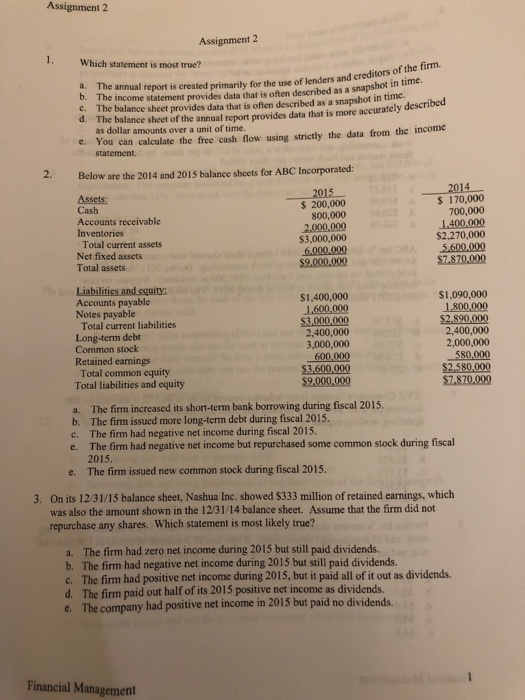

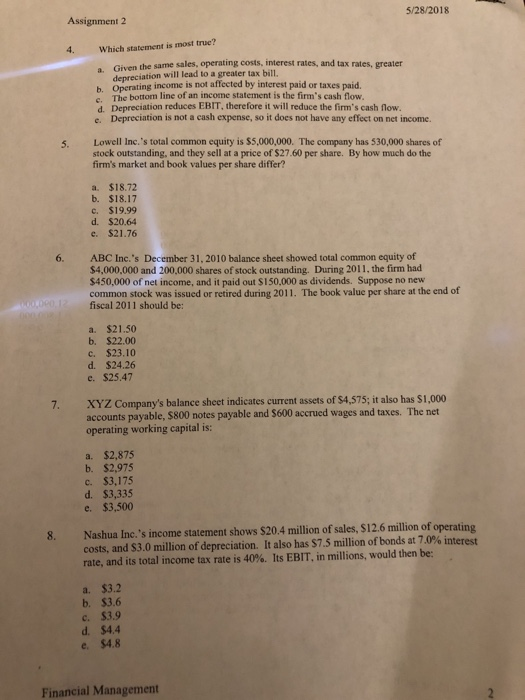

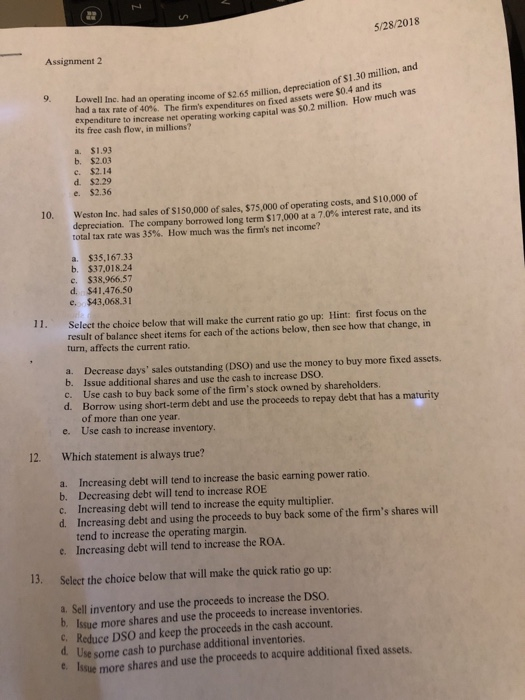

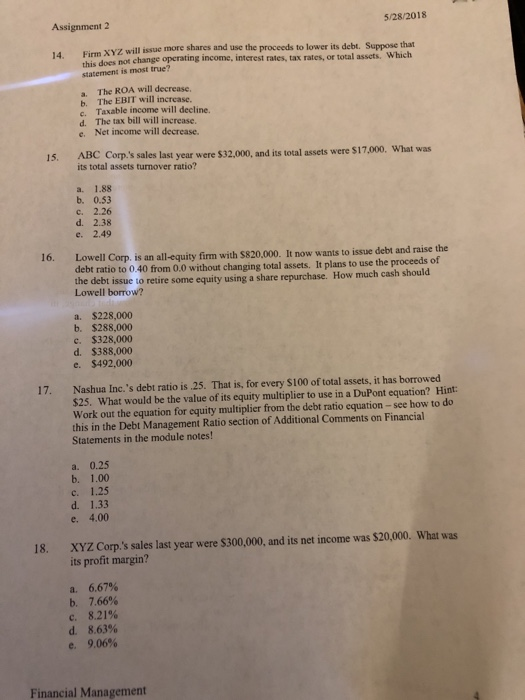

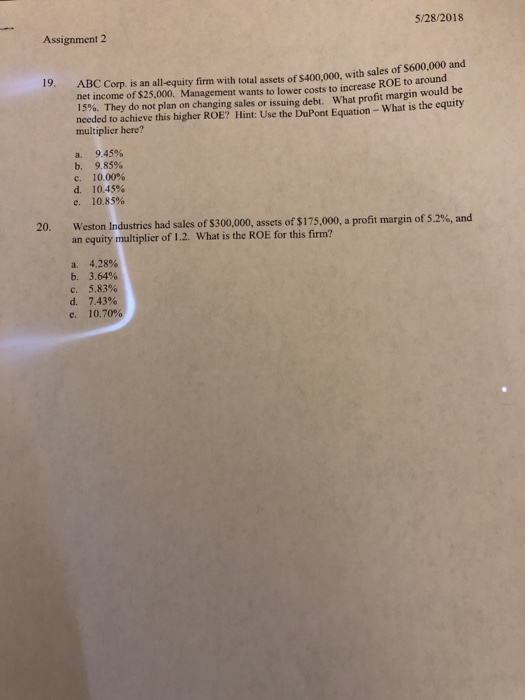

Assignment 2 Which statement is most true? a. Th b. port is created primarily for the use of lenders and creditors of the firm. e annual re T he income statement provides data that is often described as a snapshol l The balance sheet provides data that is often described as a snapshot in time. c. The balance sheet of the annual report provides data that is more accurately descri as dollar amounts over a unit of time. d. e. You can calculate the free eash flow using strictly the data from the income 2. Below are the 2014 and 2015 balance sheets for ABC Incorporated: Assets: Cash Accounts receivable Inventories $ 200,000 800,000 2.000,000 $3,000,000 6.000.000 S 170,000 700,000 S2,270,000 Total current assets Net fixed assets Total assets Accounts payable Notes payable $1,400,000 1600,000 $1,090,000 1.800,000 Total current liabilities Long-term debt Common stock Retained eanings Total common equity Total liabilities and equity 2,400,000 3,000,000 600,000 $3,600,000 $9,000,000 2,400,000 2,000,000 $7,870.000 a. b. c. e. The firm increased its short-term bank borrowing during fiscal 2015. The firm issued more long-term debt during fiscal 2015. The firm had negative net income during fiscal 2015. The firm had negative net income but repurchased some common stock during fiscal 2015. The firm issued new common stock during fiscal 2015. e. 3. On its 12/31/15 balance sheet, Nashua Inc. showed $333 million of retained earnings, which was also the amount shown in the 12/31/14 balance sheet. Assume that the firm did not repurchase any shares. Which statement is most likely true? a. The firm had zero net income during 2015 but still paid dividends. b. The firm had negative net income during 2015 but still paid dividends c. The firm had positive net income during 2015, but it paid all of it out as dividends. d. The firm paid out half of its 2015 positive net income as dividends. e. The company had positive net income in 2015 but paid no dividends. Financial Management 5/28/2018 Assignment 2 Which statement is most true? a. Given the same sales, operating costs, interest rates, and tax rates, greater depreciation will lead to a greater tax bill, Oper rating income is not affected by interest paid or taxes paid. b. .The bottom line of an income statement is the firm's cash flow d. e. Depreciation reduces EBIT, therefore it will reduce the firm's cash flow. Depreciation is not a cash expense, so it does not have any effect on net income. 