Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment 3: Overhead: Volume-Based versus: Activity based costing (ABC) Question 1: Fill in the spaces: Delta Co. produces and sells two secure, W and Z.

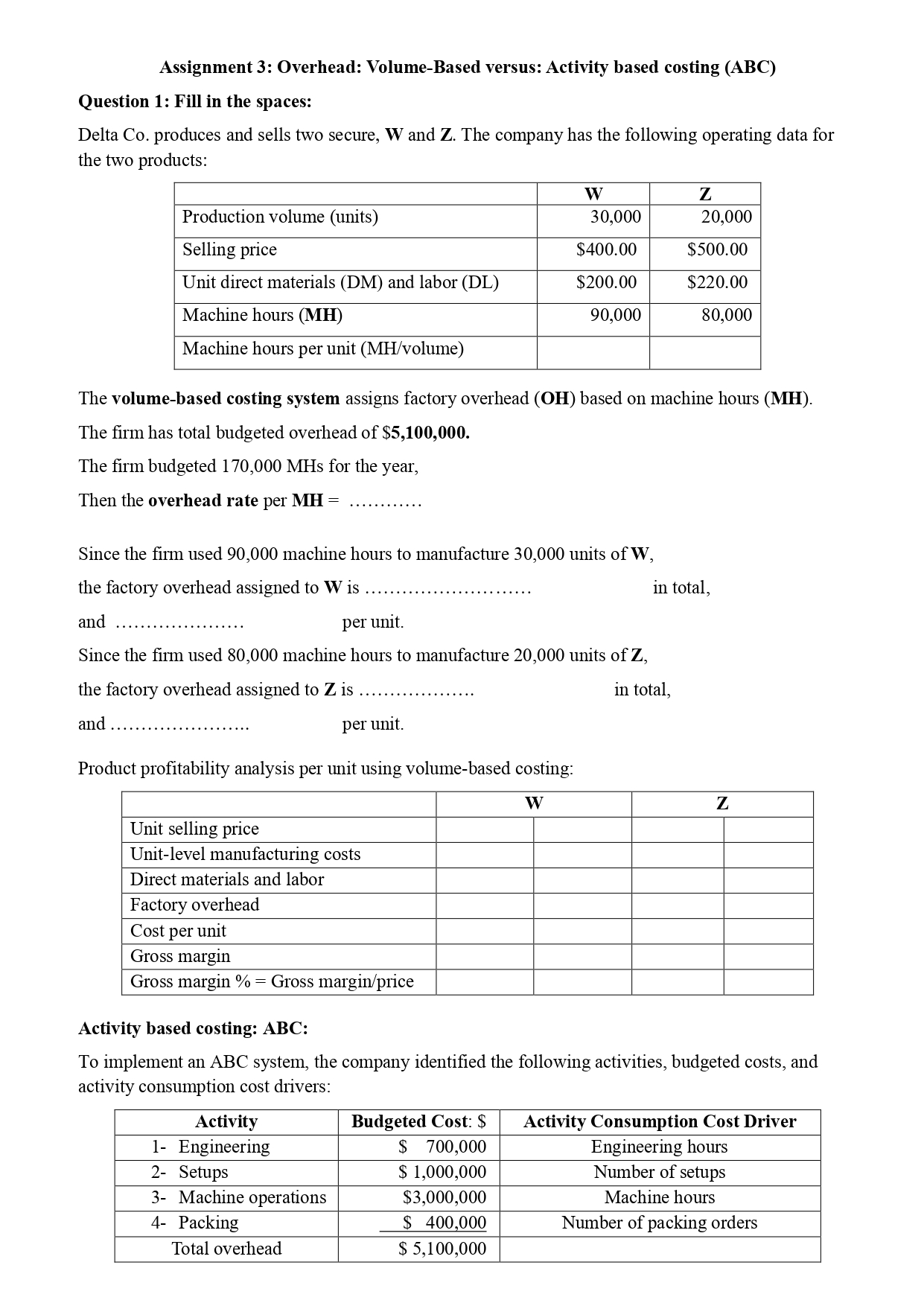

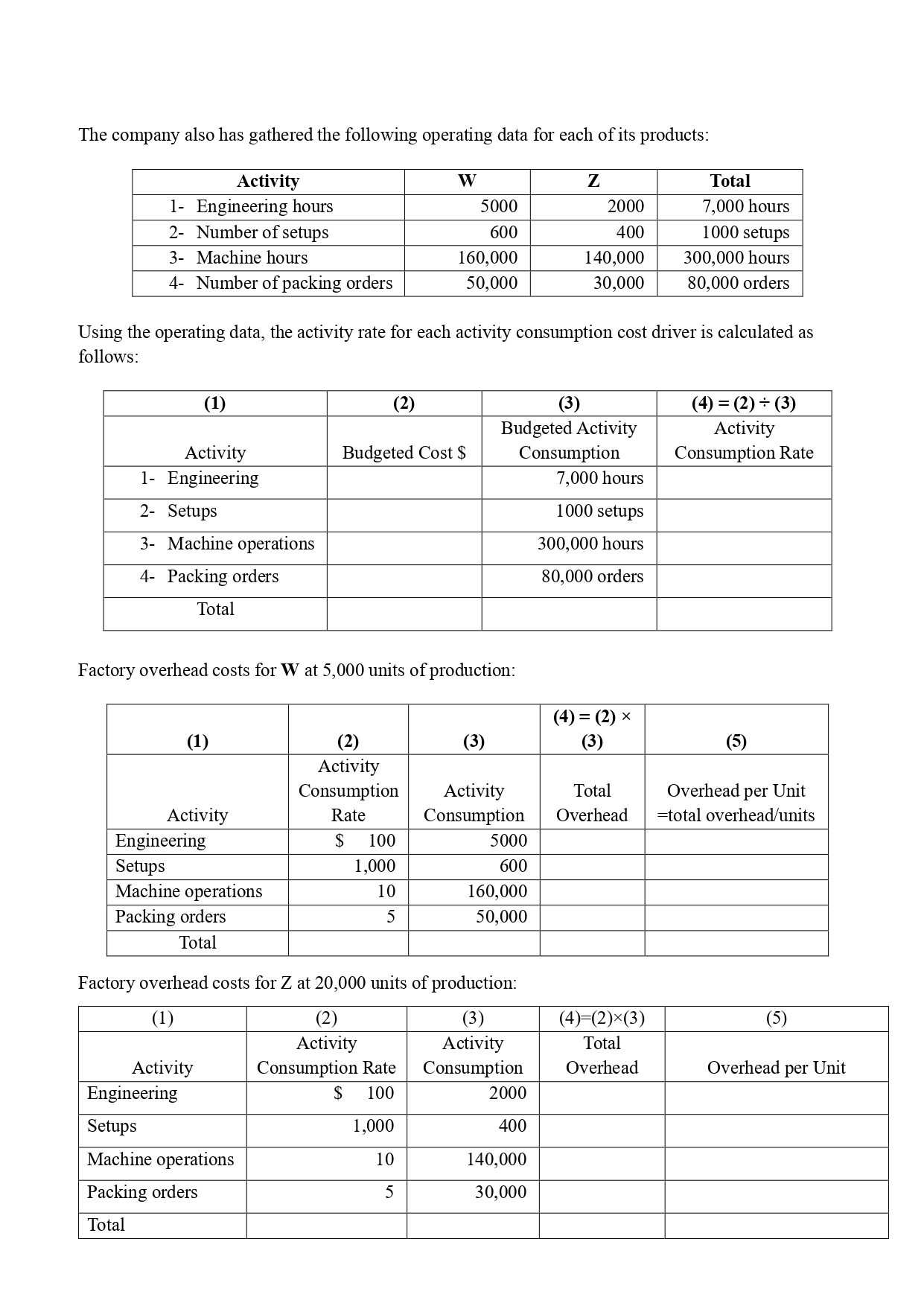

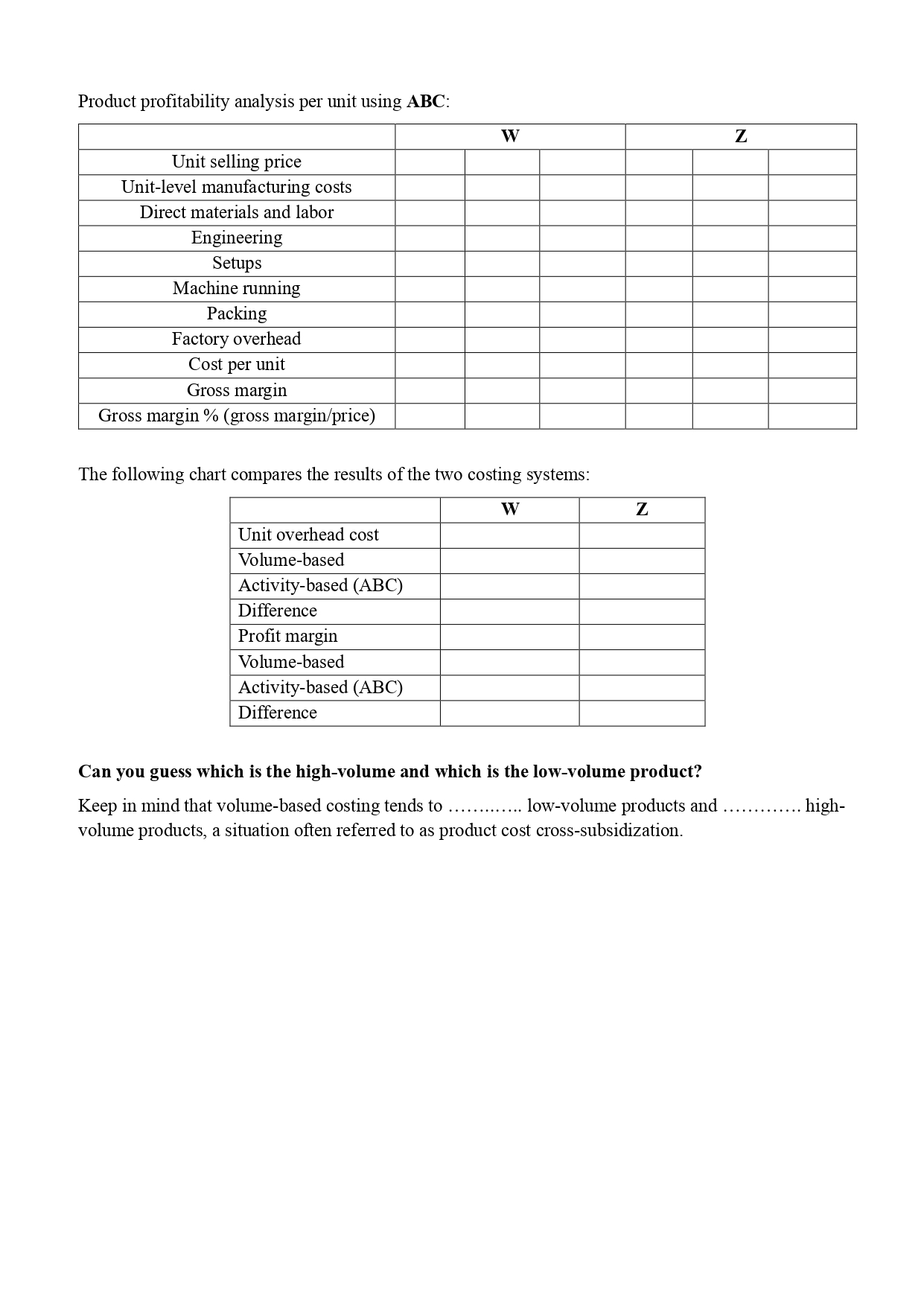

Assignment 3: Overhead: Volume-Based versus: Activity based costing (ABC) Question 1: Fill in the spaces: Delta Co. produces and sells two secure, W and Z. The company has the following operating data for the two products: The volume-based costing system assigns factory overhead (OH) based on machine hours (MH). The firm has total budgeted overhead of $5,100,000. The firm budgeted 170,000 MHs for the year, Then the overhead rate per MH= Since the firm used 90,000 machine hours to manufacture 30,000 units of W, the factory overhead assigned to W is in total, and per unit. Since the firm used 80,000 machine hours to manufacture 20,000 units of Z, the factory overhead assigned to Z is in total, and per unit. Product profitability analysis per unit using volume-based costing: Activity based costing: ABC: To implement an ABC system, the company identified the following