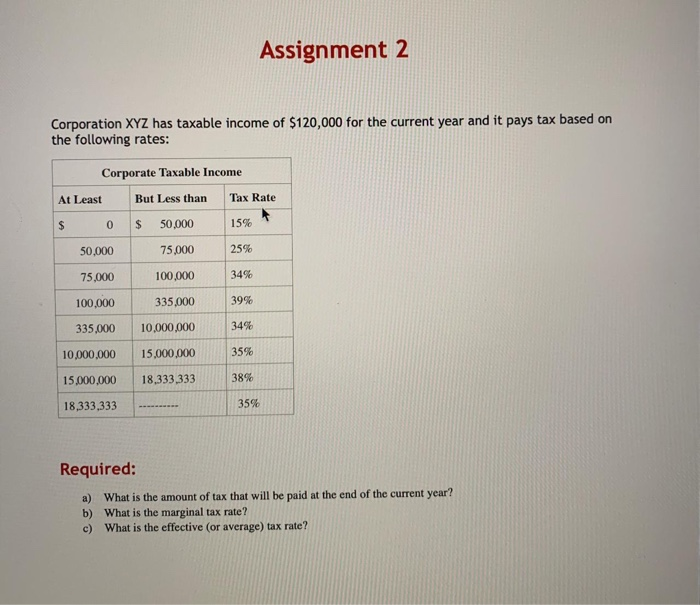

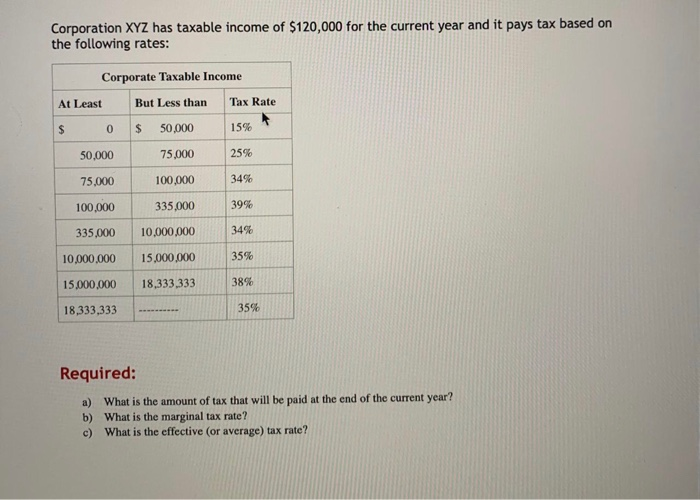

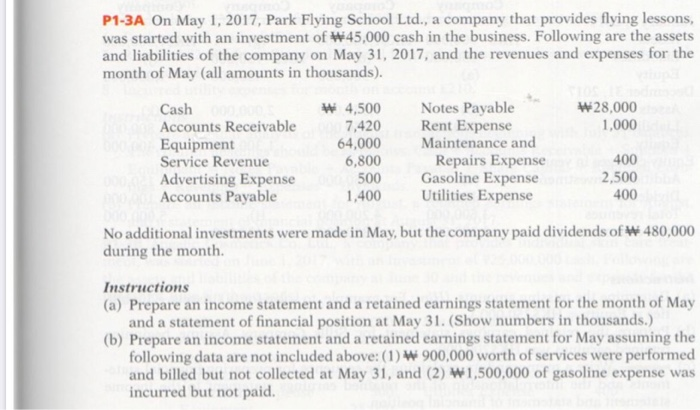

Assignment 2 Corporation XYZ has taxable income of $120,000 for the current year and it pays tax based on the following rates: Corporate Taxable Income At Least But Less than Tax Rate $ 15% o $50,000 50.000 75,000 25% 75,000 100.000 34% 100.000 335.000 39% 10,000,000 34% 335,000 10.000.000 15.000.000 35% 15.000.000 18,333,333 38% 18,333,333 35% Required: a) What is the amount of tax that will be paid at the end of the current year? b) What is the marginal tax rate? c) What is the effective (or average) tax rate? Corporation XYZ has taxable income of $120,000 for the current year and it pays tax based on the following rates: Corporate Taxable Income At Least But Less than Tax Rate $ 15% 0 $ 50,000 50,000 75.000 75.000 100,000 25% 34% 100.000 335.000 39% 10,000,000 34% 335,000 10,000,000 15,000,000 35% 18,333,333 38% 15,000,000 18,333,333 35% Required: a) What is the amount of tax that will be paid at the end of the current year? b) What is the marginal tax rate? c) What is the effective (or average) tax rate? P1-3A On May 1, 2017, Park Flying School Ltd., a company that provides flying lessons, was started with an investment of W45,000 cash in the business. Following are the assets and liabilities of the company on May 31, 2017, and the revenues and expenses for the month of May (all amounts in thousands). Cash W 4,500 Notes Payable W28,000 Accounts Receivable 7,420 Rent Expense 1,000 Equipment 64,000 Maintenance and Service Revenue 6,800 Repairs Expense 400 Advertising Expense 500 Gasoline Expense Accounts Payable 1,400 Utilities Expense 400 No additional investments were made in May, but the company paid dividends of W 480,000 during the month. 2,500 Instructions (a) Prepare an income statement and a retained earnings statement for the month of May and a statement of financial position at May 31. (Show numbers in thousands.) (b) Prepare an income statement and a retained earnings statement for May assuming the following data are not included above: (1) * 900,000 worth of services were performed and billed but not collected at May 31, and (2) W 1,500,000 of gasoline expense was incurred but not paid