5. Lowell Inc.'s total common equity is $5,000,000. The company has 530,000 shares of stock outstanding, and they sell at a price of $27.60 per share. By how much do the firm's market and book values per share differ a. $18.72 b. $18.17 c, $19.99 d. $20.64 e. $21.76 6. ABC Inc.'s December 31,2010 balance sheet showed total common equity of $4,000,000 and 200,000 shares of stock outstanding. During 2011, the firm had S450,000 of net income, and it paid out $150,000 as dividends. Suppose no new common stock was issued or retired during 2011. The book value per share at the end of fiscal 2011 should be: a. $21.50 b. $22.00 c. $23.10 d. $24.26 e. $25.47 7. XYZCompany's balance sheet indicates current assets of $4,575; it also has $1,000 accounts payable, $800 notes payable and $600 accrued wages and taxes. The net operating working capital is: a. $2,875 b. $2,975 c. $3,175 d. $3,335 e. $3,500 8. Nashua Inc.'s income statement shows $20.4 million of sales, $12.6 million of operating interest costs, and S3.0 million of depreciation. It also has S7.5 million of bonds at 7.0% rate, and its total income tax rate is 40%. Its EBIT. in millions, would then be a. $3.2 b. $3.6 c. $3.9 d. $4.4 e. $4.8 Financial Management 5/28/2018 Assignment 2 9 Lowell Inc. had an operating income of $2.65 million, depreciatioe so.4 and its had a tax rate of 40%. The firm's expenditures on fixed assets were expenditure to increase net operating working capital was S0.2 million. How much was its free cash flow, in millions? a. $1.93 b. $2.03 e. $2.14 d. $2.29 e.$2.36 10. Weston Inc. had sales of S150,000 of sales, $75,000 of operating costs, and S10,000 of depreciation. The company borrowed long term $17,000 at a 70% interest rate, and its total tax rate was 35%. How mauch was the firm's net income? a. $35,167.33 b. $37,018.24 c. $38,966.57 d. $41.476.50 e $43,068.31 11. Select the choice below that will make the current ratio go up: Hint: first focus on the result of balance sheet items for each of the actions below, then see how that change, in turn, affects the current ratio. a. Decrease days' sales outstanding (DSO) and use the money to buy more fixed assets. b. Issue additional shares and use the cash to increase DsO. c. Use cash to buy back some of the firm's stock owned by shareholders. d. Borrow using short-term debt and use the proceeds to repay debt that has a maturity of more than one year e. Use cash to increase inventory. 