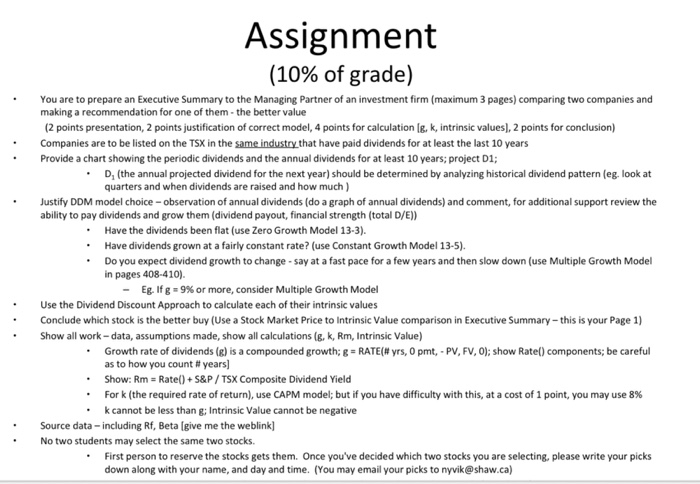

Assignment (10% of grade) You are to prepare an Executive Summary to the Managing Partner of an investment firm (maximum 3 pages) comparing two companies and making a recommendation for one of them - the better value 2 points presentation, 2 points justification of correct model, 4 points for calculation lg, k, intrinsic values], 2 points for conclusion) Companies are to be listed on the TSX in the same industry that have paid dividends for at least the last 10 years Provide a chart showing the periodic dividends and the annual dividends for at least 10 years; project D1; D, (the annual projected dividend for the next year) should be determined by analyzing historical dividend pattern (eg look at quarters and when dividends are raised and how much .Justify DDM model choice-observation of annual dividends (do a graph of annual dividends) and comment, for additional support review the ability to pay dividends and grow them (dividend payout, financial strength (total D/E)) Have the dividends been flat (use Zero Growth Model 13-3). Have dividends grown at a fairly constant rate? (use Constant Growth Model 13-5). Do you expect dividend growth to change- say at a fast pace for a few years and then slow down (use Multiple Growth Model in pages 408-410) Eg. If g 9% or more, consider Multiple Growth Model Use the Dividend Discount Approach to calculate each of their intrinsic values Conclude which stock is the better buy (Use a Stock Market Price to Intrinsic Value comparison in Executive Summary-this is your Page 1) Show all work-data, assumptions made, show all calculations (g, k, Rm, Intrinsic Value) . Growth rate of dividends (g) is a compounded growth; g RATE(# yrs, 0 pmt,-PV, FV, ); show Rate) components, be careful as to how you count # years] .Show: Rm Rate+S&P/TSX Composite Dividend Yield Fork (the required rate of return), use CAPM model; but if you have difficulty with this, at a cost of 1 point, you may use 8% k cannot be less than g; Intrinsic Value cannot be negative .Source data-including Rf, Beta (give me the weblink] No two students may select the same two stocks First person to reserve the stocks gets them. Once you've decided which two stocks you are selecting, please write your picks down along with your name, and day and time. (You may email your picks to nyvik@shaw.ca) Assignment (10% of grade) You are to prepare an Executive Summary to the Managing Partner of an investment firm (maximum 3 pages) comparing two companies and making a recommendation for one of them - the better value 2 points presentation, 2 points justification of correct model, 4 points for calculation lg, k, intrinsic values], 2 points for conclusion) Companies are to be listed on the TSX in the same industry that have paid dividends for at least the last 10 years Provide a chart showing the periodic dividends and the annual dividends for at least 10 years; project D1; D, (the annual projected dividend for the next year) should be determined by analyzing historical dividend pattern (eg look at quarters and when dividends are raised and how much .Justify DDM model choice-observation of annual dividends (do a graph of annual dividends) and comment, for additional support review the ability to pay dividends and grow them (dividend payout, financial strength (total D/E)) Have the dividends been flat (use Zero Growth Model 13-3). Have dividends grown at a fairly constant rate? (use Constant Growth Model 13-5). Do you expect dividend growth to change- say at a fast pace for a few years and then slow down (use Multiple Growth Model in pages 408-410) Eg. If g 9% or more, consider Multiple Growth Model Use the Dividend Discount Approach to calculate each of their intrinsic values Conclude which stock is the better buy (Use a Stock Market Price to Intrinsic Value comparison in Executive Summary-this is your Page 1) Show all work-data, assumptions made, show all calculations (g, k, Rm, Intrinsic Value) . Growth rate of dividends (g) is a compounded growth; g RATE(# yrs, 0 pmt,-PV, FV, ); show Rate) components, be careful as to how you count # years] .Show: Rm Rate+S&P/TSX Composite Dividend Yield Fork (the required rate of return), use CAPM model; but if you have difficulty with this, at a cost of 1 point, you may use 8% k cannot be less than g; Intrinsic Value cannot be negative .Source data-including Rf, Beta (give me the weblink] No two students may select the same two stocks First person to reserve the stocks gets them. Once you've decided which two stocks you are selecting, please write your picks down along with your name, and day and time. (You may email your picks to nyvik@shaw.ca)