Answered step by step

Verified Expert Solution

Question

1 Approved Answer

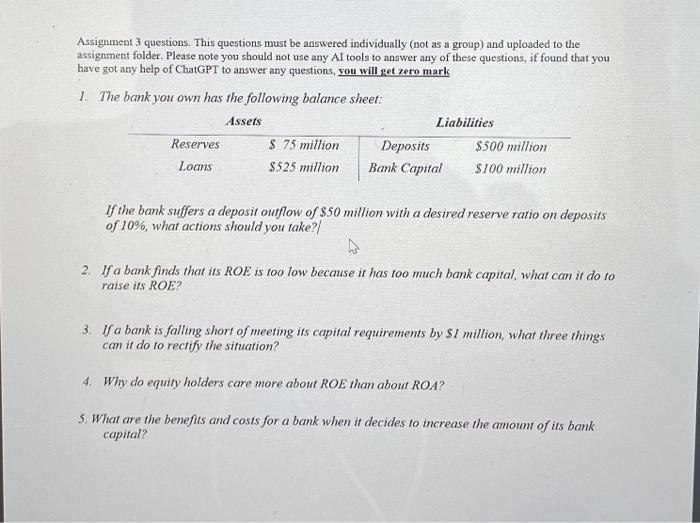

Assignment 3 questions. This questions must be answered individually (not as a group) and uploaded to the assignment folder. Please note you should not use

Assignment 3 questions. This questions must be answered individually (not as a group) and uploaded to the assignment folder. Please note you should not use any AI tools to answer any of these questions, if found that you have got any help of ChatGPT to answer any questions, you will get zero mark 1. The bank you own has the following balance sheet: Assets Reserves Loans $ 75 million $525 million Liabilities Deposits Bank Capital $500 million $100 million If the bank suffers a deposit outflow of $50 million with a desired reserve ratio on deposits of 10%, what actions should you take? 2. If a bank finds that its ROE is too low because it has too much bank capital, what can it do to raise its ROE? 3. If a bank is falling short of meeting its capital requirements by $1 million, what three things can it do to rectify the situation? 4. Why do equity holders care more about ROE than about ROA? 5. What are the benefits and costs for a bank when it decides to increase the amount of its bank capital?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started