Question

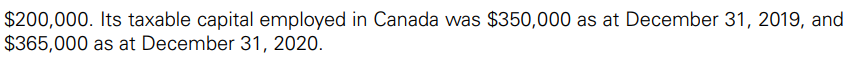

Assignment 2 $200,000. Its taxable capital employed in Canada was $350,000 as at December 31, 2019, and $365,000 as at December 31, 2020.

Assignment 2

$200,000. Its taxable capital employed in Canada was $350,000 as at December 31, 2019, and $365,000 as at December 31, 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

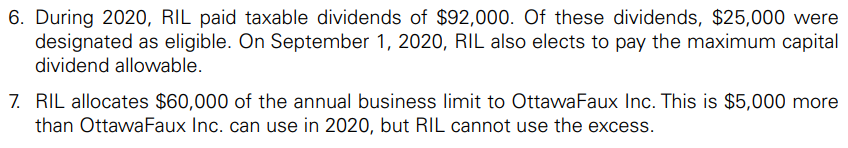

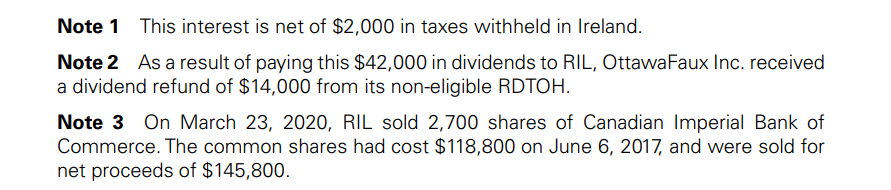

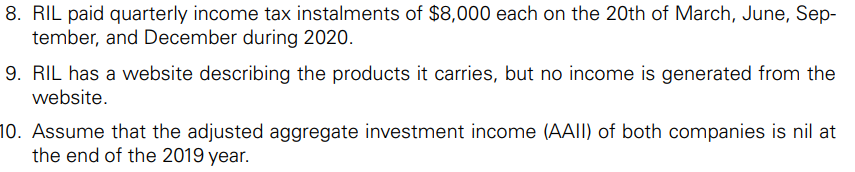

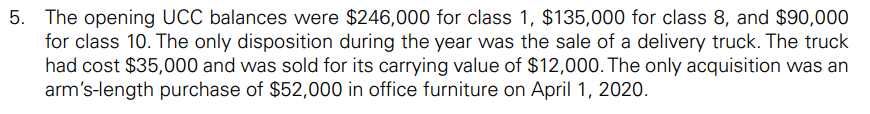