12. Which statement is always true? a. Increasing debt will tend to increase the basic earning power ratio. b. Decreasing debt will tend to increase ROE c. Increasing debt will tend to increase the equity multiplier. d. Increasing debt and using the proceeds to buy back some of the firm's shares will tend to increase the operating margin. e. Increasing debt will tend to increase the ROA. 13. Select the choice below that will make the quick ratio go up: a. Sell inventory and use the proceeds to increase the Dso. b. Issue more shares and use the proceeds to increase inventories. C, Reduce DSO and keep the proceeds in the cash account. Use some cash to purchase additional inventories e Isue more shares and use the proceeds to acquire additional fixed assets Assignment 2 5/28/2018 Firm XYZ will issue more shares and use the proceeds to lower its debt. Suppose that rates, tax rates, or total assets. Which 14. this does not change operating income, interest staterment is most true? a. The ROA will decrease. The EBIT will increase. b. c. d. e. Taxable income will decline. The tax bill will increase. Net income will decrease. 15. ABC Corp.'s sales last year were S32,000, and its total assets were $17,000. What was its total assets turnover ratio? a. 1.88 b. 0.33 c. 2.26 d. 2.38 e. 2.49 Lowell Corp. is an all-equity firm with $820,000. It now wants to issue debt and raise the debt ratio to 0.40 from 0.0 without changing total assets. It plans to use the proceeds of the debt Lowell borrow? t issue to retire some equity using a share repurchase. How much cash should a. $228,000 b. $288,000 c. $328,000 d. $388,000 e $492,000 Nashua Inc.'s debt ratio is .25. That is, for every $100 of total assets, it has borrowed $25. Work out the equation for equity multiplier from the debt ratio equation -see how to do this in the Debt Management Ratio section of Additional Comments on Financial Statements in the module notes! 17. What would be the value of its equity multiplier to use in a DuPont equation? Hint: a. 0.25 b. 1.00 c. 1.25 d. 1.33 e. 4.00 18. XYZ Corp.'s sales last year were $300,000, and its net income was $20,000. What was its profit margin? a. b. c. d. e. 6.67% 7.66% 8.21% 8.63% 9.06% Financial Management 5/28/2018 Assignment 2 nd ABC Corp. is an all-equity firm with total assets of $400,000, with sales of $600.000 a net income of $25,000. Management wants to lower costs to increase ROE to around 15%. They do not plan on changing sales or issuing debt. what profit margin woul needed to achieve this higher ROE? Hint: Use the DuPont Equation- What is the equity multiplier here? 19. d be 9.45% 9.85% 10 00% 10.45% 10.85% a. b. c. d. e. 20. Weston Industries had sales of$300,000, assets of $175,000, a profit margin of 52%, and an equity multiplier of 1.2. What is the ROE for this firm? a. b. c. d. e. 4.28% 3.64% 5.83% 7.43% 10.70%