answers are provided just need explanations please for studying thank you

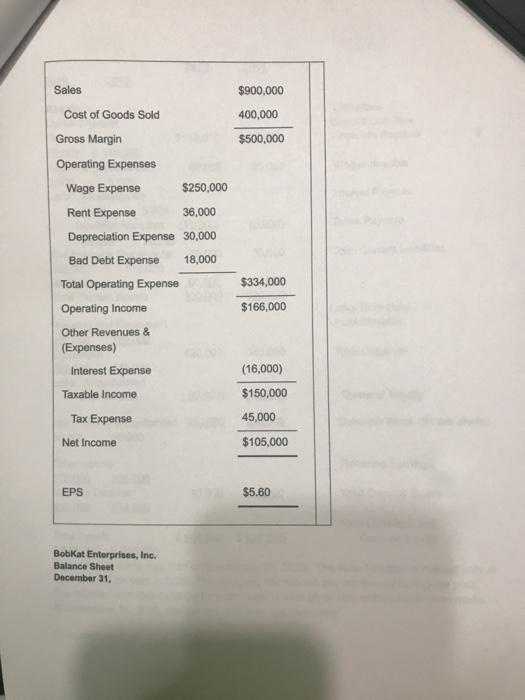

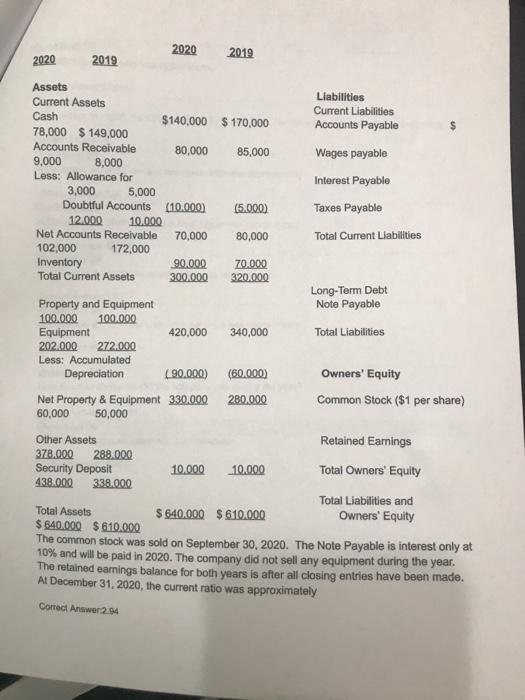

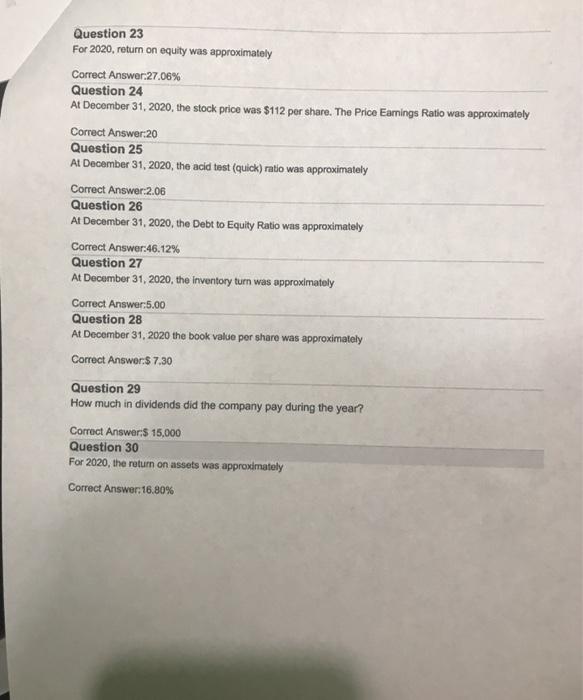

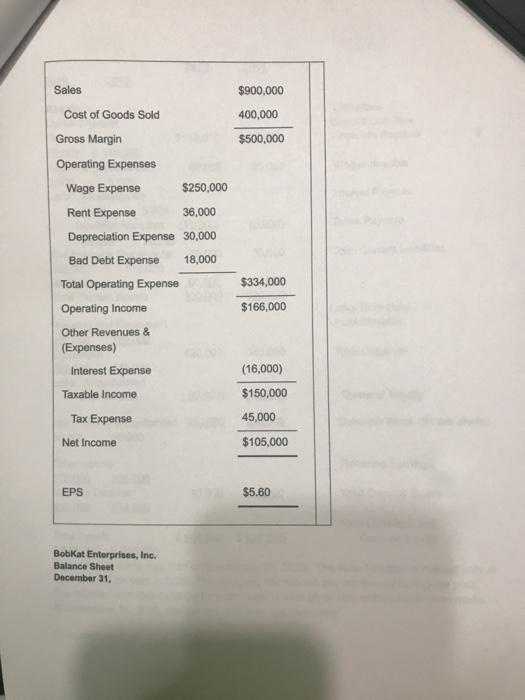

$900,000 400,000 $500,000 Sales Cost of Goods Sold Gross Margin Operating Expenses Wage Expense $250,000 Rent Expense 36,000 Depreciation Expense 30,000 Bad Debt Expense 18,000 Total Operating Expense Operating Income Other Revenues & (Expenses) Interest Expense Taxable income Tax Expense Net Income $334,000 $166,000 (16,000) $150,000 45,000 $105,000 EPS $5.60 Bobkat Enterprises, Inc. Balance Sheet December 31. 2020 2019 2020 2019 Assets Liabilities Current Assets Cash Current Liabilities $140,000 $ 170,000 Accounts Payable 78,000 $ 149,000 Accounts Receivable 80,000 85,000 Wages payable 9,000 8,000 Less: Allowance for Interest Payable 3,000 5,000 Doubtful Accounts (10.000) (5.000) Taxes Payable 12.000 10.000 Net Accounts Receivable 70,000 80,000 Total Current Liabilities 102,000 172,000 Inventory 90.000 70.000 Total Current Assets 300.000 320.000 Long-Term Debt Property and Equipment Note Payable 100.000 100.000 Equipment 420,000 340,000 Total Liabilities 202.000 272.000 Less: Accumulated Depreciation (90.000) (60.000) Owners' Equity Net Property & Equipment 330.000 280.000 Common Stock ($1 per share) 60,000 50,000 Other Assets Retained Earnings 378,000 288.000 Security Deposit 10.000 10.000 Total Owners' Equity 438.000 338.000 Total Liabilities and Total Assets $ 640.000 $ 610.000 Owners' Equity $ 640.000 $ 610.000 The common stock was sold on September 30, 2020. The Note Payable is interest only at 10% and will be paid in 2020. The company did not sell any equipment during the year. The retained eamings balance for both years is after all closing entries have been made. At December 31, 2020, the current ratio was approximately Correct Answer: 2.94 Question 23 For 2020, return on equity was approximately Correct Answer:27.06% Question 24 At December 31, 2020, the stock price was $112 per share. The Price Earnings Ratio was approximately Correct Answer:20 Question 25 At December 31, 2020, the acid test (quick) ratio was approximately Correct Answer:2.06 Question 26 At December 31, 2020, the Debt to Equity Ratio was approximately Correct Answer:46.12% Question 27 At December 31, 2020, the inventory turn was approximately Correct Answer:5.00 Question 28 At December 31, 2020 the book value por share was approximately Correct Answer:$ 7.30 Question 29 How much in dividends did the company pay during the year? Correct Answer:$ 15,000 Question 30 For 2020, the return on assets was approximately Correct Answer:16.80%