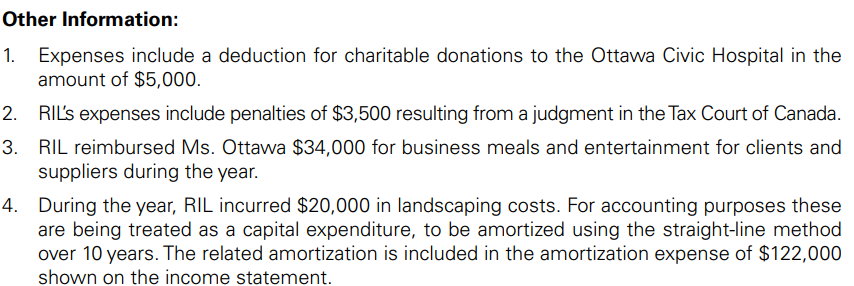

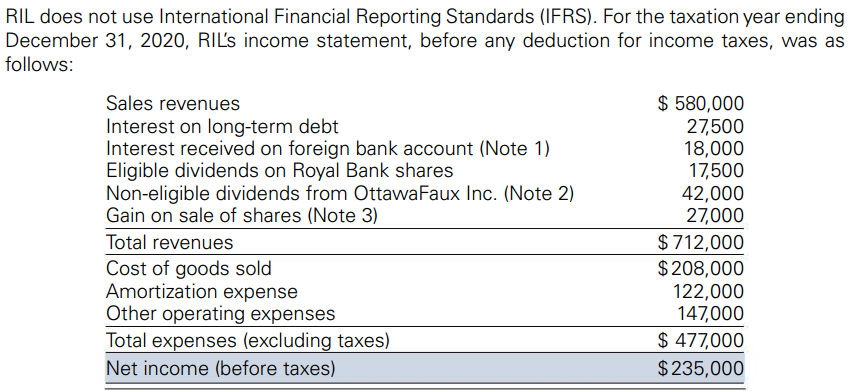

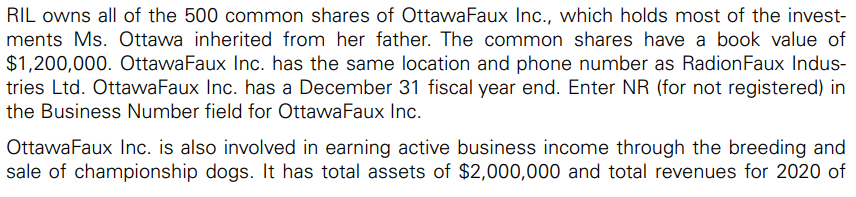

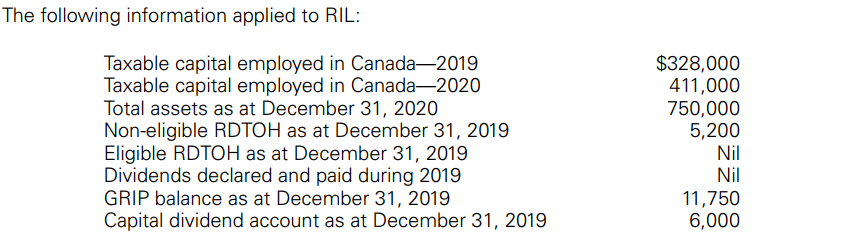

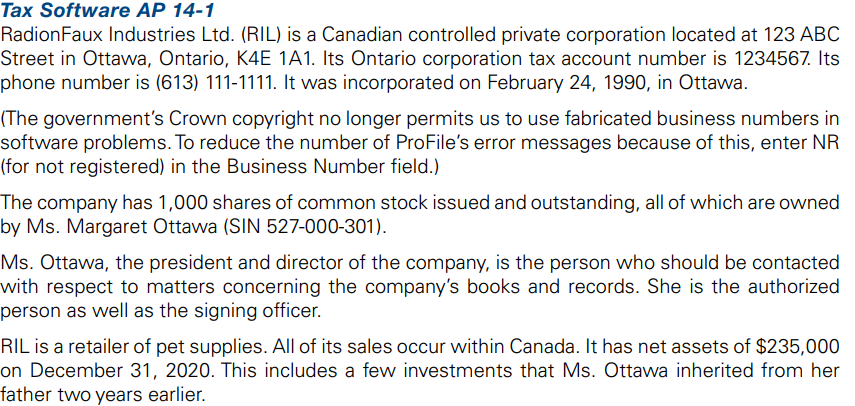

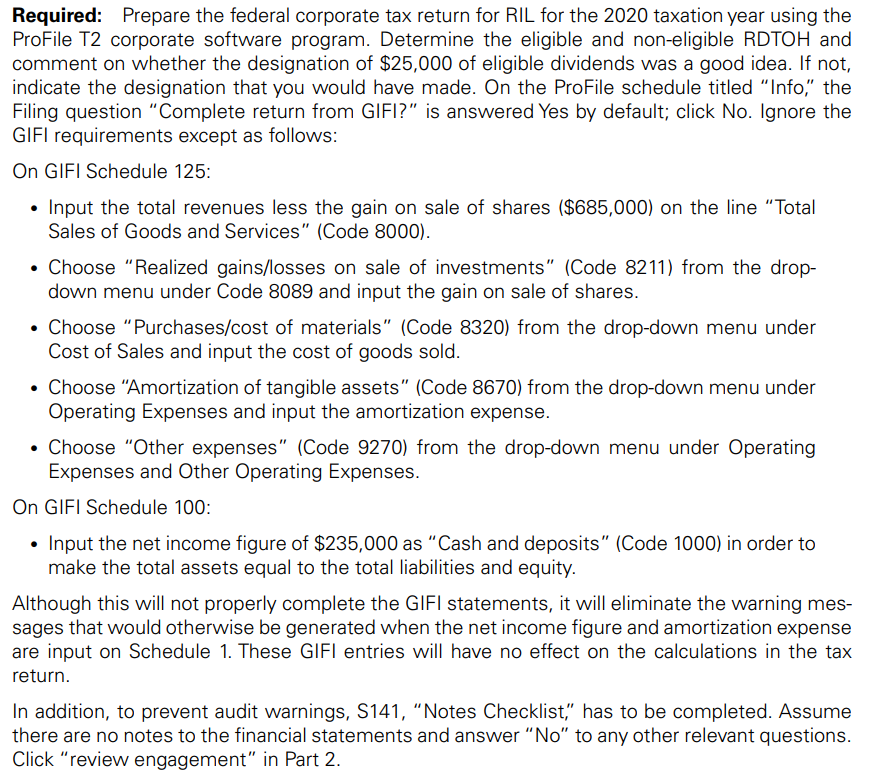

Important Information Company RadionFaux Industries Ltd RIL Location 123 ABC Street Ottawa Ontario K4E 1A1 Tax Account Number 1234567 YearEnd December ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

3rd edition

1119372933, 978-1119372936

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App