activities, budgeted costs, and activity consumption cost drivers: The company also has gathered the following operating data for each of its products: Using the operating data, the activity rate for each activity consumption cost driver is calculated as follows: Factory overhead costs for W at 5,000 units of production: Factory overhead costs for Z at 20,000 units of production: Product profitability analysis per unit using ABC: The following chart compares the results of the two costing systems: Can you guess which is the high-volume and which is the low-volume product? Keep in mind that volume-based costing tends to low-volume products and highvolume products, a situation often referred to as product cost cross-subsidization

Assignment 3: Overhead: Volume-Based versus: Activity based costing (ABC) Question 1: Fill in the spaces: Delta Co. produces and sells two secure, W and Z. The company has the following operating data for the two products: The volume-based costing system assigns factory overhead (OH) based on machine hours (MH). The firm has total budgeted overhead of $5,100,000. The firm budgeted 170,000 MHs for the year, Then the overhead rate per MH= Since the firm used 90,000 machine hours to manufacture 30,000 units of W, the factory overhead assigned to W is in total, and per unit. Since the firm used 80,000 machine hours to manufacture 20,000 units of Z, the factory overhead assigned to Z is in total, and per unit. Product profitability analysis per unit using volume-based costing: Activity based costing: ABC: To implement an ABC system, the company identified the following activities, budgeted costs, and activity consumption cost drivers: The company also has gathered the following operating data for each of its products: Using the operating data, the activity rate for each activity consumption cost driver is calculated as follows: Factory overhead costs for W at 5,000 units of production: Factory overhead costs for Z at 20,000 units of production: Product profitability analysis per unit using ABC: The following chart compares the results of the two costing systems: Can you guess which is the high-volume and which is the low-volume product? Keep in mind that volume-based costing tends to low-volume products and highvolume products, a situation often referred to as product cost cross-subsidization Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started