Question

Assignment 3 USE U.S. GAAP CODIFICTION Epps Corp., a public company, leased equipment from Anderson Inc. on January 2, 2018, for a period of three

Assignment 3

USE U.S. GAAP CODIFICTION

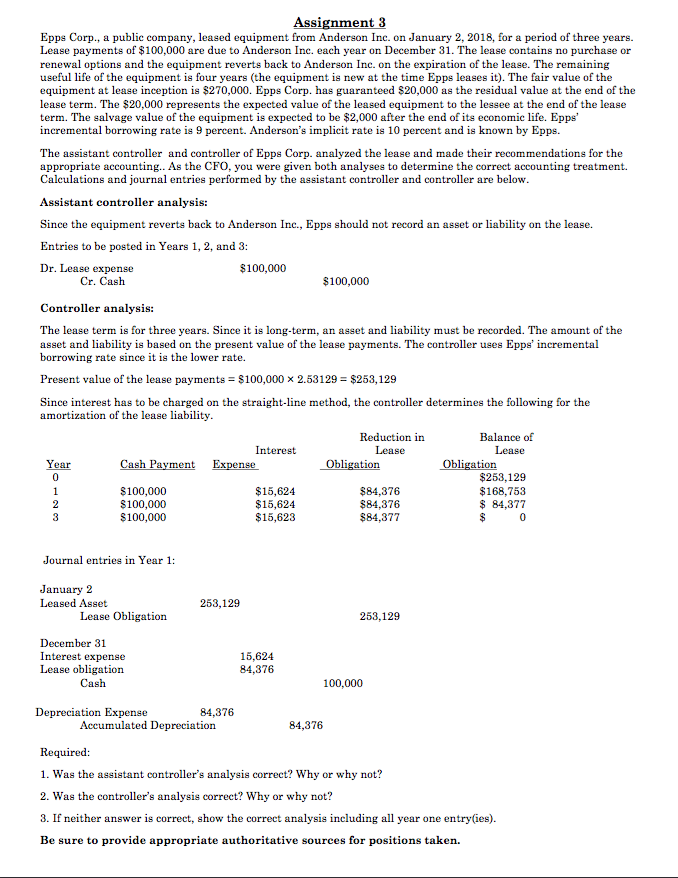

Epps Corp., a public company, leased equipment from Anderson Inc. on January 2, 2018, for a period of three years. Lease payments of $100,000 are due to Anderson Inc. each year on December 31. The lease contains no purchase or renewal options and the equipment reverts back to Anderson Inc. on the expiration of the lease. The remaining useful life of the equipment is four years (the equipment is new at the time Epps leases it). The fair value of the equipment at lease inception is $270,000. Epps Corp. has guaranteed $20,000 as the residual value at the end of the lease term. The $20,000 represents the expected value of the leased equipment to the lessee at the end of the lease term. The salvage value of the equipment is expected to be $2,000 after the end of its economic life. Epps incremental borrowing rate is 9 percent. Andersons implicit rate is 10 percent and is known by Epps.

The assistant controller and controller of Epps Corp. analyzed the lease and made their recommendations for the appropriate accounting.. As the CFO, you were given both analyses to determine the correct accounting treatment. Calculations and journal entries performed by the assistant controller and controller are below.

Assistant controller analysis:

Since the equipment reverts back to Anderson Inc., Epps should not record an asset or liability on the lease.

Entries to be posted in Years 1, 2, and 3:

Dr. Lease expense $100,000

Cr. Cash $100,000

Controller analysis:

The lease term is for three years. Since it is long-term, an asset and liability must be recorded. The amount of the asset and liability is based on the present value of the lease payments. The controller uses Epps incremental borrowing rate since it is the lower rate.

Present value of the lease payments = $100,000 2.53129 = $253,129

Since interest has to be charged on the straight-line method, the controller determines the following for the amortization of the lease liability.

Reduction in Balance of

Interest Lease Lease

Year Cash Payment Expense Obligation Obligation

0 $253,129

1 $100,000 $15,624 $84,376 $168,753

2 $100,000 $15,624 $84,376 $ 84,377

3 $100,000 $15,623 $84,377 $ 0

Journal entries in Year 1:

January 2

Leased Asset 253,129

Lease Obligation 253,129

December 31

Interest expense 15,624

Lease obligation 84,376

Cash 100,000

Depreciation Expense 84,376

Accumulated Depreciation 84,376

Required:

1. Was the assistant controllers analysis correct? Why or why not?

2. Was the controllers analysis correct? Why or why not?

3. If neither answer is correct, show the correct analysis including all year one entry(ies).

Be sure to provide appropriate authoritative sources for positions taken.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started