Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment (3) Ch.5 The following data is about revenues and expenses of an engineer from his private engineering office in Cairo for the year ended

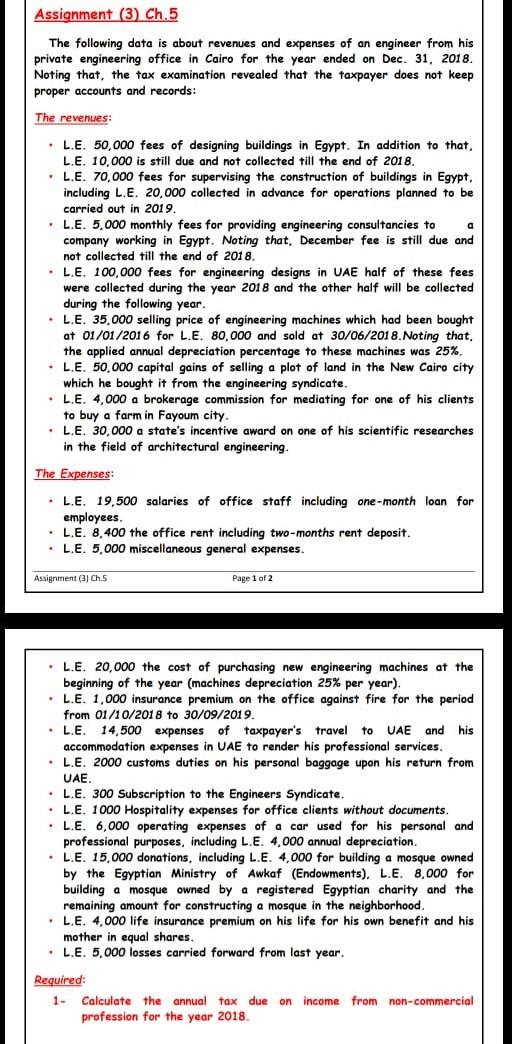

Assignment (3) Ch.5 The following data is about revenues and expenses of an engineer from his private engineering office in Cairo for the year ended on Dec. 31, 2018. Noting that, the tax examination revealed that the taxpayer does not keep proper accounts and records: The revenues: .L.E. 50,000 fees of designing buildings Egypt. In addition to that, L.E. 10,000 is still due and not collected till the end of 2018. .L.E. 70,000 fees for supervising the construction of buildings in Egypt, including L.E. 20,000 collected in advance for operations planned to be carried out in 2019. a L.E. 5,000 monthly fees for providing engineering consultancies to company working in Egypt. Noting that, December fee is still due and not collected till the end of 2018. L.E. 100,000 fees for engineering designs in UAE half of these fees were collected during the year 2018 and the other half will be collected during the following year. .L.E. 35,000 selling price of engineering machines which had been bought at 01/01/2016 for L.E. 80,000 and sold at 30/06/2018. Noting that, the applied annual depreciation percentage to these machines was 25%. .L.E. 50,000 capital gains of selling a plot of land in the New Cairo city which he bought it from the engineering syndicate. .L.E. 4,000 a brokerage commission for mediating for one of his clients to buy a farm in Fayoum city. .L.E. 30,000 a state's incentive award on one of his scientific researches in the field of architectural engineering. The Expenses: .L.E. 19,500 salaries of office staff including one-month loan for employees. .L.E. 8,400 the office rent including two-months rent deposit. .L.E. 5,000 miscellaneous general expenses. Assignment (3) Ch.5 Page 1 of 2 .L.E. 20,000 the cost of purchasing new engineering machines at the beginning of the year (machines depreciation 25% per year). .L.E. 1,000 insurance premium on the office against fire for the period from 01/10/2018 to 30/09/2019. B .L.E. 14,500 expenses of taxpayer's travel to UAE and his accommodation expenses UAE to render his professional services. .L.E. 2000 customs duties on his personal baggage upon his return from UAE. . L.E. 300 Subscription to the Engineers Syndicate. .L.E. 1000 Hospitality expenses for office clients without documents. .L.E. 6,000 operating expenses of a car used for his personal and professional purposes, including L.E. 4,000 annual depreciation. .L.E. 15,000 donations, including L.E. 4,000 for building a mosque owned by the Egyptian Ministry of Awkaf (Endowments), L.E. 8,000 for building a mosque owned by a registered Egyptian charity and the remaining amount for constructing a mosque in the neighborhood. .L.E. 4,000 life insurance premium on his life for his own benefit and his mother in equal shares. .L.E. 5,000 losses carried forward from last year. Required: 1- Calculate the annual tax due on income from non-commercial profession for the year 2018. Assignment (3) Ch.5 The following data is about revenues and expenses of an engineer from his private engineering office in Cairo for the year ended on Dec. 31, 2018. Noting that, the tax examination revealed that the taxpayer does not keep proper accounts and records: The revenues: .L.E. 50,000 fees of designing buildings Egypt. In addition to that, L.E. 10,000 is still due and not collected till the end of 2018. .L.E. 70,000 fees for supervising the construction of buildings in Egypt, including L.E. 20,000 collected in advance for operations planned to be carried out in 2019. a L.E. 5,000 monthly fees for providing engineering consultancies to company working in Egypt. Noting that, December fee is still due and not collected till the end of 2018. L.E. 100,000 fees for engineering designs in UAE half of these fees were collected during the year 2018 and the other half will be collected during the following year. .L.E. 35,000 selling price of engineering machines which had been bought at 01/01/2016 for L.E. 80,000 and sold at 30/06/2018. Noting that, the applied annual depreciation percentage to these machines was 25%. .L.E. 50,000 capital gains of selling a plot of land in the New Cairo city which he bought it from the engineering syndicate. .L.E. 4,000 a brokerage commission for mediating for one of his clients to buy a farm in Fayoum city. .L.E. 30,000 a state's incentive award on one of his scientific researches in the field of architectural engineering. The Expenses: .L.E. 19,500 salaries of office staff including one-month loan for employees. .L.E. 8,400 the office rent including two-months rent deposit. .L.E. 5,000 miscellaneous general expenses. Assignment (3) Ch.5 Page 1 of 2 .L.E. 20,000 the cost of purchasing new engineering machines at the beginning of the year (machines depreciation 25% per year). .L.E. 1,000 insurance premium on the office against fire for the period from 01/10/2018 to 30/09/2019. B .L.E. 14,500 expenses of taxpayer's travel to UAE and his accommodation expenses UAE to render his professional services. .L.E. 2000 customs duties on his personal baggage upon his return from UAE. . L.E. 300 Subscription to the Engineers Syndicate. .L.E. 1000 Hospitality expenses for office clients without documents. .L.E. 6,000 operating expenses of a car used for his personal and professional purposes, including L.E. 4,000 annual depreciation. .L.E. 15,000 donations, including L.E. 4,000 for building a mosque owned by the Egyptian Ministry of Awkaf (Endowments), L.E. 8,000 for building a mosque owned by a registered Egyptian charity and the remaining amount for constructing a mosque in the neighborhood. .L.E. 4,000 life insurance premium on his life for his own benefit and his mother in equal shares. .L.E. 5,000 losses carried forward from last year. Required: 1- Calculate the annual tax due on income from non-commercial profession for the year 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started