3 of Gantt charts Gus bell and Jeff can use to schedule preparations for the above ad of Analyse the various types of Gant negotiation (20) allion g the SECTION B QUESTION 4 (40) of an example, critically discuss how making cost and schedule trade-offs may accelerate proiect (20) duration what QUESTION 5 (20) With the aid of an example, critically discuss how performing activities in parallel may accelerate project duration $22.2 d. Jeff e can't Now, we're GRAMME HANDBOOK: JANUARY 2020 INTAKE tract below and answer the questions the SECTION A Read the extract belowa Case: Cory Electric "Frankly speaking, Jeff, I didn't + surprised when they said that administrator, you will head un of Cory Electric, "You have ready to go". Jeff Stokes components manufacture off I didn't think we would stand a chance in winning this $20 million program. I was really ev said that they'd like to accept our bid and begin negotiations. As Chief contract s will head up the negotiation team, "remarked Gus Bell, vice president and general manager You have two weeks to prepare your data and line up your team. I want to see you when you're leff Stokes was chief contract negotiator for Cory Electric, a $250-million-a year electrical hts manufacturer serving virtually every major U.S industry. Cory Electric had a well-established matrix that had withstood fifteen years of testing. Job casting standards were well established, but did include some "fat" upon the discretion of the functional manager. Two weeks later, Jeff met with Gus Bell to discuss the negotiation process. Gus Bell: "Have you selected an appropriate team? You had better make sure that you're covered on all sides" Jeff: "There will be four, plus myself, at the negotiating table; the programme manager, the chief engineer who developed the engineering labour packages; the chief manufacturing engineer who developed the production labour package; and a pricing specialist who has been on the proposal since the kick-off meeting. We have a strong team and should be able to handle any questions" Gus Bell: "Okay, I'll take your word for it. I have my own checklist for contract negotiations. I want you to come back with a guaranteed fee of $1.6 million for our stockholders. Have you worked out the possible situations based on the negotiated costs?" 6) To IME Jeft: "Yes! Our minimum position is $20 million plus an 8 percent profit. Of course, this profit percentage will vary depending on the negotiated cost. We can bid the programme at $15 million cost; that's $5 million below our target cost and still book a 1.6 million profit by overrunning the cost-plus-fee contract. Here is a list of the possible cases. See Exhibit one below. Exhibiti. Cost positions Negotiated Fee Total Target Overrun Total Fee Paclase Fee 2.100.000 500.000 17,100,000 15.000.000 1.600.000 14.00 18.000.000 2.000.000 16.000.000 400,000 1.600.000 1250 1.900.000 18.900.000 300,000 1.600.000 11.18 200,000 1.800.000 19.800.000 18.000.000 10.00 1,600,000 20.700.000 1,700,000 100,000 19,000,000 $1.95 1,600,000 1.500.000 21.600.000 8.00 1.600.000 500,000 1.500.000 -100,000 1,600.000 23.400.000 1.400.000 200,000 1.600.000 6.36 24.300.000 1,300.000 300.000 23,000,000 1.600.000 5.65 25,200,000 1.600.000 400,000 1.200,00 Negotiated Cost hoo- 17.000.000 20,000,000 21.000.000 22.000.000 Shoo-IN 2.4 OXOCO Assume total cost will be spent 7.61 21.000.000 22.000.000 23.000.000 24.000.000 7.27 Minimun position 696 Man fee 6.67 Sharing ratio $20.000.000 = 1.600.000 = 896 of minimum position = 9% 43 OMVAN PROGRAMME HANDBOOK: JANUARY 2020 INTAKE Shift L BALIE LE LOW 4 |||| TW6 t. No nestone UU Jeff: "Ive lead functional managers. The only majuri for raw material procurement. We have included in the package suppliers" Jeff: "Yes, ve something dr take up to ar Gus Bell: "Where are the weak points in our proposal? I'm sure we have some" labour justifications. The lv major problem might be where ning curve efficiency. The use on our previous contracts several of the employee on-going projects here to eviously. That learning grams with the customer parter, given these circumstances Gus Bell: "P the person ti off contract necessary." Source: John Jeff: "Last month, the customer sent in a finding team to go over all of our labour that I get from our people is that we're covered all the way round. The only maior be performing on our learning curve. We put into the proposal 45 percent learning has indicated that we should be up around 50 to 55 percent efficiency based on our Unfortunately, those contracts