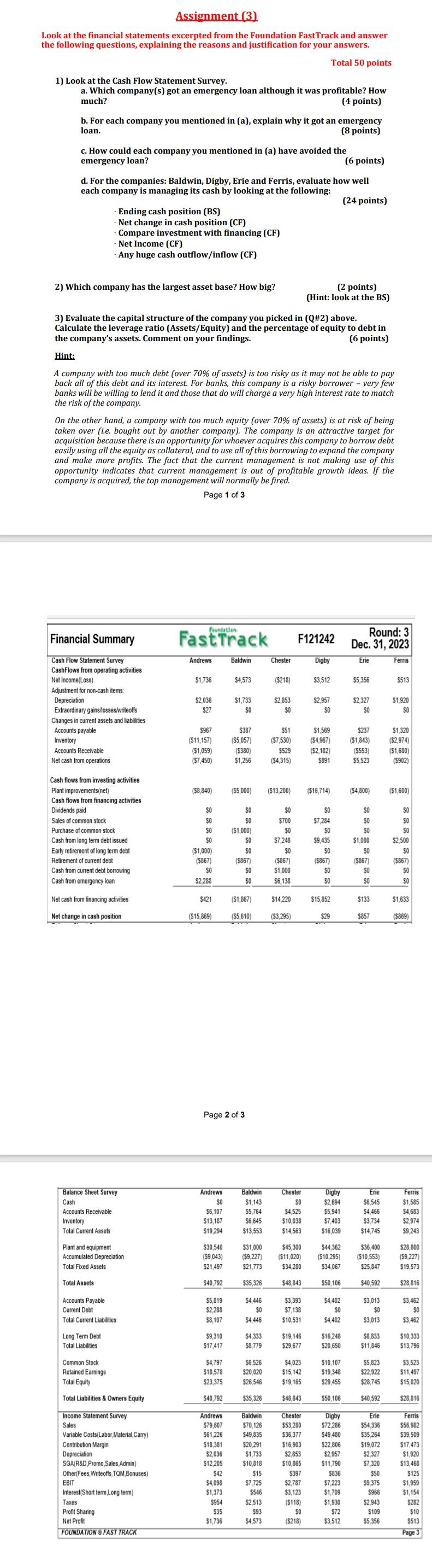

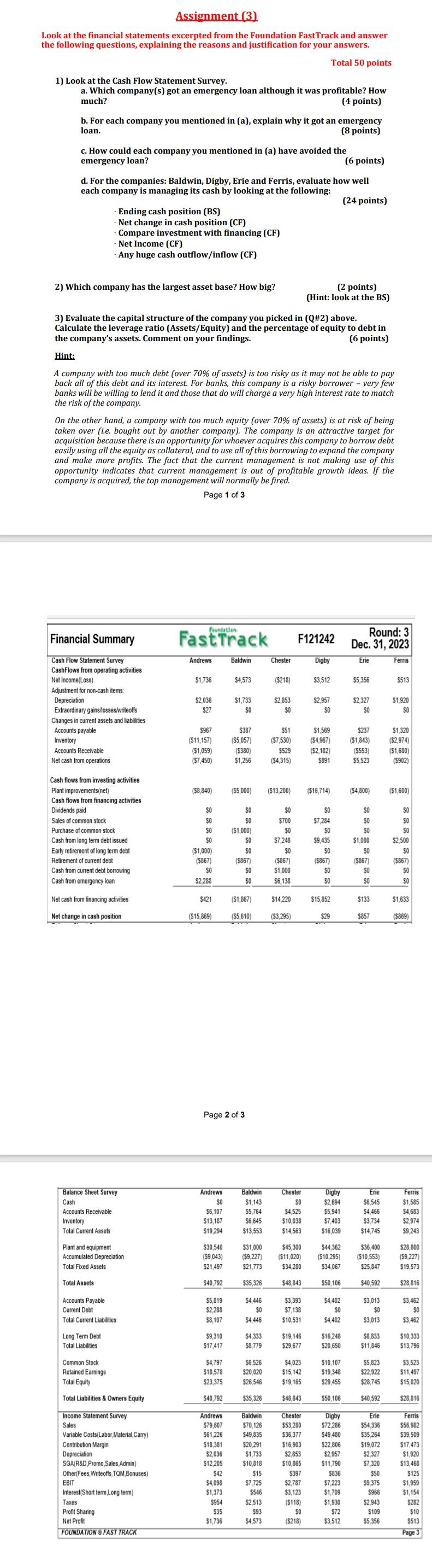

Assignment (3) Look at the financial statements excerpted from the Foundation FastTrack and answer the following questions, explaining the reasons and justification for your answers. Total 50 points 1) Look at the Cash Flow Statement Survey. a. Which company(s) got an emergency loan although it was profitable? How much? (4 points) b. For each company you mentioned in (a), explain why it got an emergency loan. (8 points) c. How could each company you mentioned in (a) have avoided the emergency loan? (6 points) d. For the companies: Baldwin, Digby, Erie and Ferris, evaluate how well each company is managing its cash by looking at the following: (24 points) - Ending cash position (BS) - Net change in cash position (CF) - Compare investment with financing (CF) - Net Income (CF) - Any huge cash outflow/inflow (CF) 2) Which company has the largest asset base? How big? (2 points) (Hint: look at the BS) 3) Evaluate the capital structure of the company you picked in (Q#2) above. Calculate the leverage ratio (Assets/Equity) and the percentage of equity to debt in the company's assets. Comment on your findings. (6 points) Hint: A company with too much debt (over 70% of assets) is too risky as it may not be able to pay back all of this debt and its interest. For banks, this company is a risky borrower - very few banks will be willing to lend it and those that do will charge a very high interest rate to match the risk of the company. On the other hand, a company with too much equity (over 70% of assets) is at risk of being taken over (i.e. bought out by another company). The company is an attractive target for acquisition because there is an opportunity for whoever acquires this company to borrow debt easily using all the equity as collateral, and to use all of this borrowing to expand the company and make more profits. The fact that the current management is not making use of this opportunity indicates that current management is out of profitable growth ideas. If the company is acquired, the top