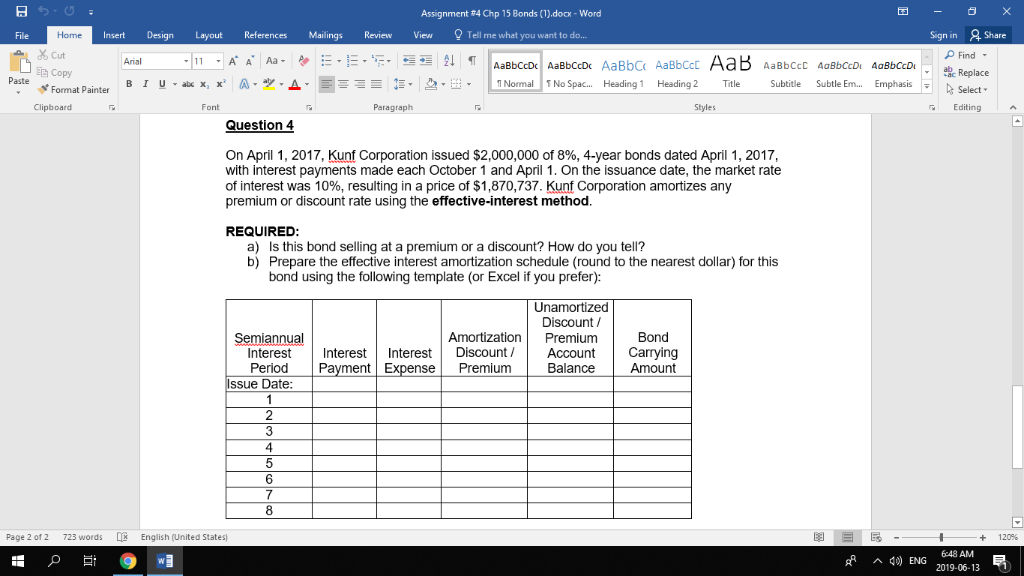

Assignment 4 Chp 15 Bonds (1).docx- Word Q Tell me what you want to do. Sign in Share Home Design References Mailings Review File Insert Layout View Cut Find 11 AA Aa E - E EE AaBbCcDc AaBbCcDc AaBbC AaBbCc AaB AaBbCcc AaBbCcD AaBb CcD Arial ab Replace ECopy Paste Subtle Em... Emphasis T No Spac... BIU 1 Normal Heading 1 Heading 2 Title Subtitle ab x, x Format Painter Select Clipboard Font Paragraph Styles Editing Assignment #4 - Chp 15- Bonds Question 3 Zhuang Corporation issued $450,000, 9.5%, eight-year bonds on May 1, 2017. Interest is paid semiannuall on November 1 and May 1 of each year. On the issuance date, the market rate of interest was 8.5%, resulting in a price of 103.5 for these bonds. The effective-interest method of amortizing the premium or discount is used. REQUIRED a) s this bond selling at a premium or a discount? How do you tell? b) Prepare the journal entry on May 1, 2017, to issue the bonds. c) Prepare the journal entry on November 1, 2017, to record the first interest payment and the amortization of any premium or discount d) What is the carrying amount of the bond on the balance sheet after the November 1 2017 entry? Question 4 On April 1. 2017, Kunf Corporation issued $2.000.000 of 8%, 4-vear bonds dated April 1, 2017 English (United Stated) Page 2 of 2 723 words 130s f-48 AM A ENG 2019-06-13 Assignment 4 Chp 15 Bonds (1).docx- Word Q Tell me what you want to do. Sign in Share Home Design References Mailings Review File Insert Layout View Cut Find 11 AA Aa E - E EE AaBbCcDc AaBbCcDc AaBbC AaBbCc AaB AaBbCcc AaBbCcD AaBb CcD Arial ab Replace ECopy Paste Format Painter A- A == = E 1 Normal Subtle Em... Emphasis BIU TNo Spac... Heading 1 Heading 2 Title Subtitle ab x, x Select Clipboard Font Paragraph Styles Editing Question 4 On April 1, 2017, Kunf Corporation issued $2,000,000 of 8%, 4-year bonds dated April 1, 2017, with interest payments made each October 1 and April 1. On the issuance date, the market rate of interest was 10%, resulting in a price of $1,870,737. Kunf Corporation amortizes any premium or discount rate using the effective-interest method. REQUIRED a) Is this bond selling at a premium or a discount? How do you tell? b) Prepare the effective interest amortization schedule (round to the nearest dol lar) for this bond using the following template (or Excel if you prefer) Unamortized Discount/ Amortization Discount Bond Semiannual Premium Interest Interest C rying Amo oriod Balance Payment Expense Premium Issue Date: 4 8 723 words Page 2 of 2 English (United States) 1209c f-48 AM A ENG 2019-06-13