Answered step by step

Verified Expert Solution

Question

1 Approved Answer

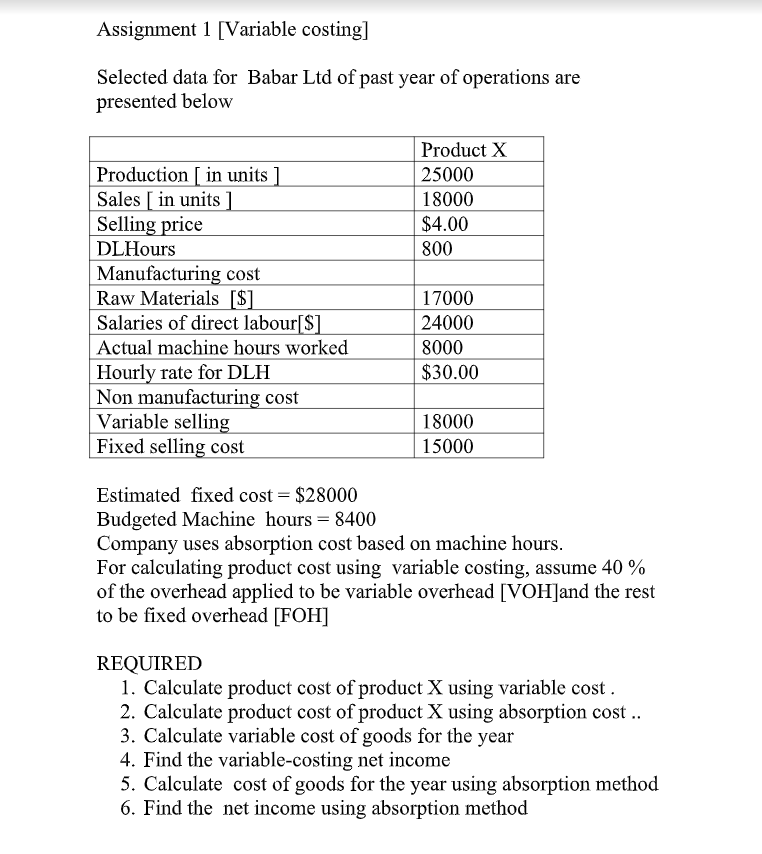

Assignment 1 [Variable costing] Selected data for Babar Ltd of past year of operations are presented below Product X Production [in units ] 25000

Assignment 1 [Variable costing] Selected data for Babar Ltd of past year of operations are presented below Product X Production [in units ] 25000 Sales [in units ] 18000 Selling price $4.00 DLHours 800 Manufacturing cost Raw Materials [$] 17000 Salaries of direct labour[$] 24000 Actual machine hours worked 8000 Hourly rate for DLH $30.00 Non manufacturing cost Variable selling 18000 Fixed selling cost 15000 Estimated fixed cost = $28000 Budgeted Machine hours = 8400 Company uses absorption cost based on machine hours. For calculating product cost using variable costing, assume 40% of the overhead applied to be variable overhead [VOH]and the rest to be fixed overhead [FOH] REQUIRED 1. Calculate product cost of product X using variable cost. 2. Calculate product cost of product X using absorption cost.. 3. Calculate variable cost of goods for the year 4. Find the variable-costing net income 5. Calculate cost of goods for the year using absorption method 6. Find the net income using absorption method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started