the customer referred to were four years old. Several worked on those programs have left the company. Others are assigned to on-going estimate that we could put together about 10 percent of people we used previous percentage will be a big point for disagreements. We finished off the previous programs with percent learning curve position. I don't see how they can expect us to be smarter, given the QUESTION 1 I'd like to man-hours in that orde If so much v example. Gus Bell: "If that's the only weakness, then we're in good shape. It sounds like we have a fool That's good! What's your negotiation sequence going to be? QUESTION For the case project. Th may be incl time is esta Jeff: "I'd like to negotiate the bottom line only, but that's a dream. We'll probably negotiate the the man-hours and the learning curve, the overhead rate, and finally the profit percentage. Hopeful it in that order." QUESTION Analyse th negotiatior Gus Bell: "Do you think that we'll be able to negotiate a cost above our minimum position?" Jeff: "Our proposal was $22.2 million. I don't foresee any problem that will prevent us from coming out the the minimum position. The 5 percent change in learning curve efficiency amounts to approximately Sime We should be well covered. "The first move will be up to them. I expect that they'll come in with an offer of $ 18 to 519 million US binary chop procedure, that'll give us our guaranteed minimum position, SECTION B QUESTION With the a duration. Gus Bell: "Do you know the guys who you'll be negotiating with?" QUESTION With the duration Jeff: "Yes, I've dealt with them before. The last time, the negotiations took three days. I think web we wanted. I expect this one to go just smoothly" Gus Bell: "Okay, Jeff. I'm convinced we're prepared for negotiations. Have a good trip" ered the original pro velf and his team around The negotiations began at 9:00 AM on Monday morning. The customer countered theo million with an offer of $15 million. After six solid hours of arguments, Jeff and immediately called Gus Bell at Cory Electric. Counteroffer to their offer Colbility to their abad Edining in good faith Jeff: "Their counteroffer to our bid is absurd. They've asked us to make a counter do that. The instant we give them a counter-offer, we are in fact giving credib they're claiming that, if we don't give them a counteroffer, then we're not bargain in trouble" PROGRAMME HANDBOOK: JANUARY 2020 INTAKE Work to justify then bid? MANAGEMENT 22 very well". Tomorrow drastically changes in their w we're going to discuss every element of the proposal ya des in their position within the next day or two, contract negotiations will probably Jeff: Yes, very something drastic rate up to a month perhaps this is one program that sh on that you're negotiating with aram that should be negotiated at the top levels of management Find out ng with reports to a vice president and general manager, as you do if not, break the customer gives us someone at your level. We'll negotiate this at my level ion tract negotiations until the ci Gus Bell: "Perhe the person that you off contract nep necessary Source: John Wila ner John Wiley & Sons Inc. im who QUESTION 1 om line only, but that's a dream. We'll probably negotiate the raw materials, the urve, the overhead rate, and finally the profit percentage. Hopefully, we can do it e to negotiate the bottom linee ours and the learning curve, the ov arve 135 mun-hours and that order stainty) was on man-hours, discuss an appropriate time estimating approach using an (20) so much variability (uncerta -rail. pumple. QUESTION 2 -ials, for the case study above, Create a PERT (20) a PERT schedule with the key activities for the $20 million contract negotiation an 6 to 10 activities identified from the case study. Additional relevant activities AON network diagram and find the critical path using stack once estimated activity in do project. There should be be included. Create an AON netwe time is established. QUESTION 3 of Gantt charts Gus bell and Jeff can use to schedule preparations for the above ad of Analyse the various types of Gant negotiation (20) allion g the SECTION B QUESTION 4 (40) of an example, critically discuss how making cost and schedule trade-offs may accelerate proiect (20) duration what QUESTION 5 (20) With the aid of an example, critically discuss how performing activities in parallel may accelerate project duration $22.2 d. Jeff e can't Now, we're GRAMME HANDBOOK: JANUARY 2020 INTAKE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started