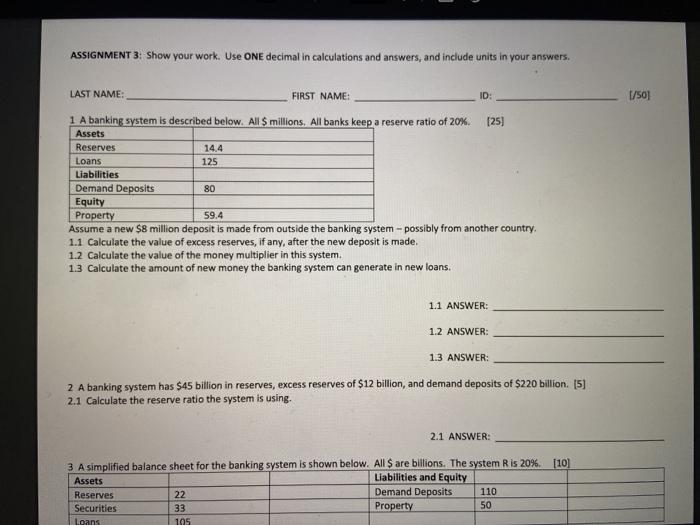

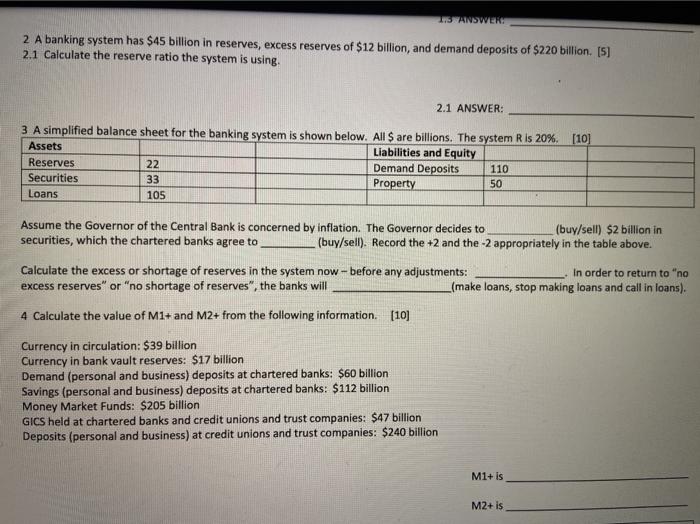

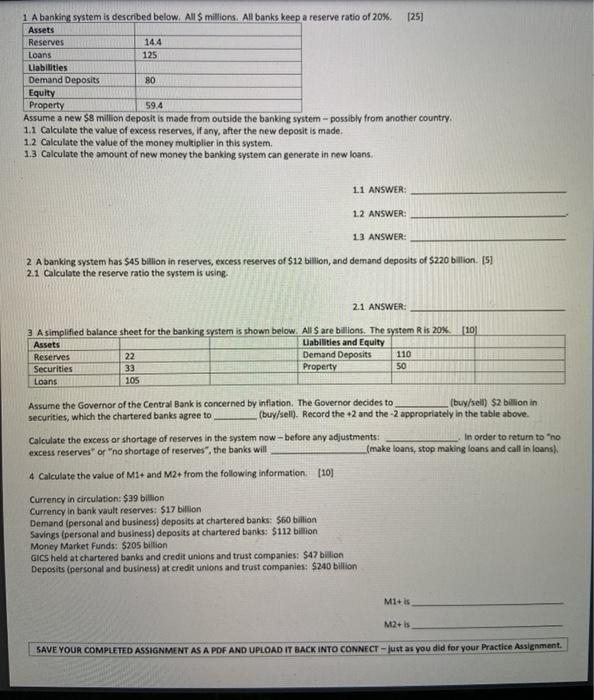

ASSIGNMENT 3. Show your work. Use ONE decimal in calculations and answers, and include units in your answers. LAST NAME: FIRST NAME: ID: [/50 1 A banking system is described below. All $ millions. All banks keep a reserve ratio of 20%. (25) Assets Reserves 14.4 Loans 125 Liabilities Demand Deposits 80 Equity Property 59.4 Assume a new $8 million deposit is made from outside the banking system - possibly from another country. 1.1 Calculate the value of excess reserves, if any, after the new deposit is made. 1.2 Calculate the value of the money multiplier in this system. 13 Calculate the amount of new money the banking system can generate in new loans. 1.1 ANSWER: 1.2 ANSWER: 1.3 ANSWER: 2 A banking system has $45 billion in reserves, excess reserves of $12 billion, and demand deposits of $220 billion. [5] 2.1 Calculate the reserve ratio the system is using. 2.1 ANSWER: (10) 3 A simplified balance sheet for the banking system is shown below. All $ are billions. The system Ris 20% Assets Liabilities and Equity Reserves 22 Demand Deposits 110 Securities 33 Property 50 Loans 195 15 ANSWERH 2 A banking system has $45 billion in reserves, excess reserves of $12 billion, and demand deposits of $220 billion. [5] 2.1 Calculate the reserve ratio the system is using. 2.1 ANSWER: 3 A simplified balance sheet for the banking system is shown below. All $ are billions. The system Ris 20%. [10] Assets Liabilities and Equity Reserves 22 Demand Deposits 110 Securities 33 Property 50 Loans 105 Assume the Governor of the Central Bank is concerned by inflation. The Governor decides to (buy/sell) $2 billion in securities, which the chartered banks agree to (buy/sell). Record the +2 and the -2 appropriately in the table above. Calculate the excess or shortage of reserves in the system now - before any adjustments: In order to return to "no excess reserves" or "no shortage of reserves", the banks will (make loans, stop making loans and call in loans). 