management will normally be fired. Page 1 of 3 Assignment (3) Look at the financial statements excerpted from the Foundation FastTrack and answer the following questions, explaining the reasons and justification for your answers. Total 50 points 1) Look at the Cash Flow Statement Survey. a. Which company(s) got an emergency loan although it was profitable? How much? (4 points) b. For each company you mentioned in (a), explain why it got an emergency loan. (8 points) c. How could each company you mentioned in (a) have avoided the emergency loan? (6 points) d. For the companies: Baldwin, Digby, Erie and Ferris, evaluate how well each company is managing its cash by looking at the following: (24 points) - Ending cash position (BS) - Net change in cash position (CF) - Compare investment with financing (CF) - Net Income (CF) - Any huge cash outflow/inflow (CF) 2) Which company has the largest asset base? How big? (2 points) (Hint: look at the BS) 3) Evaluate the capital structure of the company you picked in (Q#2) above. Calculate the leverage ratio (Assets/Equity) and the percentage of equity to debt in the company's assets. Comment on your findings. (6 points) Hint: A company with too much debt (over 70% of assets) is too risky as it may not be able to pay back all of this debt and its interest. For banks, this company is a risky borrower - very few banks will be willing to lend it and those that do will charge a very high interest rate to match the risk of the company. On the other hand, a company with too much equity (over 70% of assets) is at risk of being taken over (i.e. bought out by another company). The company is an attractive target for acquisition because there is an opportunity for whoever acquires this company to borrow debt easily using all the equity as collateral, and to use all of this borrowing to expand the company and make more profits. The fact that the current management is not making use of this opportunity indicates that current management is out of profitable growth ideas. If the company is acquired, the top management will normally be fired. Page 1 of 3