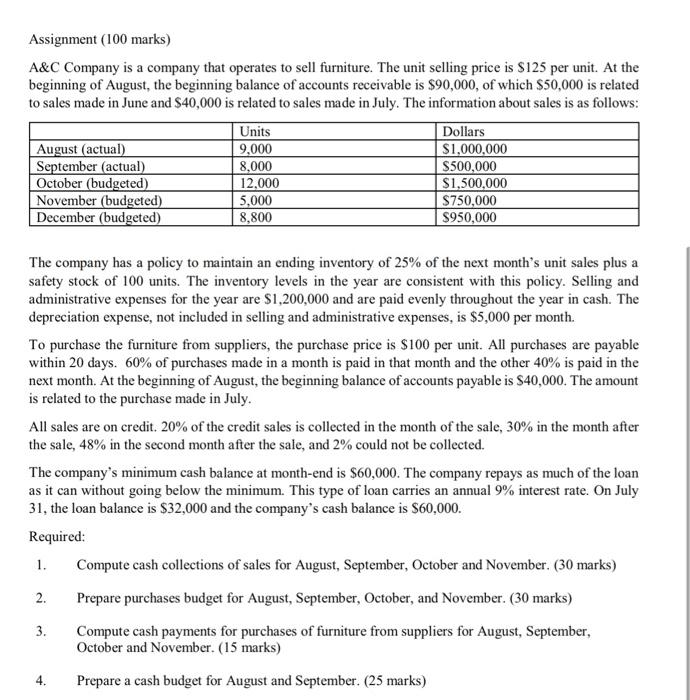

Assignment (100 marks) A\&C Company is a company that operates to sell furniture. The unit selling price is $125 per unit. At the beginning of August, the beginning balance of accounts receivable is $90,000, of which $50,000 is related to sales made in June and $40,000 is related to sales made in July. The information about sales is as follows: The company has a policy to maintain an ending inventory of 25% of the next month's unit sales plus a safety stock of 100 units. The inventory levels in the year are consistent with this policy. Selling and administrative expenses for the year are $1,200,000 and are paid evenly throughout the year in cash. The depreciation expense, not included in selling and administrative expenses, is $5,000 per month. To purchase the furniture from suppliers, the purchase price is $100 per unit. All purchases are payable within 20 days. 60% of purchases made in a month is paid in that month and the other 40% is paid in the next month. At the beginning of August, the beginning balance of accounts payable is $40,000. The amount is related to the purchase made in July. All sales are on credit. 20% of the credit sales is collected in the month of the sale, 30% in the month after the sale, 48% in the second month after the sale, and 2% could not be collected. The company's minimum cash balance at month-end is $60,000. The company repays as much of the loan as it can without going below the minimum. This type of loan carries an annual 9% interest rate. On July 31 , the loan balance is $32,000 and the company's cash balance is $60,000. Required: 1. Compute cash collections of sales for August, September, October and November. (30 marks) 2. Prepare purchases budget for August, September, October, and November. ( 30 marks) 3. Compute cash payments for purchases of furniture from suppliers for August, September, October and November. (15 marks) 4. Prepare a cash budget for August and September. ( 25 marks) Assignment (100 marks) A\&C Company is a company that operates to sell furniture. The unit selling price is $125 per unit. At the beginning of August, the beginning balance of accounts receivable is $90,000, of which $50,000 is related to sales made in June and $40,000 is related to sales made in July. The information about sales is as follows: The company has a policy to maintain an ending inventory of 25% of the next month's unit sales plus a safety stock of 100 units. The inventory levels in the year are consistent with this policy. Selling and administrative expenses for the year are $1,200,000 and are paid evenly throughout the year in cash. The depreciation expense, not included in selling and administrative expenses, is $5,000 per month. To purchase the furniture from suppliers, the purchase price is $100 per unit. All purchases are payable within 20 days. 60% of purchases made in a month is paid in that month and the other 40% is paid in the next month. At the beginning of August, the beginning balance of accounts payable is $40,000. The amount is related to the purchase made in July. All sales are on credit. 20% of the credit sales is collected in the month of the sale, 30% in the month after the sale, 48% in the second month after the sale, and 2% could not be collected. The company's minimum cash balance at month-end is $60,000. The company repays as much of the loan as it can without going below the minimum. This type of loan carries an annual 9% interest rate. On July 31 , the loan balance is $32,000 and the company's cash balance is $60,000. Required: 1. Compute cash collections of sales for August, September, October and November. (30 marks) 2. Prepare purchases budget for August, September, October, and November. ( 30 marks) 3. Compute cash payments for purchases of furniture from suppliers for August, September, October and November. (15 marks) 4. Prepare a cash budget for August and September. ( 25 marks)