4 Calculate the value of M1+ and M2+ from the following information. [10] Currency in circulation: $39 billion Currency in bank vault reserves: $17 billion Demand (personal and business) deposits at chartered banks: $60 billion Savings (personal and business) deposits at chartered banks: $112 billion Money Market Funds: $205 billion GICS held at chartered banks and credit unions and trust companies: $47 billion Deposits (personal and business) at credit unions and trust companies: $240 billion M1+is M2+ is 1 A banking system is described below. All 5 millions. All banks keep a reserve ratio of 20% (25) Assets Reserves 14.4 Loans 125 Liabilities Demand Deposits 80 Equity Property 59.4 Assume a new $8 million deposit is made from outside the banking system - possibly from another country. 1.1 Calculate the value of excess reserves, if any, after the new deposit is made. 1.2 Calculate the value of the money multiplier in this system. 1.3 Calculate the amount of new money the banking system can generate in now loans. 11 ANSWER: 12 ANSWER: 13 ANSWER: 2 A banking system has $45 billion in reserves, excess reserves of $12 billion, and demand deposits of $220 billion. [5] 2.1 Calculate the reserve ratio the system is using. 2.1 ANSWER: (10) 3. A simplified balance sheet for the banking system is shown below. All are billions. The system Ris 20% Assets Liabilities and Equity Reserves 22 Demand Deposits 110 Securities 33 Property 50 Loans 105 Assume the Governor of the Central Bank is concerned by inflation. The Governor decides to (buy/sell) $2 billion in securities, which the chartered banks agree to (buy/Sell). Record the +2 and the -2 appropriately in the table above. Calculate the excess or shortage of reserves in the system now-before any adjustments: In order to return to "no excess reserves" or "no shortage of reserves", the banks will (make loans, stop making loans and call in loans), 4 Calculate the value of M1+ and M2. from the following information (10) Currency in circulation: $39 billion Currency in bank vault reserves: $17 billion Demand (personal and business) deposits at chartered banks: $60 billion Savings (personal and business) deposits at chartered banks: $112 billion Money Market Funds: $205 billion GICS held at chartered banks and credit unions and trust companies: $47 billion Deposits (personal and business) at credit unions and trust companies: $240 billion Mit is M2+ is SAVE YOUR COMPLETED ASSIGNMENT AS A POF AND UPLOAD IT BACK INTO CONNECT - just as you did for your Practice Assignment