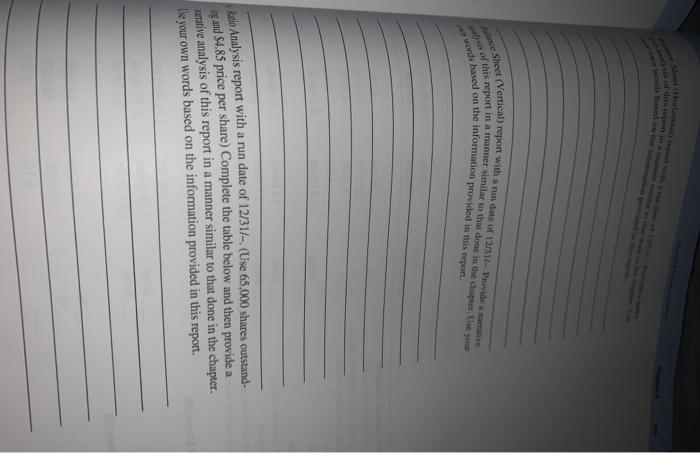

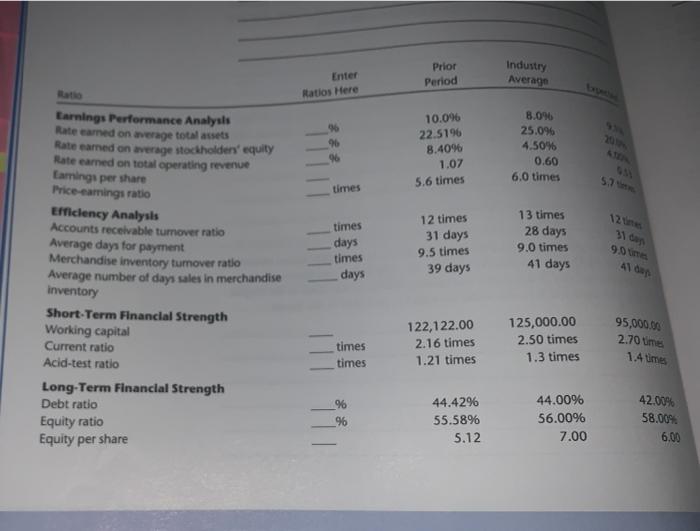

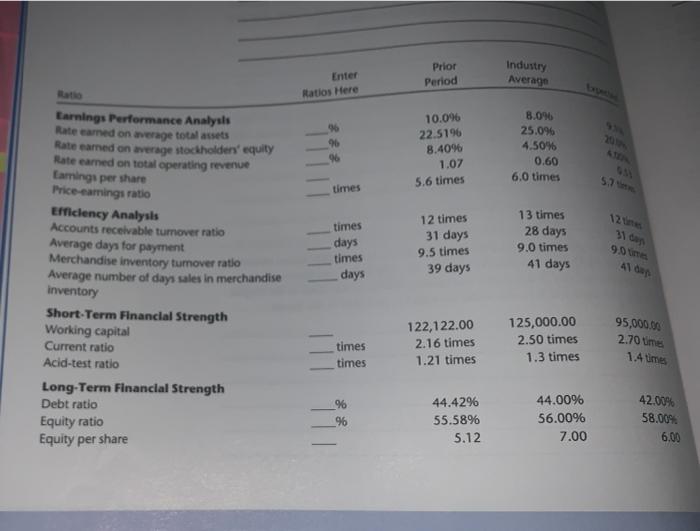

Assignment 18. Problem 9-A Complete Audit Test p. 390-393. Review the check figures on the "Web Browser." Also, use the Student Solution Checking to check your work. Problem A b. Income Statement (Vertical report with a run date of 12/01/- Provide a narra tive analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report e Sheet (Vertical) report with un date of 121 Provides of this report in a manner similar to that done in se chapter. Use you wants based on the information provided in this report Ratio Analysis report with a run date of 12/317- (Use 65,000 shares outstand- ng and S4.85 price per share) Complete the table below and then provide a urative analysis of this report in a manner similar to that done in the chapter. like your own words based on the information provided in this report. Enter Ratios Here Prior Period Industry Average 96 10.09 22.5196 8.40% 1.07 5.6 times 8.0% 25.096 4.50% 0.60 6.0 times 96 5 times 12 times 31 days 9.5 times 39 days times days times days 13 times 28 days 9.0 times 41 days Earnings Performance Analysis Rate earned on average total assets Rate earned on average stockholders' equity Rate earned on total operating revenue Camings per share Price-camins ratio Efficiency Analysis Accounts receivable turnover ratio Average days for payment Merchandise inventory tumover ratio Average number of days sales in merchandise inventory Short-Term Financial Strength Working capital Current ratio Acid-test ratio Long-Term Financial Strength Debt ratio Equity ratio Equity per share 90 122,122.00 2.16 times 1.21 times 125,000.00 2.50 times 1.3 times 95,000.00 2.70 m. 1.4 mes times times 96 96 44.42% 55.58% 5.12 44.00% 56.00% 7.00 42.00% 58.009 6.00 Chapter 9 393 1. Statement of Cash Flows report with a run date of 12/311- Provide a native analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report Assignment 18. Problem 9-A Complete Audit Test p. 390-393. Review the check figures on the "Web Browser." Also, use the Student Solution Checking to check your work. Problem A b. Income Statement (Vertical report with a run date of 12/01/- Provide a narra tive analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report e Sheet (Vertical) report with un date of 121 Provides of this report in a manner similar to that done in se chapter. Use you wants based on the information provided in this report Ratio Analysis report with a run date of 12/317- (Use 65,000 shares outstand- ng and S4.85 price per share) Complete the table below and then provide a urative analysis of this report in a manner similar to that done in the chapter. like your own words based on the information provided in this report. Enter Ratios Here Prior Period Industry Average 96 10.09 22.5196 8.40% 1.07 5.6 times 8.0% 25.096 4.50% 0.60 6.0 times 96 5 times 12 times 31 days 9.5 times 39 days times days times days 13 times 28 days 9.0 times 41 days Earnings Performance Analysis Rate earned on average total assets Rate earned on average stockholders' equity Rate earned on total operating revenue Camings per share Price-camins ratio Efficiency Analysis Accounts receivable turnover ratio Average days for payment Merchandise inventory tumover ratio Average number of days sales in merchandise inventory Short-Term Financial Strength Working capital Current ratio Acid-test ratio Long-Term Financial Strength Debt ratio Equity ratio Equity per share 90 122,122.00 2.16 times 1.21 times 125,000.00 2.50 times 1.3 times 95,000.00 2.70 m. 1.4 mes times times 96 96 44.42% 55.58% 5.12 44.00% 56.00% 7.00 42.00% 58.009 6.00 Chapter 9 393 1. Statement of Cash Flows report with a run date of 12/311- Provide a native analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report