Answered step by step

Verified Expert Solution

Question

1 Approved Answer

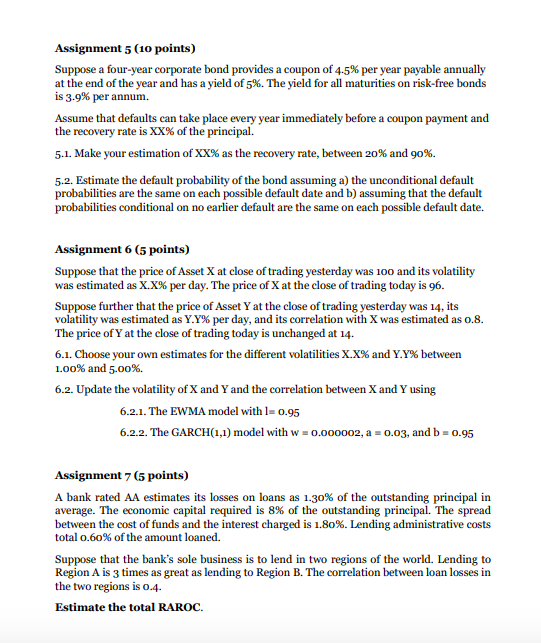

Assignment 5 ( 1 0 points ) Suppose a four - year corporate bond provides a coupon of 4 . 5 % per year payable

Assignment points

Suppose a fouryear corporate bond provides a coupon of per year payable annually

at the end of the year and has a yield of The yield for all maturities on riskfree bonds

is per annum.

Assume that defaults can take place every year immediately before a coupon payment and

the recovery rate is of the principal.

Make your estimation of as the recovery rate, between and

Estimate the default probability of the bond assuming a the unconditional default

probabilities are the same on each possible default date and b assuming that the default

probabilities conditional on no earlier default are the same on each possible default date.

Assignment points

Suppose that the price of Asset X at close of trading yesterday was and its volatility

was estimated as XX per day. The price of X at the close of trading today is

Suppose further that the price of Asset Y at the close of trading yesterday was its

volatility was estimated as YY per day, and its correlation with X was estimated as o

The price of at the close of trading today is unchanged at

Choose your own estimates for the different volatilities XX and YY between

and

Update the volatility of X and Y and the correlation between X and Y using

The EWMA model with

The GARCH model with and

Assignment points

A bank rated AA estimates its losses on loans as of the outstanding principal in

average. The economic capital required is of the outstanding principal. The spread

between the cost of funds and the interest charged is Lending administrative costs

total of the amount loaned.

Suppose that the bank's sole business is to lend in two regions of the world. Lending to

Region is times as great as lending to Region The correlation between loan losses in

the two regions is

Estimate the total RAROC.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started