Answered step by step

Verified Expert Solution

Question

1 Approved Answer

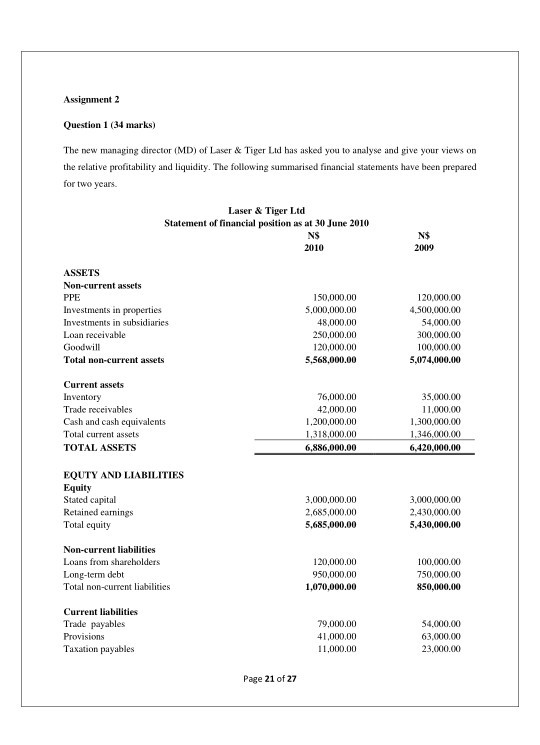

Assignment 2 Question 1 (34 marks) The new managing director (MD) of Laser & Tiger Lid has asked you to analyse and give your views

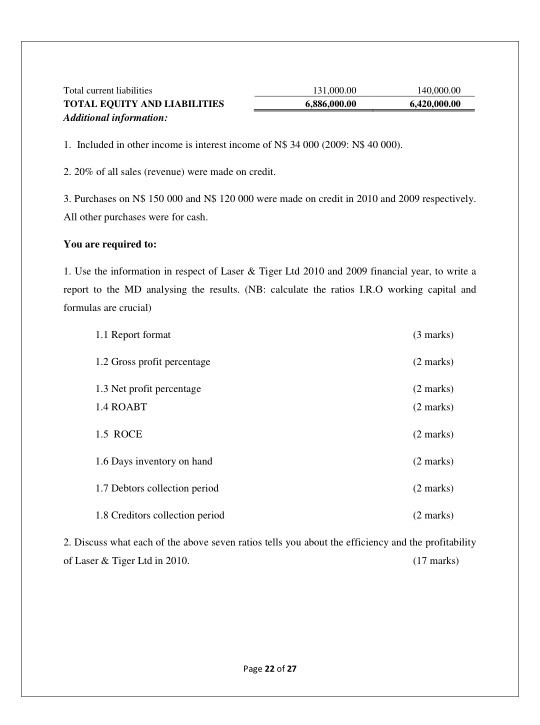

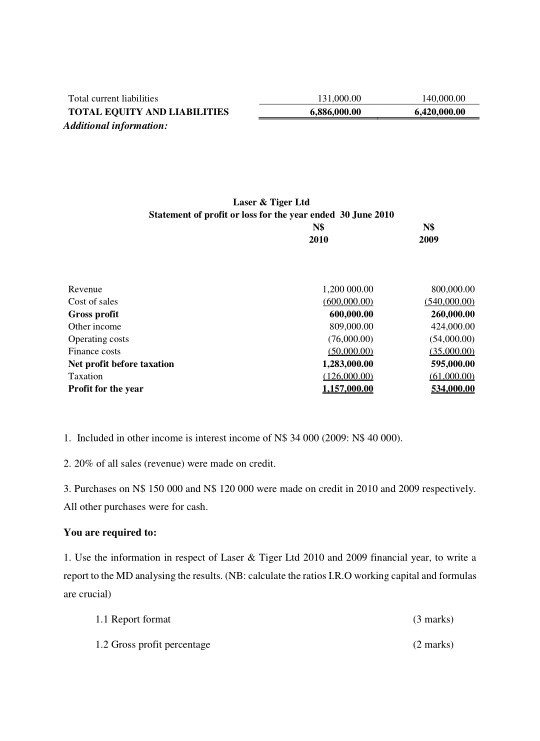

Assignment 2 Question 1 (34 marks) The new managing director (MD) of Laser & Tiger Lid has asked you to analyse and give your views on the relative profitability and liquidity. The following summarised financial statements have been prepared for two years. Laser & Tiger Ltd Statement of financial position as at 30 June 2010 NS 2010 N$ 2009 ASSETS Non-current assets PPE Investments in properties Investments in subsidiaries Loan receivable Goodwill Total non-current assets 150,000.00 5,000,000.00 48,000.00 250,000.00 120,000.00 5,568,000.00 120,000.00 4.500,000.00 54,000.00 300,000.00 100,000.00 5,074,000.00 Current assets Inventory Trade receivables Cash and cash equivalents Total current assets TOTAL ASSETS 76,000.00 42,000,00 1,200,000.00 1,318,000.00 6,886,000.00 35.000.00 11.000.00 1,300,000.00 1.346,000.00 6.420,000.00 EQUTY AND LIABILITIES Equity Stated capital Retained earnings Total equity 3,000,000.00 2,685,000.00 5,685,000.00 3,000,000.00 2,430,000.00 5.430,000.00 Non-current liabilities Loans from shareholders Long-term debt Total non-current liabilities 120,000.00 950,000.00 1,070,000.00 100.000.00 750,000.00 850,000.00 Current liabilities Trade payables Provisions Taxation payables 79,000.00 41,000.00 11,000.00 54.000.00 63,000.00 23.000.00 Page 21 of 27 Total current liabilities TOTAL EQUITY AND LIABILITIES Additional information: 131,000.00 6.886,000.00 140,000.00 6,420,000.00 1. Included in other income is interest income of N$ 34 000 (2009: NS 40000). 2. 20% of all sales (revenue) were made on credit. 3. Purchases on N$ 150 000 and N$ 120 000 were made on credit in 2010 and 2009 respectively. All other purchases were for cash. You are required to: 1. Use the information in respect of Laser & Tiger Lid 2010 and 2009 financial year, to write a report to the MD analysing the results. (NB: calculate the ratios 1.R.O working capital and formulas are crucial) 1.1 Report format (3 marks) 1.2 Gross profit percentage (2 marks) 1.3 Net profit percentage (2 marks) 1.4 ROABT (2 marks) 1.5 ROCE (2 marks) 1.6 Days inventory on hand (2 marks) 1.7 Debtors collection period (2 marks) 1.8 Creditors collection period (2 marks) 2. Discuss what each of the above seven ratios tells you about the efficiency and the profitability of Laser & Tiger Ltd in 2010. (17 marks) Page 22 of 27 Total current liabilities TOTAL EQUITY AND LIABILITIES Additional information: 131,00%).00 6,886,000.00 140,000.00 6,420,000.00 Laser & Tiger Ltd Statement of profit or loss for the year ended 30 June 2010 NS 2010 NS 2009 Revenue Cost of sales Gross profit Other income Operating costs Finance costs Net profit before taxation Taxation Profit for the year 1,200 000.00 600,00X200) 600,000.00 809,000.00 (76,000.00) (150.000,00) 1.283.000.00 (126.000.00) 1.157.000.00 800.000.00 (540.000.00 260,000.00 424.000.00 (54.000,00) (35.000.000 595,000.00 161.000.00 534.000.00 1. Included in other income is interest income of N$ 34 000 (2009: N$ 40000). 2.20% of all sales (revenue) were made on credit. 3. Purchases on N$ 150 000 and NS 120 000 were made on credit in 2010 and 2009 respectively. All other purchases were for cash. You are required to: 1. Use the information in respect of Laser & Tiger Ltd 2010 and 2009 financial year, to write a report to the MD analysing the results. (NB: calculate the ratios I.R.O working capital and formulas are crucial) 1.1 Report format 1.2 Gross profit percentage (3 marks) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started